TomTom 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounting policy

Current and deferred taxes are recognised as an expense or income in the profit and loss account, except when they relate to items credited

or debited directly to equity. In this case, the tax is also recognised directly in equity, or where it arises from the initial accounting for a business

combination.

The group's income tax expense is calculated using tax rates that have been enacted or substantively enacted at the balance sheet date.

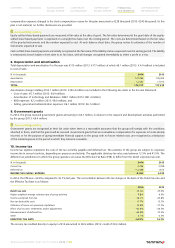

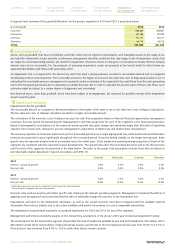

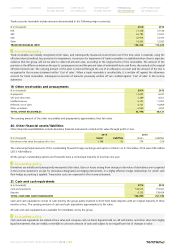

11. Deferred income tax

As at 31 December 2014, the group had a deferred tax liability of €167 million (2013: €172 million) and a deferred tax asset of €18 million

(2013: €10 million). The deferred tax asset and liability result from timing differences between the tax and accounting treatment of the

amortisation of intangible assets, tax loss carry forwards, cash-settled share-based payments and certain provisions.

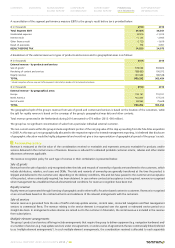

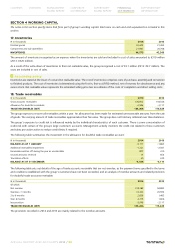

(€ in thousands) 2014 2013

DEFERRED TAX:

To be recovered after more than 12 months –147,016 –160,141

To be recovered within 12 months –1,097 –1,905

TOTAL –148,113 –162,046

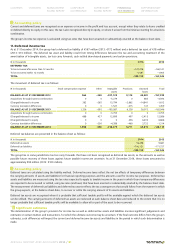

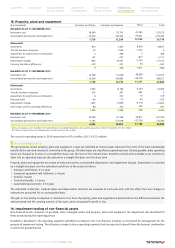

The movement of deferred tax is as follows:

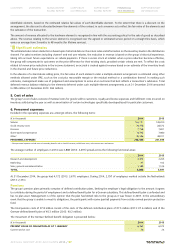

(€ in thousands) Stock compensation expense Other Intangible

assets

Provisions Assessed

losses

Total

BALANCE AS AT 31 DECEMBER 2012 964 –330 –207,129 9,115 40,081 –157,299

Acquisitions through business combination 0 0 –5,279 0 685 –4,594

(Charged)/released to income 362 –265 15,794 –2,662 –14,841 –1,612

Currency translation differences 0 0 1,527 –215 147 1,459

BALANCE AS AT 31 DECEMBER 2013 1,326 –595 –195,087 6,238 26,072 –162,046

Acquisitions through business combination 0 0 –3,705 0 0 –3,705

(Charged)/released to income 668 437 12,899 497 –2,415 12,086

(Charged)/released to equity 0 0 0 436 6,430 6,866

Currency translation differences 0 –200 –4,386 –460 3,732 –1,314

BALANCE AS AT 31 DECEMBER 2014 1,994 –358 –190,279 6,711 33,819 –148,113

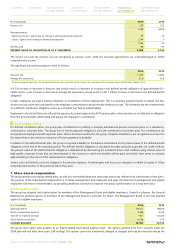

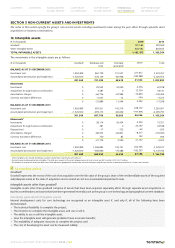

Deferred tax balances are presented in the balance sheet as follows:

(€ in thousands) 2014 2013

Deferred tax assets 18,438 9,681

Deferred tax liabilities –166,551 –171,727

TOTAL –148,113 –162,046

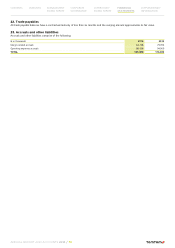

The group has in some jurisdictions tax loss carry forwards that have not been recognised as deferred tax assets, as the amounts as well as

possible future recovery of these losses against future taxable income are uncertain. As at 31 December 2014, these losses amounted to

approximately €90 million (2013: €100 million).

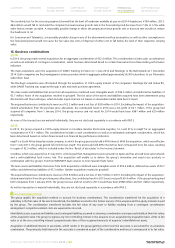

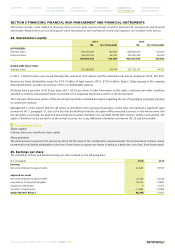

Accounting policy

Deferred taxes are calculated using the liability method. Deferred income taxes reflect the net tax effects of temporary differences between

the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax

assets and liabilities are measured using the tax rates expected to apply to taxable income in the years in which those temporary differences

are expected to be recovered or settled, using tax rates (and laws) that have been enacted or substantially enacted by the balance sheet date.

The measurement of deferred tax liabilities and deferred tax assets reflects the tax consequences that would follow from the manner in which

the group expects, at the balance sheet date, to recover or settle the carrying amount of its assets and liabilities.

Deferred tax assets are recognised when it is probable that sufficient taxable profits will be available against which the deferred tax assets

can be utilised. The carrying amounts of deferred tax assets are reviewed at each balance sheet date and reduced to the extent that it is no

longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered.

Significant estimates

The determination of the group's provision for income tax as well as deferred tax assets and liabilities involves significant judgements and

estimates on certain matters and transactions, for which the ultimate outcome may be uncertain. If the final outcome differs from the group's

estimates, such differences will impact the current and deferred income tax assets and liabilities in the period in which such determination is

made.

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 61