Under Armour 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

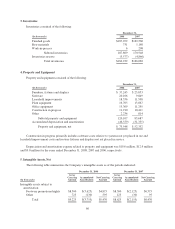

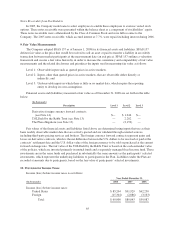

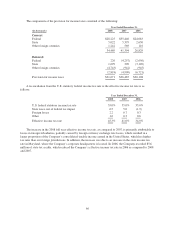

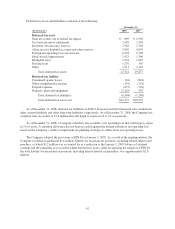

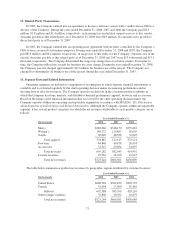

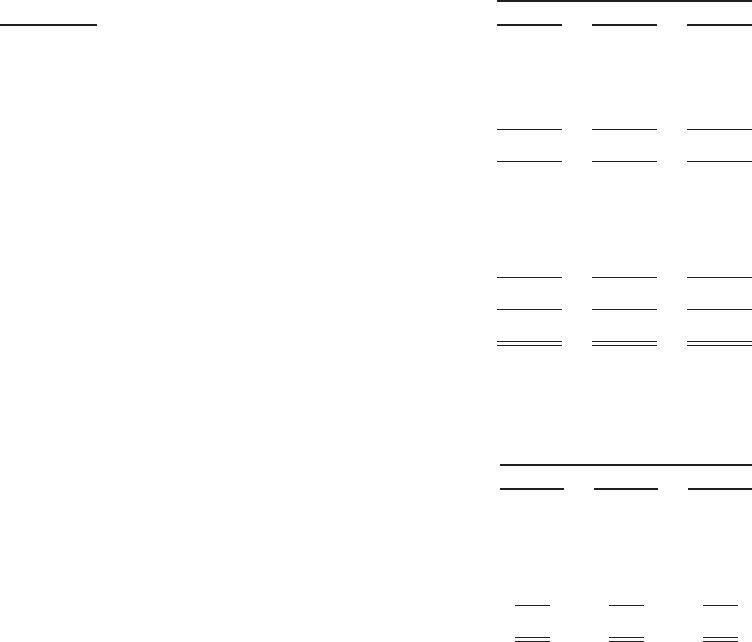

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

(In thousands) 2008 2007 2006

Current

Federal $28,225 $35,446 $24,083

State 5,022 5,379 2,630

Other foreign countries 1,242 569 116

34,489 41,394 26,829

Deferred

Federal 226 (4,257) (2,656)

State 1,699 290 (3,120)

Other foreign countries (4,743) (942) (945)

(2,818) (4,909) (6,721)

Provision for income taxes $31,671 $36,485 $20,108

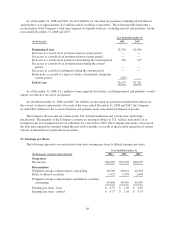

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2008 2007 2006

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal tax impact 6.5 5.0 (1.9)

Foreign losses 2.2 0.7 0.3

Other 1.6 0.3 0.6

Effective income tax rate 45.3% 41.0% 34.0%

The increase in the 2008 full year effective income tax rate, as compared to 2007, is primarily attributable to

losses in foreign subsidiaries, partially caused by foreign currency exchange rate losses, which resulted in a

larger proportion of the Company’s consolidated taxable income earned in the United States, which has higher

tax rates than our foreign jurisdictions. In addition, the increase was due to an increase in the state income tax

rate in Maryland, where the Company’s corporate headquarters is located. In 2006, the Company recorded $5.6

million of state tax credits, which reduced the Company’s effective income tax rate in 2006 as compared to 2008

and 2007.

66