TomTom 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

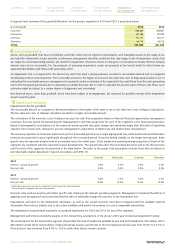

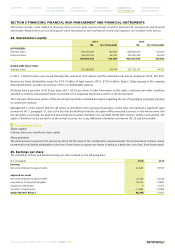

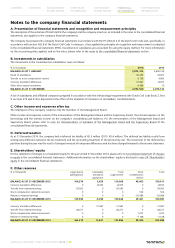

Liquidity and loan covenant

The approach to managing liquidity is to ensure that sufficient funds are available to meet financial obligations when they fall due under both

normal and stressed conditions, without incurring unacceptable losses or risking damage to the group's reputation.

To ensure there is sufficient cash to meet expected operational expenses, including the servicing of financial obligations, actual and future

cash flow requirements are regularly monitored, taking into account the maturity profiles of financial assets and liabilities and the rolling

forecast of the group's liquidity reserve, which comprises cash and cash equivalents and an undrawn credit facility of €200 million.

Under the covenants of the facility, the group is required to meet certain performance indicators with regard to its interest cover (4.0) and

leverage ratio (3.0), which are tested twice a year. Interest cover is defined as the ratio of the last twelve months (LTM) EBITDA to LTM interest

expense for the relevant test period. The leverage ratio is defined as the ratio of total consolidated net debt as at the testing date to the

consolidated LTM EBITDA in respect of the relevant period ending on that date. In case of a breach of these covenants, the banks are

contractually entitled to request early repayment of the outstanding amount. On 31 December 2014, the group complied with the loan

covenants and, based on the group's plan for 2015, management expects to be able to comply with the loan covenants during 2015.

The outstanding borrowings of €50 million from the credit facility has a one-month maturity period from the date of draw down but can

continuously be rolled-over up to the end date of the facility agreement at management's discretion. Assuming the amount utilised remains

the same until the end of the agreement and the level of market interest as well as the required performance indicators remain constant based

on the situation as at 31 December 2014, the annual interest due up to 31 March 2018 would be €0.4 million.

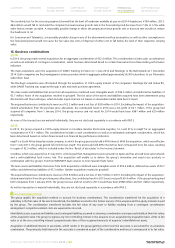

Interest rates

Interest rate risk arises primarily from the existing long-term borrowings. These borrowings have a floating interest coupon based on Euribor

plus a spread that depends on leverage levels. Interest rate risk is hedged with appropriate hedging instruments whenever deemed necessary

in accordance with the Corporate Treasury Policy.

Based on the expectation of interest rate movements in the coming period and the acceptability of potential exposure, the current policy is

not to hedge the interest rate of current borrowings. Accordingly, changes in Euribor may have an impact on the group's results for the

coming year.

Market-related interest income is received on the cash balances. Our intention is to prioritise capital preservation and when possible we invest

our surplus cash using approved investment instruments, such as bank deposits and money market fund investments. All transactions and

counterparty risk limits are governed by Corporate Treasury Policy.

Capital risk management

The group's financing policy aims to maintain a capital structure that enables the group to achieve its strategic objectives and daily operational

needs, and to safeguard the group's ability to continue as a going concern.

In order to maintain or adjust the capital structure, the group may issue new shares, adjust its dividend policy, return capital to shareholders

or sell assets to reduce debt, taking into account relevant interest cover and leverage covenants of external borrowings as disclosed above.

As at 31 December 2014, the group had a net cash position of €103 million (31 December 2013: €83 million).

Further quantitative disclosures are included throughout these consolidated financial statements.

CONTENTS OVERVIEW MANAGEMENT

BOARD REPORT CORPORATE

GOVERNANCE SUPERVISORY

BOARD REPORT FINANCIAL

STATEMENTS SUPPLEMENTARY

INFORMATION

ANNUAL REPORT AND ACCOUNTS 2014 / 74