TomTom 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

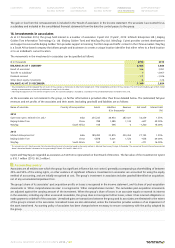

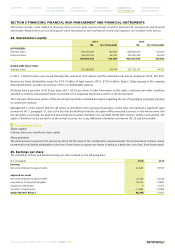

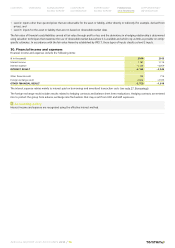

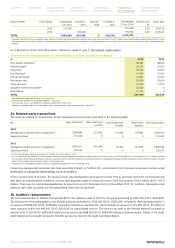

27. Borrowings

(€ in thousands) 2014 2013

Non-current 48,925 99,348

Current 0 74,089

TOTAL 48,925 173,437

On 22 December 2014, the group signed a new credit facility agreement (the 'new facility'), replacing the previous facility agreement. The

agreement is effective up to 31 March 2018 and includes two additional one-year extension options.

The new facility comprises of a revolving credit facility for an amount of €250 million, of which €50 million was drawn at the end of December

2014. Netted with the transaction costs of €1.1 million, the carrying amount of the group's outstanding borrowings at 31 December 2014

was €48.9 million. The interest is in line with market conditions and is based on Euribor plus a margin that depends on certain leverage

covenants. The average interest paid on borrowings in 2014 was 1.3% (2013: 1.2%).

At 31 December 2014 the outstanding borrowings are presented as a non-current liability, as management expects to maintain at least a

similar level of utilisation in the coming twelve months.

As the contractual interest rate is based on market interest rates plus a certain margin, and the fact that there has been no significant change

to the group's credit rating, the fair value of the borrowings at the end of 2014 and 2013 is estimated to approximate their carrying value.

Accounting policy

Borrowings are recognised initially at fair value, net of transaction costs incurred. Subsequently, amounts are stated at amortised cost with

the difference being recognised in the income statement over the period of the borrowings using the effective interest rate method.

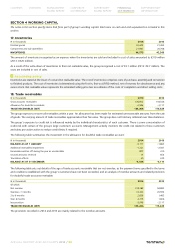

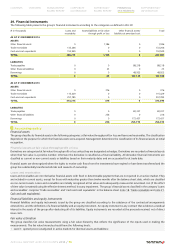

28. Financial risk management

Financial risk factors

The group's activities result in exposure to a variety of financial risks including credit, foreign currencies, liquidity and interest rate risk.

Management policies have been established to identify, analyse and monitor these risks, and to set appropriate risk limits and controls. Financial

risk management is carried out in accordance with our Corporate Treasury Policy. The written principles and policies are reviewed periodically

to reflect changes in market conditions, the activities of the business, and laws and regulations affecting the group's business.

Credit

Credit risk arises primarily from cash and cash equivalents held at financial institutions, and, to a certain extent, from trade receivables relating

to wholesale customers.

Cash balances are held with counterparties that have a credit risk rating of at least BBB-, as rated by an acknowledged rating agency. Moreover,

to avoid significant concentration of exposure to particular financial institutions, it has been ensured that transactions and businesses are

properly spread among different counterparties.

The group's exposure to wholesale customers is managed through establishing proper credit limits and continuous credit risk assessments

for each individual customer.

Procedures include aligning credit and trading terms and conditions with an assessment of the individual characteristics and risk profile of

each customer. This assessment is made based on past experiences and independent ratings from external rating agencies whenever available.

As at 31 December 2014, total bad debt provision represented approximately 0.4% of group revenue (2013: 0.3%).

Foreign currencies

The group operates internationally and conducts business in multiple currencies. Revenues are earned in euro, pound sterling (GBP), the US

dollar (USD) and other currencies, and do not necessarily match cost of sales and other costs which are largely in euro and the US dollar and

to a certain extent in other currencies. Foreign currency exposures on commercial transactions relate mainly to estimated purchases and sales

transactions that are denominated in currencies other than reporting currency - the euro (€).

The group manages foreign currency transaction risk through options and forward contracts to cover forecasted net exposures. All such

transactions are carried out within the guidelines set by Corporate Treasury Policy, which is reviewed annually by the Audit Committee.

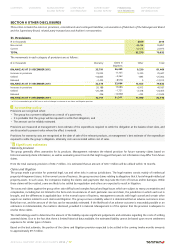

A 2.5% strengthening/weakening of the euro as at 31 December 2014 against the currencies listed below would have increased (decreased)

profit or loss by the amount shown below. This analysis assumes that all other variables remain constant. The analysis was performed on the

same basis as in 2013.

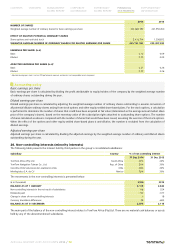

2014 2013

(€) Strengthen Weaken Strenghten Weaken

GBP 248,885 –236,708 –327,148 311,664

USD –823,283 783,392 –228,989 278,258

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 73