Shutterfly 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES

OF EQUITY SECURITIES.

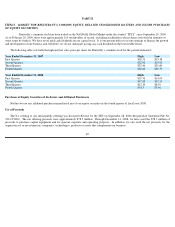

Shutterfly’s common stock has been traded on the NASDAQ Global Market under the symbol “SFLY” since September 29, 2006.

As of February 20, 2009, there were approximately 114 stockholders of record, excluding stockholders whose shares were held in nominee or

street name by brokers. We have never paid cash dividends on our capital stock. It is our present policy to retain earnings to finance the growth

and development of our business and, therefore, we do not anticipate paying any cash dividends in the foreseeable future.

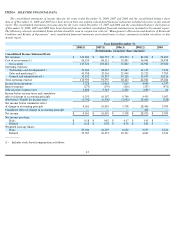

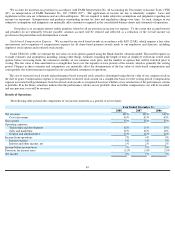

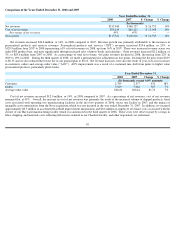

The following table sets forth the high and low sales price per share for Shutterfly’s common stock for the periods indicated:

Purchases of Equity Securities of the Issuer and Affiliated Purchasers

Neither we nor any affiliated purchaser repurchased any of our equity securities in the fourth quarter of fiscal year 2008.

Use of Proceeds

The S-

1 relating to our initial public offering was declared effective by the SEC on September 28, 2006 (Registration Statement File No.

333-

135426). The net offering proceeds were approximately $78.5 million. Through December 31, 2008, we have used the $78.5 million of

proceeds to purchase capital equipment and for general corporate and operating purposes. In addition, we also used the net proceeds for the

acquisition of, or investment in, companies, technologies, products or assets that complement our business.

Year Ended December 31, 2007

High

Low

First Quarter

$18.53

$13.38

Second Quarter

$22.92

$15.92

Third Quarter

$32.46

$21.80

Fourth Quarter

$36.40

$25.59

Year Ended December 31, 2008

High

Low

First Quarter

$25.70

$14.65

Second Quarter

$17.83

$12.21

Third Quarter

$12.14

$8.59

Fourth Quarter

$9.13

$5.96

40