Shutterfly 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

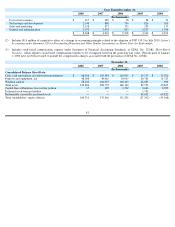

We utilized a discounted cash flow approach to determine the Level 3 valuation for our auction rate securities. The assumptions used in

preparing the discounted cash flow model include estimates for interest rates, timing and amount of cash flows, credit and liquidity premiums,

and expected holding periods of the auction rate securities. These assumptions are volatile and subject to change as the underlying sources of

these assumptions and market conditions change. They represent our estimates given available data as of December 31, 2008.

On January 1, 2008, we adopted SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-

Including an

amendment of FASB Statement No. 115” ("

SFAS No. 159"). SFAS No. 159 permits companies to choose to measure certain financial assets

and liabilities at fair value (the “fair value option”).

If the fair value option is elected, any upfront costs and fees related to the item must be

recognized in earnings and cannot be deferred, e.g. debt issue costs. The fair value election is irrevocable and may generally be made on an

instrument-by-

instrument basis, even if a company has similar instruments that it elects not to fair value. At the adoption date, unrealized gains

and losses on existing items for which fair value has been elected are reported as a cumulative adjustment to beginning retained earnings. We

chose not to elect the fair value option for our financial assets and liabilities existing on January 1, 2008, and did not elect the fair value option

for any financial assets and liabilities transacted during the twelve months ended December 31, 2008, except for the Rights related to our auction

rate securities that were recorded in conjunction with signing an agreement with one of our investment advisors.

Goodwill and Intangible Assets

.

We

account for intangible assets and goodwill in accordance with Statement of Financial Accounting

Standards No. 142, Goodwill and Other Intangible Assets (“SFAS No. 142”).

Goodwill and intangible assets with indefinite lives are not

amortized but are tested for impairment on an annual basis during our fourth quarter or whenever events or changes in circumstances indicate

that the carrying amount of these assets may not be recoverable. Intangible assets with finite useful lives are amortized using the straight-

line

method over their useful lives and are reviewed for impairment in accordance with SFAS No. 144.

Intangible assets from acquisitions are amortized on a straight-line basis over the estimated useful lives which range from one to five years.

For goodwill analysis, we operate under one reporting unit as defined by SFAS No. 142. To determine the fair value of our reporting unit

we used a discounted cash flow model, using ten years of projected unleveraged free cash flows and terminal EBITDA earnings multiples. The

discount rates used for the analysis reflected a weighted average cost of capital based on industry and capital structure adjusted for equity risk

premiums and size risk premiums based on market capitalization. The discount rates used were also subjected to broad sensitivity analysis to

ensure that fair value estimates were within a reasonable range. The discounted cash flow valuation uses projections of future cash flows and

includes assumptions concerning future operating performance and economic conditions and may differ from actual future cash flows. As a

result of this work, under the fair value measurement methodology, we concluded the fair value of our reporting unit exceeded our carrying

value.

Software and Website Development Costs.

We capitalize eligible costs associated with software developed or obtained for internal use in

accordance with the AICPA Statement of Position No. 98-

1 "Accounting for the Costs of Computer Software Developed or Obtained for Internal

Use" and EITF Issue No. 00-2 "Accounting for Website Development Costs." Accordingly, payroll and payroll-related costs and stock-

based

compensation incurred in the development phase are capitalized and amortized over the product’

s estimated useful life, which is generally three

years. Costs associated with minor enhancements and maintenance for our website are expensed as incurred.

Income Taxes.

We use the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities

are recognized by applying the statutory tax rates in effect in the years in which the differences between the financial reporting and tax filing

bases of existing assets and liabilities are expected to reverse. We have considered future taxable income and ongoing prudent and feasible tax

planning strategies in assessing the need for a valuation allowance against our deferred tax assets. We believe that all net deferred tax assets

shown on our balance sheet are more likely than not to be realized in the future and no valuation allowance is necessary. In the event that actual

results differ from those estimates or we adjust those estimates in future periods, we may need to record a valuation allowance, which will

impact deferred tax assets and the results of operations in the period the change in made.

48