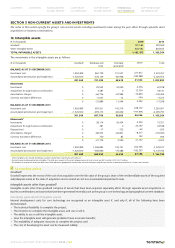

TomTom 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

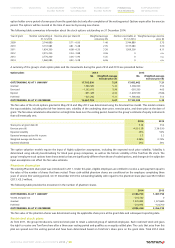

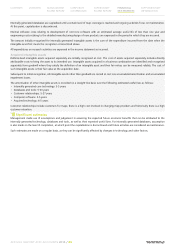

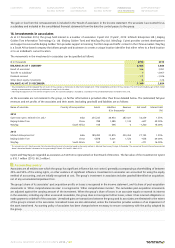

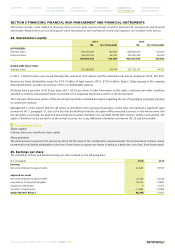

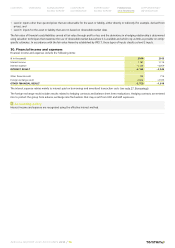

Trade accounts receivable include amounts denominated in the following major currencies:

(€ in thousands) 2014 2013

EUR 71,358 57,146

GBP 24,785 12,507

USD 22,914 33,193

Other 14,209 12,583

TRADE RECEIVABLES (NET) 133,266 115,429

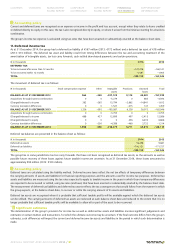

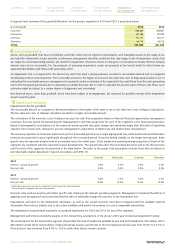

Accounting policy

Trade receivables are initially recognised at fair value, and subsequently measured at amortised cost (if the time value is material), using the

effective interest method, less provision for impairment. A provision for impairment of trade receivables is established when there is objective

evidence that the group will not be able to collect all amounts due, according to the original terms of the receivables. The amount of the

provision is the difference between the asset's carrying amount and the present value of estimated future cash flows, discounted at the original

effective interest rate. The carrying amount of the asset is reduced through the use of an allowance account and the amount of the loss is

recognised in the income statement within 'Cost of sales'. When a trade receivable is uncollectible, it is written off against the allowance

account for trade receivables. Subsequent recoveries of amounts previously written off are credited against 'Cost of sales' in the income

statement.

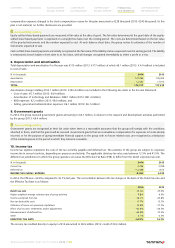

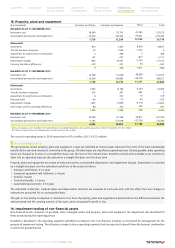

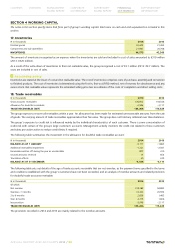

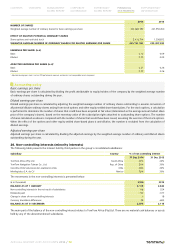

19. Other receivables and prepayments

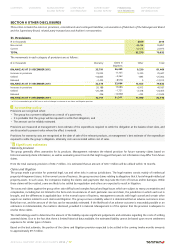

(€ in thousands) 2014 2013

Prepayments 12,673 6,247

VAT and other taxes 3,389 6,551

Unbilled revenue 9,475 11,057

Deferred cost of sales 4,721 10,969

Other receivables 2,940 3,297

TOTAL OTHER RECEIVABLES 33,198 38,121

The carrying amount of the other receivables and prepayments approximates their fair value.

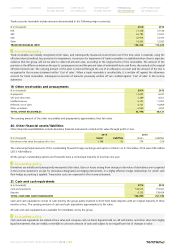

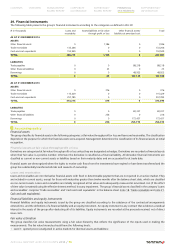

20. Other financial assets/liabilities

Other financial assets/liabilities include derivative financial instruments carried at fair value through profit or loss.

2014 2013

(€ in thousands) Assets Liabilities Assets Liabilities

Derivatives at fair value through profit or loss 1,186 –23 376 –236

The notional principal amounts of the outstanding forward foreign exchange and option contracts on 31 December 2014 were €54 million

(2013: €69 million).

All the group's outstanding options and forwards have a contractual maturity of less than one year.

Accounting policy

Derivatives are initially and subsequently measured at fair value. Gains or losses arising from changes in fair value of derivatives are recognised

in the income statement, except for derivatives designated as hedging instruments, in a highly effective hedge relationship, for which cash

flow hedge accounting is applied. Transaction costs are expensed in the income statement.

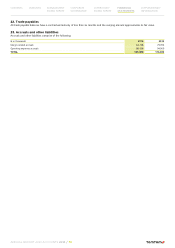

21. Cash and cash equivalents

(€ in thousands) 2014 2013

Cash and equivalents 148,614 119,361

Deposits 4,335 138,424

TOTAL CASH AND CASH EQUIVALENTS 152,949 257,785

Cash and cash equivalents consist of cash held by the group partly invested in short-term bank deposits with an original maturity of three

months or less. The carrying amount of cash and cash equivalents approximates its fair value.

All cash and cash equivalents are available for immediate use by the group.

Accounting policy

Cash and cash equivalents are stated at face value and comprise cash on hand, deposits held on call with banks, and other short-term highly

liquid investments that are readily convertible to a known amount of cash and subject to an insignificant risk of changes in value.

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 69