TomTom 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

By performing the procedures mentioned above at group entities, together with additional procedures at group level, we have been able to

obtain sufficient and appropriate audit evidence about the group's financial information to provide an opinion on the consolidated and

company financial statements.

Our Key Audit Matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements.

We have communicated the key audit matters to the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters

discussed.

These matters were addressed in the context of our audit of the financial statements as a whole and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

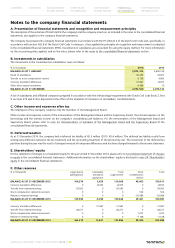

•Impairment of non-financial asset

Assets that have an indefinite useful life, such as goodwill, are tested for impairment at least on an annual basis. Other intangible assets are

tested for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment

loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable amount. The recoverable amount is based on

certain key assumptions, such as cash flow projections covering a five-year period and the perpetual growth rate and discount rate per cash

generating unit. These assumptions which are determined by management are judgemental. As a result the valuation of intangible assets

including goodwill is significant to our audit. Our audit procedures included, among others, obtaining an understanding of the valuation

model and assumptions used, challenging management's assumptions and involving independent valuation experts to support us in our

evaluation of the model. We also focused on the adequacy of disclosures about key assumptions and sensitivity. Management's disclosures

on the impairment of non-financial assets are included in note 14 to the consolidated financial statements.

•Revenue recognition

The process of revenue recognition, including the appropriate allocation of multiple-element arrangements and the estimation of rebates,

involves significant management judgement. As such we have considered revenue recognition significant to our audit, requiring special audit

consideration. We performed focused procedures to test the allocation of revenue to separately identifiable components of multiple element

arrangements, particularly in relation to transactions that include the delivery of hardware products combined with a service element. This

allocation is based on the estimated fair value per deliverable. We also performed substantive testing in relation to deferred revenue balances.

Management's disclosures on revenue are included in note 4.

•Provisions and accruals

There are several accruals and provisions that are subject to a high level of judgment such as the provision for claims and litigations, tax risks

and the warranty provision. Due to the uncertainty involved, this area is significant to our audit. As part of our procedures, we challenged

management's rationale for determining the probability of related risks and considered information from both company representatives and

external sources to be able to assess the reasonableness of the recorded amounts. Management has included information about these risks

in note 31.

Responsibilities of Management and the Supervisory Board for Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with EU-IFRS and Part 9 of

Book 2 of the Dutch Civil Code, and for the preparation of the management board report in accordance with Part 9 of Book 2 of the Dutch

Civil Code. Furthermore management is responsible for such internal control as management determines is necessary to enable the preparation

of financial statements that are free from material misstatement, whether due to fraud or error.

As part of the preparation of the financial statements, management is responsible for assessing the company's ability to continue as a going

concern. Based on the financial reporting frameworks mentioned, management should prepare the financial statements using the going

concern basis of accounting unless management either intends to liquidate the company or to cease operations, or has no realistic alternative

but to do so. Management should disclose events and circumstances that may cast significant doubt on the company's ability to continue as

a going concern.

The Supervisory Board is responsible for overseeing the company's financial reporting process.

Our Responsibilities for the Audit of the Financial Statements

Our objective is to plan and perform the audit assignment in a manner that allows sufficient and appropriate audit evidence to be obtained

for our final opinion.

Our audit has been performed with a high, but not absolute, level of assurance, which means we may have not have detected all errors and

fraud.

We have exercised professional judgement and have maintained professional skepticism throughout the audit, in accordance with Dutch

Standards on Auditing, ethical requirements and independence requirements. Our audit included e.g.:

• Identifying and assessing the risks of material misstatement of the financial statements, whether due to fraud or error, designing and

performing audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for

our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud

may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 87