Shutterfly 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We account for uncertain tax positions in accordance with FASB Interpretation No. 48 Accounting for Uncertainty in Income Taxes ("FIN

48"), an interpretation of FASB Statement No. 109 ("SFAS 109"). The application of income tax law is inherently complex. Laws and

regulations in this area are voluminous and are often ambiguous. We are required to make subjective assumptions and judgments regarding our

income tax exposures. Interpretations and guidance surrounding income tax laws and regulations change over time. As such, changes in our

subjective assumptions and judgments can materially affect amounts recognized in the consolidated balance sheets and statements of operations.

Our policy is to recognize interest and/or penalties related to all tax positions in income tax expense. To the extent that accrued interest

and penalties do not ultimately beocme payable, amounts accrued will be reduced and reflected as a reduction of the overall income tax

provision in the period that such determination is made.

Stock-based Compensation Expense

. We account for our stock based awards in accordance with FAS 123(R), which requires a fair value

measurement and recognition of compensation expense for all share-

based payment awards made to our employees and directors, including

employee stock options and restricted stock awards.

Under SFAS No 123R, we estimate the fair value of stock options granted using the Black-

Scholes valuation model. This model requires us

to make estimates and assumptions including, among other things, estimates regarding the length of time an employee will retain vested stock

options before exercising them, the estimated volatility of our common stock price and the number of options that will be forfeited prior to

vesting. The fair value is then amortized on a straight-

line basis over the requisite service periods of the awards, which is generally the vesting

period. Changes in these estimates and assumptions can materially affect the determination of the fair value of stock-

based compensation and

consequently, the related amount recognized in our consolidated statements of operations.

The cost of restricted stock awards and performance based restricted stock awards is determined using the fair value of our common stock on

the date of grant. Compensation expense is recognized for restricted stock awards on a straight-

line basis over the vesting period. Compensation

expense associated with performance based restricted stock awards is recognized based on whether or not satisfaction of the performance criteria

is probable. If in the future, situations indicate that the performance criteria are not probable, then no further compensation cost will be recorded,

and any previous costs will be reversed.

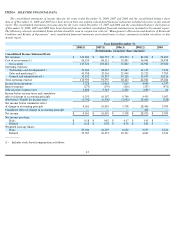

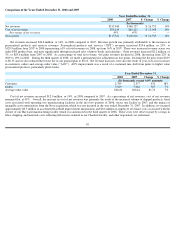

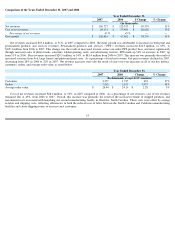

Results of Operations

The following table presents the components of our income statement as a percent of net revenues:

Year Ended December 31,

2008

2007

2006

Net revenues

100

%

100

%

100

%

Cost of revenues

45

%

45

%

45

%

Gross profit

55

%

55

%

55

%

Operating expenses:

Technology and development

18

%

15

%

15

%

Sales and marketing

20

%

18

%

18

%

General and administrative

15

%

16

%

16

%

Income from operations

2

%

6

%

6

%

Interest expense

0

%

0

%

0

%

Interest and other income, net

1

%

2

%

2

%

Income before income taxes

3

%

8

%

8

%

Provision for income taxes

(1

)%

(3

)%

(3

)%

Net income

2

%

5

%

5

%

49