Shutterfly 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

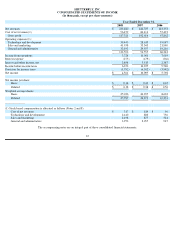

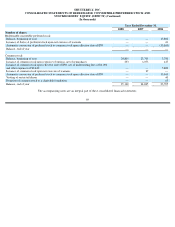

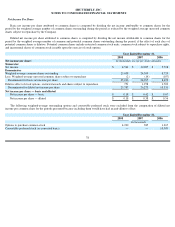

SHUTTERFLY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

Year Ended December 31,

2008

2007

2006

Cash flows from operating activities:

Net income

$

4,561

$

10,095

$

5,798

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation and amortization

24,211

17,384

10,525

Amortization of intangible assets

1,827

412

222

Stock

-

based compensation

8,628

4,001

2,300

Charitable contribution expense for shares issued to charitable foundation

—

—

923

Change in carrying value of preferred stock warrant liability

—

—

(

152

)

Loss/(gain) on disposal of property and equipment

308

262

(29

)

Deferred income taxes

(473

)

5,853

3,199

Gain on auction rate securities Rights

(9,013

)

—

—

Impairment of non

-

current auction rate securities

9,013

—

—

Changes in operating assets and liabilities, net of effects of acquisition:

Accounts receivable, net

(1,512

)

(2,316

)

(1,215

)

Inventories

1,178

(2,290

)

(1,419

)

Prepaid expenses and other current assets

(120

)

(1,750

)

(1,171

)

Other assets

(243

)

(1,668

)

(121

)

Accounts payable

2,431

(602

)

5,514

Accrued and other liabilities

5,482

10,390

(2,603

)

Deferred revenue

762

2,421

1,714

Net cash provided by operating activities

47,040

42,192

23,485

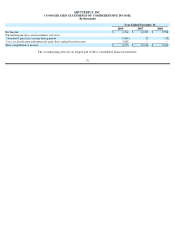

Cash flows from investing activities:

Purchases of property and equipment

(18,220

)

(31,881

)

(19,330

)

Capitalization of software and website development costs

(4,527

)

(3,112)

(1,351)

Acquisition of business and intangible assets, net of cash acquired

(10,097

)

(2,858

)

—

Purchases of short term investments

—

(

3,000

)

—

Proceeds from sale of short term investments

3,002

—

—

Proceeds from sale of property and equipment

6

28

—

Purchase of auction rate securities

(52,250

)

—

—

Net cash used in investing activities

(82,086

)

(40,823

)

(20,681

)

Cash flows from financing activities:

Principal payments of capital lease obligations

(808

)

(2,840

)

(1,446

)

Proceeds from IPO shares issued, net of issuance costs

—

—

78,468

Proceeds from issuance of common stock upon exercise of stock options

1,158

4,975

83

Shares withheld for payment of employee

’

s withholding tax liability

(260

)

—

—

Repurchases of common stock

—

—

(

11

)

Tax benefit of stock options

538

27

—

Net cash provided by financing activities

628

2,162

77,094

Net increase (decrease) in cash and cash equivalents

(34,418)

3,531

79,898

Cash and cash equivalents, beginning of period

122,582

119,051

39,153

Cash and cash equivalents, end of period

$

88,164

$

122,582

$

119,051

Supplemental disclosures of cash flow information

Cash paid during the period for interest

$

47

$

198

$

205

Cash paid during the period for income taxes

535

812

—

Supplemental schedule of non

-

cash investing and financing activities

Accrued acquisition liabilities

400

—

—

Conversion of preferred stock

—

—

89,795

Conversion of preferred stock warrant liability into APIC

—

—

1,381

Preferred stock warrants exercised on net basis

—

—

143

71