Shutterfly 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

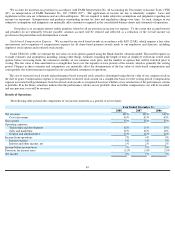

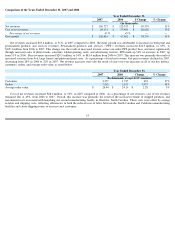

Interest expense decreased by $0.1 million for 2007, due primarily to a decrease in interest expense on capitalized lease obligations.

Interest and other income, net, increased by $3.1 million for 2007, due to larger invested cash balances for the full year 2007, versus

2006. In 2006, interest and other income, net also included $0.1 million of income related to changes in the fair value of our redeemable

convertible preferred stock warrants. Upon the completion of our initial public offering on October 4, 2006, all of our warrants to purchase

shares of preferred stock converted into warrants to purchase shares of common stock and accordingly, no additional amounts for the change in

fair value for the warrants will be recorded.

The provision for income taxes was $6.3 million for 2007, compared to a provision of $3.9 million for 2006. Our effective tax rate was 38%

in 2007, down from 40% in 2006. This decrease in our effective tax rate is primarily the result of a favorable resolution of a state tax audit by

California, as well as the changes that were made to our ongoing research and development tax credits reserves. Other factors, such as the

volume of disqualifying dispositions also contributed to the reduction in our tax rate, year-over-year.

As of December 31, 2007, we had approximately $31 million of federal and $32 million of state net operating loss carryforwards available

to reduce future taxable income. These net operating loss carryforwards begin to expire in 2020 and 2011 for federal and state tax purposes,

respectively.

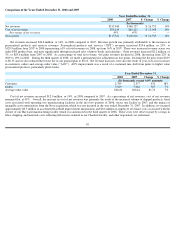

Year Ended December 31,

2007

2006

Change

(In thousands)

Interest Expense

$

(179

)

$

(266

)

$

87

Interest and other income, net

$

5,515

$

2,387

$

3,128

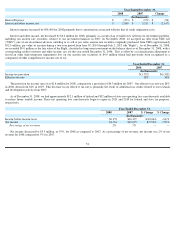

Year Ended December 31,

2007

2006

(In thousands)

Income tax provision

$

(6,302

)

$

(3,942

)

Effective tax rate

38

%

40

%

55