Shutterfly 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

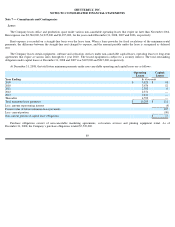

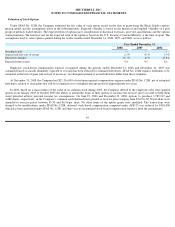

The components of the net deferred tax assets as of December 31, 2008 and 2007 are as follows (in thousands):

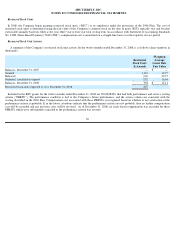

As of January 1, 2008, the Company had $756,000 of unrecognized tax benefits. As of December 31, 2008, the Company booked an

additional $1,010,000 for unrecognized tax benefits for fiscal 2008. A reconciliation of the beginning and ending amounts of unrecognized

income tax benefits during the twelve month period ended December 31, 2008 is as follows (in thousands):

The company does not expect the balance of unrecognized tax benefits to significantly increase or decrease in the next twelve months.

As of December 31, 2008, the Company is subject to taxation in the United States, California, and twelve other jurisdictions in the United

States.

December 31,

2008

2007

Deferred tax assets:

Net operating loss carryforwards

$

1,240

$

7,481

Reserves and other tax benefits

4,312

3,485

Tax credits

4,499

2,715

Depreciation and amortization

2,612

1,196

Other

408

94

Deferred tax assets

13,071

14,971

Deferred tax liabilities:

Deferred tax liabilities

—

—

Net deferred tax assets

$

13,071

$

14,971

2008

2007

Balance of unrecognized tax benefits at January 1

$ 756

1,200

Additions for tax positions of prior years

455

$

—

Additions for tax positions related to current year

555

259

Reductions for tax positions of prior years

—

(

607

)

Settlement of franchise tax audit

—

(

96

)

Balance of unrecognized tax benefits at December 31

1,766

$

756

99