Sharp 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

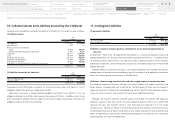

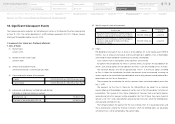

Ⅱ. Reduction of Common Stock and Capital Reserve, and Appropriation of Surpluses for the

121st Term

1. Purpose of reduction of common stock and capital reserve, and appropriation of surpluses

In order for the Company to promptly improve its financing standing to prepare for a dynamic and

flexible capital policy in the future, the Company decided to reduce common stock and capital reserve

transferring distributable amounts to other capital surplus. The Company also decided to dispose of

surplus in accordance with the provisions of Article 452 of the Companies Act to cover deficiencies

in retained earnings carried forward by using other capital surplus increased by reduction of common

stock and capital reserve.

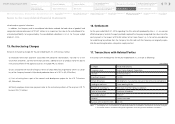

2. Terms and conditions of Reduction of Common Stock and Capital Reserve

(1) Amounts of common stock to be decreased

233,884,726,500 yen

(2) Amounts of capital reserve to be decreased

196,759,726,500 yen

(3) Method of reduction of common stock and capital reserve

After implementing reduction of common stock and capital reserve based on the provisions of

Article 447, Paragraph 1 and Article 448, Paragraph 1 of the Companies Act, the Company will

transfer the total amount of common stock and capital reserve to other capital surplus.

(4) Schedule of Reduction of Common Stock and Capital Reserve

May 14, 2015

(Thursday)

Resolution of Board of Directors meetings related to reduction of common

stock and capital reserve

Resolution of Board of Directors meetings related to proposal to reduction

of common stock and capital reserve to be discussed by Ordinary General

Meeting of Shareholders

May 29, 2015

(Friday) Public notice with respect to statements of objection by creditors

June 23, 2015

(Tuesday) Resolution of Ordinary General Meeting of Shareholders

June 29, 2015

(Monday) Final deadline for statements of objection by creditors

June 30, 2015

(Tuesday) Effective date of reduction of common stock and capital reserve (planned)

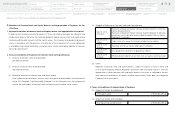

(5) Others

Reduction of common stock and capital reserve is subject to issuance of Class A Shares and

Class B Shares becoming effective. Reduction of common stock and capital reserve is a transfer

appropriation in which common stock and capital reserve in net assets as indicated on the bal-

ance sheet are transferred to the account of other capital surplus, which does not change the

Company’s net asset amounts.

3. Terms and conditions of Appropriation of Surpluses

(1) Amounts of surplus to be decreased

Other capital surplus 219,780,861,290 yen

(2) Amounts of surplus to be increased

Retained earnings carried forward 219,780,861,290 yen

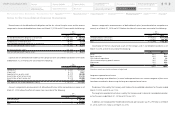

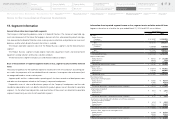

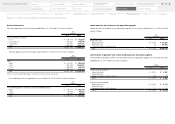

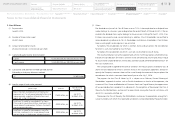

Notes to the Consolidated Financial Statements

54

Financial Section

Notes to the Consolidated

Financial Statements

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary