TomTom 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

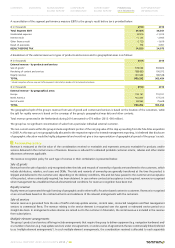

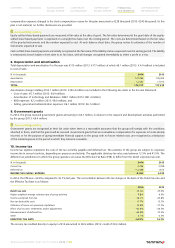

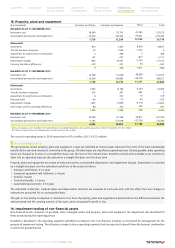

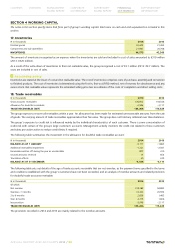

(€ in thousands) 2014 2013

Interest cost 229 222

7,028 6,818

Remeasurements:

- Experience losses / (gains) due to change in demographical assumptions 59 –10

- Losses / (gains) from change in financial assumptions 1,394 0

1,453 –10

Benefits paid –98 –45

PRESENT VALUE OF OBLIGATION AS AT 31 DECEMBER 8,383 6,763

The service cost and the interest cost are recognised as pension costs, while the actuarial (gains)/losses are credited/charged to 'Other

comprehensive income'.

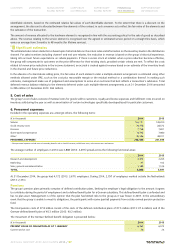

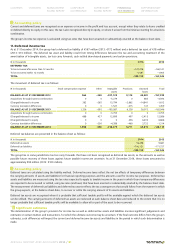

The significant actuarial assumptions were as follows:

2014 2013

Discount rate 2.30% 3.40%

Average life expectancy121.0 20.8

1The above average life expectancy is the average actual value for males and females retiring at age 65 set in accordance with the common German mortality tables 'Heubeck 2005 G'.

A 0.1% increase or decrease in discount rate would result in a decrease or increase in the defined benefit obligation of approximately €0.1

million and a 1-year increase or decrease in average life expectancy would result in a €0.1 million increase or decrease in the defined benefit

obligation.

In Italy, employees are paid a leaving indemnity on termination of their employment. This is a statutory payment based on Italian civil law.

An amount is accrued each year based on the employee's remuneration and previously revalued accruals. The indemnity has the characteristics

of a defined contribution obligation and is an unfunded, but fully provided liability.

Employees in the United States are offered the opportunity to participate in the 401K pension plan, which involves no contribution or obligation

from the group besides withholding and paying the employee's contribution.

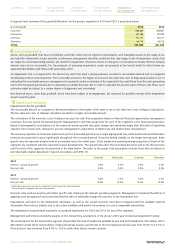

Accounting policy

For defined contribution plans, the group pays contributions to publicly or privately administered pension insurance plans on a mandatory,

contractual or voluntary basis. The group has no further payment obligations once the contributions have been paid. The contributions are

recognised as employee benefit expenses when service has been rendered to the group. Prepaid contributions are recognised as an asset to

the extent that a cash refund or reduction of future payments is available.

In relation to the defined benefit plan, the group recognised a liability on the balance sheet based on the present value of the defined benefit

obligation at the end of the reporting period. The defined benefit obligation is calculated annually using the projected unit credit method.

The present value of the defined benefit obligation is determined by discounting the estimated future cash outflows using interest rates of

high-quality corporate bonds that are denominated in the currency in which the benefits will be paid, and which have terms to maturity

approximating to the terms of the related pension obligation.

Service costs and interest costs are charged to the pension expenses. Actuarial gains and losses are charged or credited to equity in 'Other

comprehensive income' in the period in which they arise.

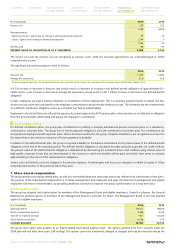

7. Share-based compensation

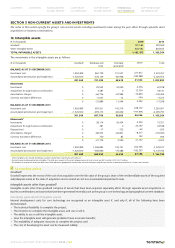

The group operates two equity-settled plans, as well as a cash-settled phantom share plan (previously referred to as 'performance share plan').

The purpose of the share-based compensation is to retain management and employees and align the interests of management and eligible

employees with those of shareholders, by providing additional incentives to improve the group's performance on a long-term basis.

Stock option plans

The group has adopted stock option plans for members of the Management Board and eligible employees. Under the schemes, the General

Meeting has granted options to members of the Management Board to subscribe for shares. The Management Board in turn has granted

options to eligible employees.

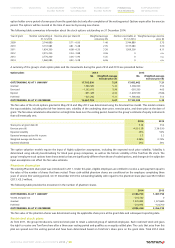

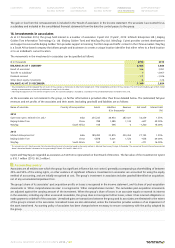

(€ in thousands) 2014 2013

Opening balance 29,012 48,818

Stock compensation expense 3,898 4,196

Transfer to retained earnings –937 –23,426

Stock options excercised –3,006 –576

CLOSING BALANCE 28,967 29,012

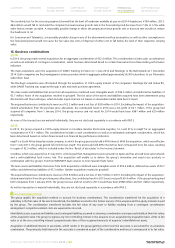

The group stock option plan qualifies as an 'Equity-settled share-based payment plan'. The options granted from 2011 onwards under the

2009 plan will vest after three years (cliff vesting). The options cannot be transferred, pledged or charged and may be exercised only by the

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 58