Shutterfly 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

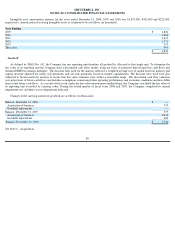

Note 7 — Commitments and Contingencies

Leases

The Company leases office and production space under various non-

cancelable operating leases that expire no later than November 2014.

Rent expense was $2,786,000, $1,925,000 and $1,295,000, for the years ended December 31, 2008, 2007 and 2006, respectively.

Rent expense is recorded on a straight-

line basis over the lease term. When a lease provides for fixed escalations of the minimum rental

payments, the difference between the straight-

line rent charged to expense, and the amount payable under the lease is recognized as deferred

rent.

The Company leases certain equipment, software and colocation services under non-cancelable capital leases, operating leases or long-

term

agreements that expire at various dates through th e year 2010.

The leased equipment is subject to a security interest. The total outstanding

obligation under capital leases at December 31, 2008 and 2007 was $107,000 and $915,000, respectively.

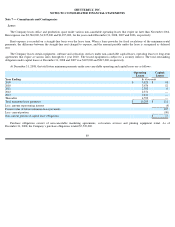

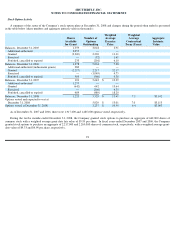

At December 31, 2008, the total future minimum payments under non-cancelable operating and capital leases are as follows:

Purchase obligations consist of non-cancelable marketing agreements, co-

location services and printing equipment rental. As of

December 31, 2008, the Company’s purchase obligations totaled $7,529,000.

Operating

Leases

Capital

Leases

Year Ending:

In thousands

2009

$

3,823

$

93

2010

3,676

12

2011

2,302

6

2012

2,371

—

2013

2,441

—

Thereafter

4,592

—

Total minimum lease payments

$

19,205

$

111

Less: amount representing interest

(4

)

Present value of future minimum lease payments

107

Less: current portion

(90

)

Non

-

current portion of capital lease obligations

$

17

89