TomTom 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

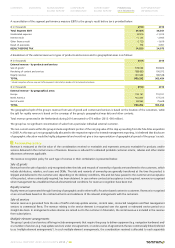

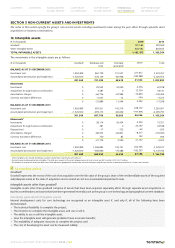

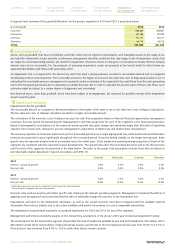

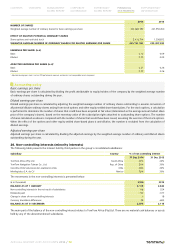

The sensitivity test for the Licensing segment showed that the level of headroom available at year-end 2014 (headroom: €104 million, 2013:

€64 million) would fall to nil should the compound annual revenue growth rate in the forecasted period decrease from 7.4% to 3.5% while

other factors remain constant. A reasonably possible change in either the perpetual revenue growth rate or discount rate would not reduce

the headroom to nil.

For Consumer and Telematics, a reasonably possible change in any of the abovementioned key assumptions as well as other assumptions in

the forecasted period would not cause the fair value less costs of disposal of either unit to fall below the level of their respective carrying

value.

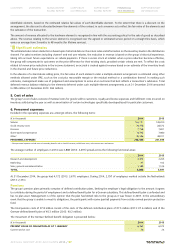

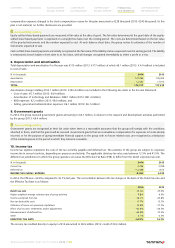

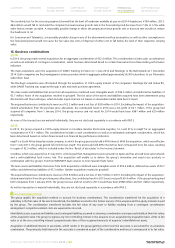

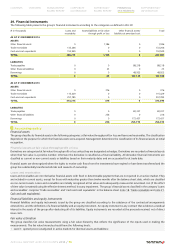

15. Business combinations

2014

In 2014, the group made several acquisitions for an aggregate consideration of €22.0 million. This consideration includes cash considerations

as well as an estimate of contingent consideration, which has been determined based on certain financial and non-financial key performance

indicators.

The main acquisitions were the acquisitions of DAMS Tracking in France on 1 June 2014 and Fleetlogic in the Netherlands on 1 December

2014. Both companies are fleet management service providers which in aggregate added approximately 54,000 subscribers to our Telematics

subscribers' base.

The Fleetlogic acquisition was effectuated through the acquisition of 100% equity interest of the companies: Fleetlogic BV and Inalise BV,

while DAMS Tracking was acquired through a sale and asset purchase agreement.

The main assets and liabilities that arose from all acquisitions combined were intangible assets of €24.5 million and deferred tax liabilities of

€3.7 million. None of the acquisitions resulted in goodwill. The fair value of the assets and liabilities acquired have been determined using

discounted cash flow technique, which includes inputs that are not based on observable market data (level 3 input).

The acquired businesses contributed a revenue of €3.2 million and a net loss of €0.8 million in 2014. Excluding the impact of the acquisition-

related amortisation from the purchase price allocations, the contributed result in 2014 was a net profit of €0.1 million. If the group had

acquired all companies from 1 January 2014, the group revenue and net result for 2014 would have been €961 million and €20 million

respectively.

As none of the transactions are material individually, they are not disclosed separately in accordance with IFRS 3.

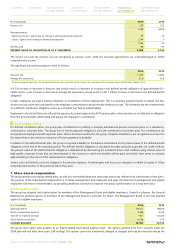

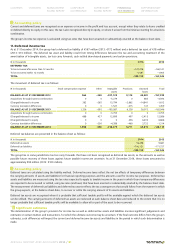

2013

In 2013, the group acquired a 100% equity interest in Coordina (Gestion Electronica Logistica, S.L.) and 51% in mapIT for an aggregated

consideration of €15.1 million. This consideration includes a cash consideration as well as an estimated contingent consideration, which has

been determined based on certain financial and non-financial key performance indicators.

mapIT is a South Africa-based associate company, in which the group previously held a 49% interest. With this acquisition, which was effective

from 1 June 2013, the group gained full control over mapIT. The previously held 49% interest has been remeasured to its fair value, resulting

in a gain of €2.5 million, which is included under the line 'Result of associates' in the income statement.

Coordina, which was acquired on 31 July 2013, is the largest fleet management service provider in Spain and has a broad local sales network

and a well-established local service hub. This acquisition will enable us to deliver the group’s innovative and easy-to-use products in

combination with the group's TomTom WEBFLEET SaaS services to more Spanish fleets faster.

The main assets and liabilities that arose from both acquisitions combined were intangible assets of €18.3 million, deferred tax assets of €0.7

million and deferred tax liabilities of €5.3 million. Neither acquisition resulted in goodwill.

The acquired businesses contributed a revenue of €3.8 million and a net loss of €0.7 million in 2013. Excluding the impact of the acquisition-

related amortisation from the purchase price allocations, the contributed result in 2013 was a net profit €0.4 million. If the group had acquired

both companies from 1 January 2013, the group revenue and net result for 2013 would have been €968 million and €21 million respectively.

As neither transaction is material individually, they are not disclosed separately in accordance with IFRS 3.

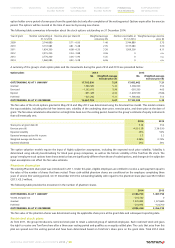

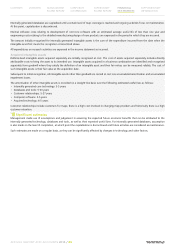

Accounting policy

The group applies the acquisition method to account for business combinations. The consideration transferred for the acquisition of a

subsidiary is the fair value of the assets transferred, the liabilities incurred to the former owners of the acquiree and the equity interests issued

by the group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration

arrangement. Acquisition-related costs are expensed as incurred.

Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values

at the acquisition date. The group recognises any non-controlling interest in the acquiree on an acquisition-by-acquisition basis, either at fair

value or at the non-controlling interest's proportionate share of the recognised amounts of acquiree's identifiable net assets.

Acquisition of additional interest in associates, which results in the group gaining control over the associate, is accounted for as a business

combination. The previously held interest in the associate is considered as part of the consideration and hence is remeasured to its fair value.

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 66