Sharp 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

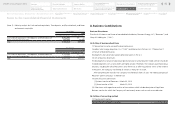

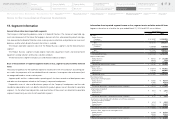

18. Significant Subsequent Events

The Company passed a resolution for the following 3 matters at the Board of Directors meeting held

on May 14, 2015. The matters described in Ⅰ and Ⅱ had been approved at the 121st Ordinary General

Meeting of Shareholders held on June 23, 2015.

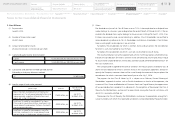

Ⅰ. Issuance of class shares by a third party allotment

1. Class A Shares

(1) Payment date

June 30, 2015

(2) Number of shares to be issued

200,000 shares

(3) Amount of procurement funds

200,000,000,000 yen (1,000,000 yen per share)

(4) Capital and capital reserve to be increased

Capital 100,000,000,000 yen (500,000 yen per share)

Capital reserve 100,000,000,000 yen (500,000 yen per share)

(5) Subscription and allotment method (planned allottee)

Allotted by a third party allotment method.

Mizuho Bank, Ltd. 100,000 shares

The Bank of Tokyo-Mitsubishi UFJ, Ltd. 100,000 shares

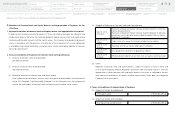

(6) Specific usage of funds to be procured

Specific usage Amounts Planned time of

spending

Repayment of the Company’s and the Company’s

subsidiary’s debt owed to the Mizuho Bank group 100,000 million yen June 2015

Repayment of the Company’s and the Company’s

subsidiary’s debt owed to the Bank of Tokyo-

Mitsubishi UFJ group

100,000 million yen June 2015

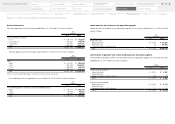

(7) Others

The dividend rate (annual) of Class A Shares is set by adding 2.5% to the Japanese yen TIBOR (6

months). Class A Shares are cumulative and non-participating. In addition, Class A shareholders

are entitled to receive dividends in preference to common shareholders.

Class A Shares have no voting rights and assignments are restricted.

Put options the consideration for which is common shares, put options the consideration for

which is cash and call options the consideration for which is cash are attached to Class A Shares.

The maximum dilution rate will be approximately 118.7% if all the put options attached

to Class A Shares the consideration for which are common shares are exercised, assuming no

amount equal to the accumulated unpaid dividends and no daily prorated unpaid preferred divi-

dend amount for the Class A Shares exists.

The put option the consideration for which is common shares can be exercised only on or after

July 1, 2019.

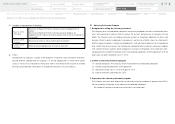

The payments for the Class A Shares by the Allotted Banks are subject to an Ordinary

General Meeting of Shareholders’ approval of matters such as Partial Amendment to Articles of

Incorporation, the issuance of Class Shares, Reduction of Common Stock and Capital Reserve,

reasonable certainty that payment will be received for the Class B Shares from Japan Industrial

Solutions, Ltd. (“JIS”) and a reconciliation among financial institutions which the Allotted Banks

are reasonably satisfied with, etc.

The Company believes the payment for the Class B Shares from JIS is reasonably certain and

that a reconciliation among the financial institutions which the Allotted Banks are reasonably

satisfied with, etc. will be completed by the payment date.

Notes to the Consolidated Financial Statements

52

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary