Sharp 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

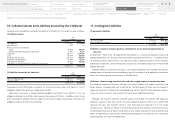

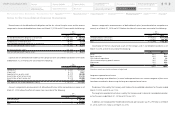

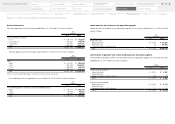

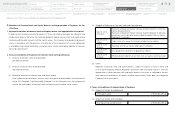

value based on appraisal valuations.

In addition, the Company and its consolidated subsidiaries reduced the book value of goodwill and

recognized a decreased amount of ¥1,827 million as an impairment loss due to the unlikelihood of an

estimated profitability to be generated by the consolidated subsidiaries in U.S.A. for the year ended

March 31, 2015.

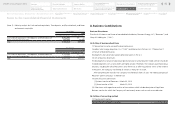

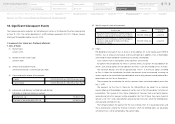

Details of restructuring charges for the year ended March 31, 2015 were as follows:

(a) Employee termination payments associated with personnel rationalization, transition to a new

value chain and others, contract termination penalties, additional costs on product warranties due to

restructuring reform of the appliance business in Europe (¥9,212 million)

(b) Loss associated with transfer of equity interests of Sharp Manufacturing Poland, which is a subsid-

iary of the Company located in Poland and production bases of LCD TVs (¥5,476 million)

(c) Costs of exiting from a part of the research and development project for the LCD TV business

(¥3,338 million)

(d) Mainly employee termination payments due to the restructuring reform of the overseas LCD TV

business (¥3,213 million)

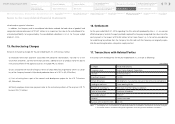

15. Restructuring Charges

For the year ended March 31, 2015, regarding thin-film solar cells produced by 3Sun s. r. l., an overseas

affiliated company to which the equity method is applied, the Company recognized a loss due to a settle-

ment payment in the amount of ¥14,382 million to Enel Green Power S. p. A. for certain consideration

for undertaking to purchase from the Company thin-film solar cells the Company was originally respon-

sible for purchasing based on a long-term supply contract.

16. Settlement

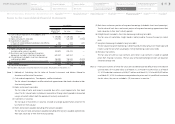

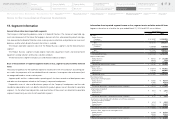

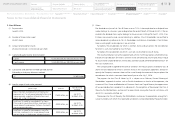

Transactions with related parties for the year ended March 31, 2015 are as followings:

17. Transactions with Related Parties

Notes: 1. Consumption tax is not included in the transaction amount but included in the balance at the end of fiscal year.

2. Transaction amounts are determined by price negotiations after taking market conditions into account.

Category Associated company

Company name Sakai Display Products Corporation

Location Sakai city Sakai ku

Investment amount 15,000

Details of business Development, manufacture and sale of device business components

Holding or held ratio Direct holding: 39.9%

Relation of related party Manufacture of the Company’s products

Detail of transaction Purchases of products

Transaction amount 150,077

Account Accounts payable

Balance at the end of the term 28,165

Yen (millions)

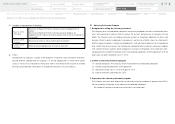

Notes to the Consolidated Financial Statements

51

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary