Shutterfly 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

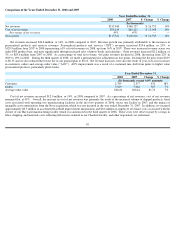

Net income increased by $4.3 million, or 74%, for 2007 as compared to 2006. As a percentage of net revenue, net income was flat at 5% in

both 2007 and 2006. Overall, our net income growth in absolute dollars is attributable to our revenue growth year-over-

year; with all other

income statement items increasing in-proportion to net revenue increases.

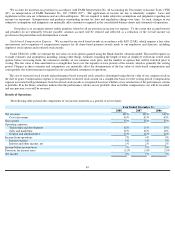

Liquidity and Capital Resources

We anticipate that our current cash and cash equivalents balances, cash generated from operations, and our line of credit will be sufficient

to meet our working capital requirements, capital lease obligations, expansion plans and technology development projects for at least the

next twelve months. Whether these resources are adequate to meet our liquidity needs beyond that period will depend on our growth, operating

results and the capital expenditures required to meet possible increased demand for our products. If we require additional capital resources to

grow our business internally or to acquire complementary technologies and businesses at any time in the future, we may seek to sell additional

debt or equity. The sale of additional equity could result in additional dilution to our stockholders. Financing arrangements may not be available

to us, or may not be in amounts or on terms acceptable to us.

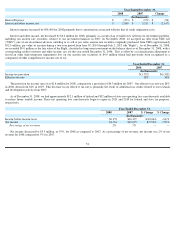

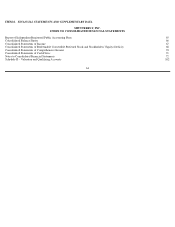

Year Ended December 31,

2007

2006

$ Change

% Change

(In thousands)

Income before income taxes

$16,397

$9,740

$ 6,657

68%

Net income

$10,095

$5,798

$ 4,297

74%

Percentage of net revenues

5%

5%

—

—

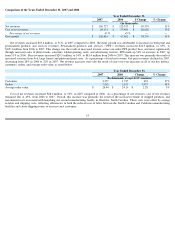

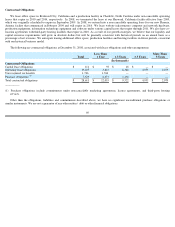

Year Ended December 31,

2008

2007

2006

(In thousands)

Consolidated Statement of Cash Flows Data:

Purchases of property and equipment

$

18,220

$

31,881

19,330

Capitalization of software and website development costs

4,527

3,112

1,351

Acquisition of business and intangibles, net of cash acquired

10,097

2,858

—

Depreciation and amortization

26,038

17,796

10,747

Cash flows from operating activities

47,040

42,192

23,485

Cash flows from investing activities

(82,086

)

(40,823

)

(20,681

)

Cash flows from financing activities

628

2,162

77,094

56