Under Armour 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

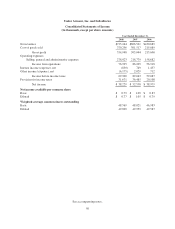

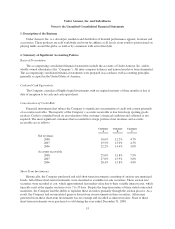

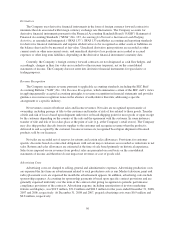

Other income (expense), net included the following amounts related to changes in foreign currency

exchange rates and derivative foreign currency forward contracts:

Year Ended December 31,

(In thousands) 2008 2007 2006

Unrealized foreign currency exchange rate gains (losses) $(5,459) $2,567 $(161)

Realized foreign currency exchange rate gains (losses) (2,166) 174 520

Unrealized derivative gains (losses) 1,650 (243) —

Realized derivative gains (losses) (204) (469) —

Although we have entered into foreign currency forward contracts to minimize some of the impact of

foreign currency exchange rate fluctuations on future cash flows, we cannot be assured that foreign currency

exchange rate fluctuations will not have a material adverse impact on our financial condition and results of

operations.

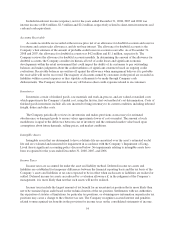

Inflation

Inflationary factors such as increases in the cost of our product and overhead costs may adversely affect our

operating results. Although we do not believe that inflation has had a material impact on our financial position or

results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to

maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net

revenues if the selling prices of our products do not increase with these increased costs.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

See “Quantitative and Qualitative Disclosure about Market Risk” under Item 7. “Management’s Discussion

and Analysis of Financial Conditions and Results of Operations” and Item 1A. “Risk Factors” of this Form 10-K

for information required by this Item.

46