Sharp 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

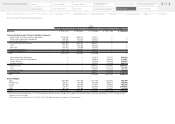

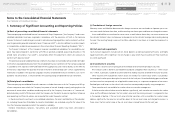

Notes to the Consolidated Financial Statements

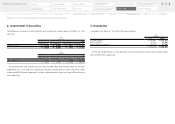

The estimated amount of all retirement benefits to be paid at future retirement dates is allocated to

each service year based on a benefit formula.

Past service costs are amortized primarily using the straight-line method over the average of the esti-

mated remaining service years (14 years) commencing with the current period. Actuarial gains and losses

are primarily amortized using the straight-line method over the average of the estimated remaining

service years (14 years) commencing with the following period.

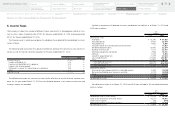

(n) Research and development expenses

Research and development expenses are charged to income as incurred. The research and development

expenses charged to income amounted to ¥132,124 million and ¥141,042 million for the years ended

March 31, 2014 and 2015, respectively.

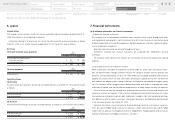

(o) Derivative financial instruments

The Company and some of its consolidated subsidiaries use derivative financial instruments, including

foreign exchange forward contracts in order to hedge the risk of fluctuations in foreign currency ex-

change rates associated with assets and liabilities denominated in foreign currencies.

All derivative financial instruments are stated at fair value and recorded on the balance sheets. The

deferred method is used for recognizing gains and losses on hedging instruments and the hedged items.

When foreign exchange forward contracts meet certain conditions, the hedged items are stated at the

forward exchange contract rates.

Derivative financial instruments are used based on internal policies and procedures on risk control. The

risks of fluctuations in foreign currency exchange rates have been assumed to be completely hedged over

the period of hedging contracts as the major conditions of the hedging instruments and the hedged items

are consistent. Accordingly, an evaluation of the effectiveness of the hedging contracts is not required.

The credit risk of such derivatives is assessed as being low because the counterparties of these transac-

tions have good credit ratings with financial institutions.

(p) Method and Period for Amortization of Goodwill

Goodwill for which the effective term is possible to be estimated is amortized evenly over the estimated

term, while the other is amortized evenly over 5 years. However, if the amount is minor, the entire

amount is amortized during the period of occurrence.

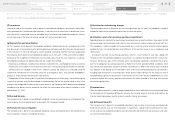

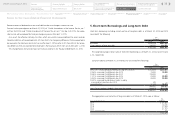

(q) Changes in accounting policies

Effective from the year ended March 31, 2015, the Company and its domestic consolidated subsidiaries

adopted paragraph 35 of the “Accounting Standard for Retirement Benefits” (ASBJ Statement No. 26

on May 17, 2012) and paragraph 67 of the “Guidance on Accounting Standard for Retirement Benefits”

(ASBJ Statement No. 25 on March 26, 2015). The Company and its domestic consolidated subsidiaries

reviewed the method of calculating retirement benefit obligations and service costs, and changed the

method of attributing expected benefit to periods primarily from a point basis to a benefit formula basis.

In accordance with transitional accounting as stipulated in paragraph 37 of the Accounting Standard

for Retirement Benefits, the effect of the changes in the method of calculating retirement benefit obliga-

tions and service costs was recognized as an adjustment to retained earnings at the beginning of the

year ended March 31, 2015. This change had an immaterial impact on net defined benefit liability and

retained earnings at the beginning of the year ended March 31, 2015, as well as on financial statements

for the year ended March 31, 2015.

(r) Changes in accounting estimates

The Company and its domestic consolidated subsidiaries previously amortized actuarial gain/loss and

past service costs on severance and pension benefits over 15 years. Effective from the year ended March

31, 2015, the amortization period has been changed to 14 years because the average of the estimated

remaining service years decreased. This change had an immaterial impact on financial statements for the

year ended March 31, 2015.

(s) Reclassifications

Certain account balances in the financial statements and accompanying footnotes for the year ended March

31, 2014 have been reclassified to conform to the presentation for the fiscal year ended March 31, 2015.

35

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

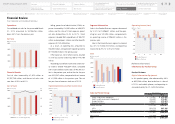

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

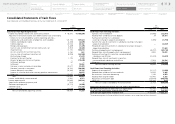

Consolidated Statements of

Cash Flows

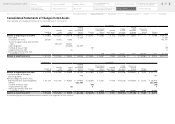

Consolidated Statements of

Changes in Net Assets

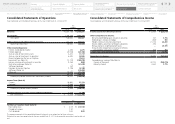

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

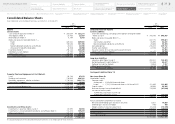

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary