Sharp 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for and minimize damage in the event of large-

scale natural disasters such as earthquakes and ty-

phoons, and is working hard to avoid the impact

of such disasters. However, if Sharp or its partners’

business activities are impaired directly or indi-

rectly due to the occurrence of an unprecedented

large-scale natural disaster, it may affect Sharp’s

business results and financial position.

(16) Risks Accompanying the Nuclear Power Plant Disaster

Electric power generation problems, caused by the

nuclear power plant accident accompanying the

Great East Japan Earthquake, have had various

adverse effects on both Japanese and overseas

markets, which is affecting Sharp’s business re-

sults and financial position. The Japanese govern-

ment has signaled its intention to reinstate nuclear

power generation following cabinet approval of a

basic energy plan defining nuclear as an “impor-

tant baseload power source.” In the absence of

a timeframe for reinstatement, however, power

generation problems remain unsolved at the pres-

ent time. Any possible future restrictions on elec-

tricity usage or hikes in electricity prices stemming

from electricity shortages could cause plant opera-

tions to be reduced and/or costs to increase, which

may affect Sharp’s business results and financial

position.

(17) Competition to Secure Skilled Personnel

Exceptional human resources in such fields as

technology and management are crucial to Sharp’s

future growth and development. However, since

demand for talented personnel in various fields

exceeds supply, competition to secure human re-

sources is intensifying. In the event that Sharp is

unable to attract new personnel or prevent the

departure of existing employees, or is unable to

improve the skills of key personnel engaged in

business management, its business results and fi-

nancial position may be affected.

(18) Other Key Variable Factors

In addition to the aforementioned risks, Sharp’s

business results may be significantly affected by

human-induced calamities such as accidents, con-

flicts, insurrections or terrorism; the spread of a

new strain of influenza or other infectious dis-

ease; or major fluctuations in the stock and bond

markets.

(19) Outline of Significant Events Relating to

Assumed Going Concern

In the two-year period through fiscal 2012, Sharp

consecutively posted large operating losses and

net losses, as well as negative major operating

cash flows, and its financial position weakened as

a result. In response, Sharp formulated a Medium-

Term Management Plan in May 2013 and has

since worked diligently to achieve recovery and

growth. With respect to performance, therefore,

Sharp returned to profitability in fiscal 2013, with

consolidated net income of ¥11,559 million. On

the funding side, Sharp has received continuous

support from financial institutions, including a syn-

dicated loan, enabling redemption of bonds upon

maturity. Sharp also secured funds and strength-

ened its financial base, by issuing new shares via

public offering and third-party allotment, etc. In

fiscal 2014, however, Sharp once again incurred a

substantial operating loss and net loss due to fall-

ing prices of small- and medium-size LCDs, loss on

related to valuation reserve for inventory purchase

commitments, impairment losses, restructuring

charges, and other measures aimed at improving

its operational foundation. These factors made it

difficult to achieve the targets of the Medium-Term

Management Plan. Accordingly, consolidated net

assets have declined significantly, to levels infring-

ing on financial covenants of the syndicated loan

agreement. Moreover, the term of the syndicated

loan expires on March 31, 2016. Although there

are events or conditions that may cast significant

doubt on the entity’s ability to continue as a going

concern, we believe that these conditions will not

cast a material uncertainty about Sharp’s ability to

continue as a going concern, due to implemen-

tation of various measures to resolve these and

other major issues as described below. Therefore,

no further disclosure for the “Going Concern

Assumption” in the notes to the consolidated fi-

nancial statements is necessary.

Sharp has formulated a new Medium-Term

Management Plan for Fiscal 2015 through 2017.

Under the plan, Sharp will strive to build stable

earnings foundation by steadily implementing

three key strategies: (1) Restructure business port-

folio, (2) Reduce fixed costs, and (3) Reorganize

and strengthen corporate/governance systems.

Furthermore, based on the premise of the plan’s

implementation, Sharp will issue preferred shares

totaling ¥200.0 billion to two main banks—Mizuho

Bank, Ltd. and The Bank of Tokyo-Mitsubishi UFJ,

Ltd.—in order to reinforce deteriorated capital

base. Sharp will also issue preferred shares totaling

¥25.0 billion to Japan Industrial Solutions Fund I,

managed by Japan Industrial Solutions Co., Ltd., to

raise investment capital. In both cases, Sharp con-

cluded preferred share subscription agreements

on May 14, 2015, and related proposals (change

to Articles of Incorporation, type of shares issued,

reduction in capital, etc.) received approval at the

121st Ordinary General Meeting of Shareholders,

held on June 23, 2015. Reconciliation among

financial institutions and other matters that rea-

sonably satisfy the underwriting financial insti-

tutions are expected to be completed by the

payment date. Sharp will work steadily to reinforce

its capital base and implement its Medium-Term

Management Plan while helping those institutions

and other related parties reach an understanding

of Sharp’s initiatives as before. Moreover, despite

financial covenants being infringed upon, Sharp’s

main financial institutions indicate that they are

not considering enforcing forfeiture of the benefit

of time. With respect to the expiration of the syn-

dicated loan contract, as well, Sharp has received

informal notice from the financial institutions that

they will continue supporting Sharp during the pe-

riod of the new Medium-Term Management Plan,

subject to the successful completion of the pre-

ferred share underwritings. Accordingly, Sharp will

avoid the risk of capital inadequacy and, thanks to

the continued support of financial institutions, will

implement specific measures outlined in its new

Medium-Term Management Plan.

Risk Factors

21

Risk Factors

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

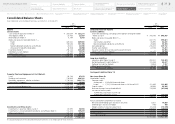

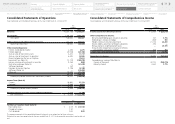

Financial Section

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

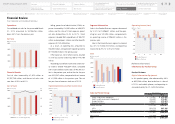

Fiscal 2014 Review by

Product Group

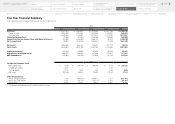

Financial Highlights

SHARP Annual Report 2015