Shutterfly 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

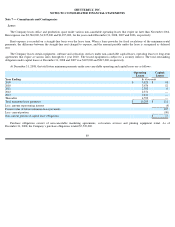

In addition to the above cases, from time to time, the Company may be involved in various legal proceedings arising in the ordinary course

of business. In all cases, at each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is

probable and reasonably estimable under the provisions of Statements of Financial Accounting Standards No. 5, Accounting for Contigencies

("FAS 5"). In such cases, the Company accrues for the amount, or if a range, the Company accrues the low end of the range as a component of

legal expense.

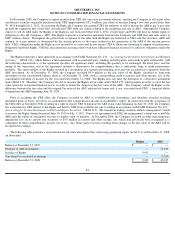

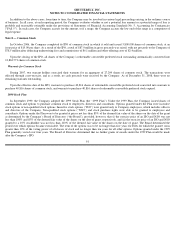

Note 8 — Common Stock

In October 2006, the Company completed its IPO of common stock in which it sold and issued 5,800,000 shares of common stock, at an

issue price of $15.00 per share. As a result of the IPO, a total of $87.0 million in gross proceeds was raised, with net proceeds to the Company of

$78.5 million after deducting underwriting fees and commissions of $6.1 million and other offering costs of $2.4 million.

Upon the closing of the IPO, all shares of the Company’

s redeemable convertible preferred stock outstanding automatically converted into

13,862,773 shares of common stock.

Warrants for Common Stock

During 2007, two warrant holders exercised their warrants for an aggregate of 27,299 shares of common stock. The transactions were

effected through a net-

exercise, and as a result, no cash proceeds were received by the Company. As of December 31, 2008, there were no

remaining warrants outstanding.

Upon the effective date of the IPO, warrants to purchase 40,816 shares of redeemable convertible preferred stock converted into warrants to

purchase 40,816 shares of common stock, and warrants to purchase 40,816 shares of redeemable convertible preferred stock expired.

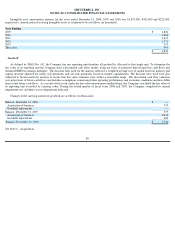

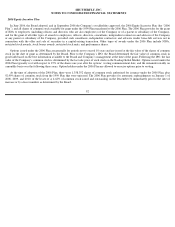

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the “1999 Plan”).

Under the 1999 Plan, the Company issued shares of

common stock and options to purchase common stock to employees, directors and consultants. Options granted under the Plan were incentive

stock options or non-qualified stock options. Incentive stock options (“ISO”)

were granted only to Company employees, which includes officers

and directors of the Company. Non-qualified stock options (“NSO”)

and stock purchase rights were able to be granted to employees and

consultants. Options under the Plan were to be granted at prices not less than 85% of the deemed fair value of the shares on the date of the grant

as determined by the Company’s Board of Directors (“the Board”),

provided, however, that (i) the exercise price of an ISO and NSO was not

less than 100% and 85% of the deemed fair value of the shares on the date of grant, respectively, and (ii) the exercise price of an ISO and NSO

granted to a 10% stockholder was not less than 110% of the deemed fair value of the shares on the date of grant. The Board determined the

period over which options became exercisable. The term of the options was to be no longer than five years for ISOs for which the grantee owns

greater than 10% of the voting power of all classes of stock and no longer than ten years for all other options. Options granted under the 1999

Plan generally vested over four years. The Board of Directors determined that no further grants of awards under the 1999 Plan would be made

after the Company’s IPO.

91