Under Armour 2008 Annual Report Download - page 69

Download and view the complete annual report

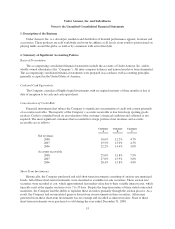

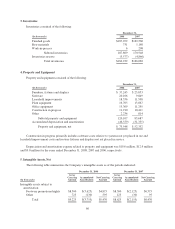

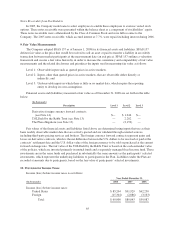

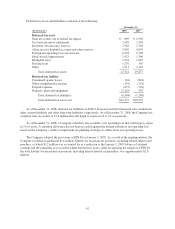

Please find page 69 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Intangible assets are amortized using estimated useful lives of 33 months to 89 months with no residual

value. Amortization expense, which is primarily included in selling, general and administrative expenses, was

$1.6 million, $1.5 million and $0.6 million for the years ended December 31, 2008, 2007 and 2006, respectively.

The estimated amortization expense of the Company’s intangible assets is $1.6 million for each of the years

ending December 31, 2009 through 2011, and $0.5 million and $0.1 million for the years ending December 31,

2012 and 2013, respectively.

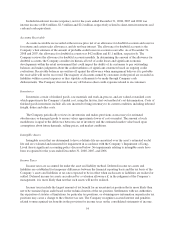

6. Revolving Credit Facility and Long Term Debt

Revolving Credit Facility

In January 2009, the Company terminated its existing revolving credit facility and entered into a new

revolving credit facility with certain lending institutions. See Note 18 for a further discussion on the new

revolving credit facility.

In December 2006, the Company entered into a third amended and restated financing agreement with a

lending institution that had a term of five years and provided for a committed revolving credit line of up to

$100.0 million based on the Company’s eligible domestic inventory and accounts receivable balances and was

used for working capital and general corporate purposes. This financing agreement was collateralized by

substantially all of the Company’s domestic assets, other than its trademarks. Up to $10.0 million of the

revolving credit facility could be used to support letters of credit, which if utilized would reduce the availability

under the revolving credit facility. The Company incurred $0.3 million in deferred financing costs in connection

with this revolving credit facility. In accordance with EITF Issue No. 98-14 Debtor’s Accounting for Changes in

Line-of-Credit or Revolving-Debt Arrangements (“EITF 98-14”) unamortized deferred financing costs of $0.6

million relating to the Company’s old revolving credit facility were added to the deferred financing costs of this

revolving credit facility and were to be amortized over the remaining life of this revolving credit facility.

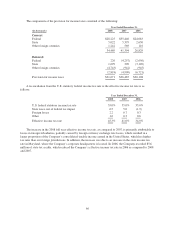

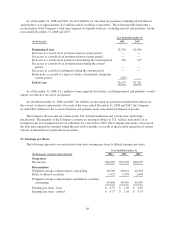

Borrowings under this revolving credit facility bore interest based on the daily balance outstanding at the

Company’s choice of LIBOR plus an applicable margin (varying from 1.0% to 2.0%) or the JP Morgan Chase

Bank prime rate plus an applicable margin (varying from 0.0% to 0.5%). The applicable margin was calculated

quarterly and varied based on the Company’s pricing leverage ratio as defined in this financing agreement. This

revolving credit facility also carried a line of credit fee varying from 0.1% to 0.5% of the available but unused

borrowings.

This financing agreement contained a number of restrictions that limited the Company’s ability, among

other things, to pledge its accounts receivable, inventory, trademarks and most of its other assets as security in its

borrowings or transactions; pay dividends on stock; redeem or acquire any of its securities; sell certain assets;

make certain investments; guaranty certain obligations of third parties; undergo a merger or consolidation; or

engage in any activity materially different from those presently conducted by the Company.

If net availability under this financing agreement fell below a certain threshold as defined in this agreement,

the Company could not exceed a maximum leverage ratio of 1.25 and could not fall below a minimum fixed

charge coverage ratio ranging from 1.10 to 1.25 as defined in the agreement. This financing agreement also

provided the lenders with the ability to reduce the available revolving credit line amount even if the Company

was in compliance with all conditions of this agreement, based on negative forecasts, trends or other

circumstances that the lenders reasonably determined could negatively impact the Company or its business,

profits, operations, financial condition or assets. The Company’s net availability as of December 31, 2008 was

above the threshold for compliance with the financial covenants and the Company was below the maximum

leverage ratio and above the minimum fixed charge coverage ratio as of December 31, 2008. As of December 31,

2008, $25.0 million was outstanding under this revolving credit facility, and the Company’s net availability was

$75.0 million based on its eligible domestic inventory and accounts receivable balances.

61