Under Armour 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

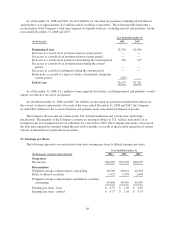

Prior to amending and restating the revolving credit facility in December 2006, the Company was party to a

revolving credit facility of $75.0 million that was to terminate in 2010. Interest rates and covenants under this

financing agreement were similar to the interest rates and covenants described above.

The weighted average interest rate on the balances outstanding under this revolving credit facility was 3.7%

and 6.3% for the years ended December 31, 2008 and 2007, respectively. No balance was outstanding during the

year ended December 31, 2006.

Long Term Debt

In March 2005, the Company entered into an agreement to finance the acquisition or lease of up to $17.0

million in qualifying capital investments. Loans under this agreement are collateralized by a first lien on the

assets acquired. The agreement is not a committed facility, with each advance under the agreement subject to the

lender’s approval. In March 2008, the lender agreed to increase the maximum financing under the agreement to

$37.0 million.

In May 2008, the Company entered into an additional agreement to finance the acquisition or lease of up to

$40.0 million in qualifying capital investments. Loans under this additional agreement are collateralized by a first

lien on the assets acquired. This additional agreement is not a committed facility, with each advance under the

agreement subject to the lender’s approval.

These agreements include a cross default provision whereby an event of default under other debt

obligations, including the revolving credit facility agreement, is considered an event of default under these

agreements. Through December 31, 2008, the Company has financed $33.0 million of property and equipment

under these agreements. As of December 30, 2008 and 2007, the outstanding principal balance was $20.1 million

and $13.4 million, respectively, under these agreements. Currently, advances under these agreements bear

interest rates which are fixed at the time of each advance. The weighted average interest rate on outstanding

borrowings was 6.1%, 6.5% and 6.3% for the years ended December 31, 2008, 2007 and 2006, respectively. The

terms of the Company’s new revolving credit facility (see Note 18 for a further discussion of the new revolving

credit facility) limit the total amount of additional financing under these agreements to $35.0 million.

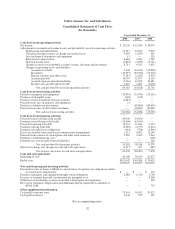

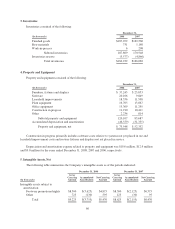

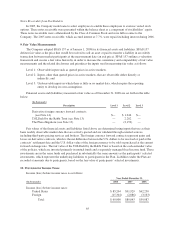

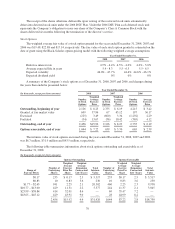

The following is a schedule of future principal payments on long term debt as of December 31, 2008:

(In thousands)

2009 $ 7,072

2010 7,167

2011 3,647

2012 1,966

2013 and thereafter 281

Total future principal payments on long term debt 20,133

Less current maturities of long term debt (7,072)

Long term debt obligations $13,061

The Company monitors the financial health and stability of its lenders under the revolving credit and long

term debt facilities, however current significant instability in the credit markets could negatively impact lenders

and their ability to perform under their facilities.

Included in interest income (expense), net for the years ended December 31, 2008, 2007 and 2006 was

interest expense, including amortization of deferred financing costs, under the revolving credit facility and long

term debt agreements of $1.5 million, $0.8 million and $0.8 million, respectively.

62