Sharp 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

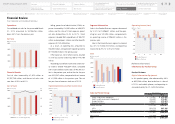

Health and Environmental Equipment

Sales in this group decreased by 3.6% to

¥315,037 million, due to declines in sales of air

conditioners, and operating income declined by

24.2% to ¥15,927 million.

Energy Solutions

Sales in this group declined by 38.3% to

¥270,874 million, due to a decrease in sales of

solar cells. The group posted an operating loss

of ¥62,679 million, compared with operating

income of ¥32,400 million in the previous year.

Business Solutions

Sales in this group climbed by 6.7% to ¥340,332

million, thanks to growth in overseas sales of

MFPs, and operating income increased by 2.8%

to ¥31,403 million.

Device Business

LCDs

Sales in this group decreased by 8.5% to

¥907,105 million, due mainly to a decline in

sales of large-size LCDs. This was despite in-

creased sales of small- and medium-size LCDs

for smartphones and tablets. Operating income

fell by 98.6% to ¥594 million.

Electronic Devices

Sales in this group increased by 35.3% to

¥441,469 million, thanks mainly to increased

sales of camera modules, which contrasted with

lower sales of LEDs. Operating income declined

by 79.3% to ¥676 million.

Capital Investment and Depreciation

Capital investment totaled ¥62,653 million, up

26.7% from the previous year. Much of this

investment was allocated to expansion and im-

provement of production lines for small- and

medium-size LCDs, in order to meet flourishing

demand for LCDs for mobile devices such as

smartphones and tablets.

By business segment, capital investment

was ¥26,697 million for the Product Business

and ¥34,340 million for the Device Business.

Unallocated capital investment amounted to

¥1,616 million.

Depreciation and amortization declined by

11.4% to ¥117,323 million.

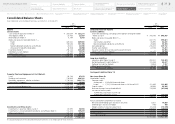

Assets, Liabilities and Net Assets

Total assets amounted to ¥1,961,909 million,

down ¥219,771 million from the end of the pre-

vious year.

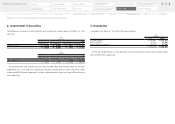

Assets

Current assets amounted to ¥1,299,195 million,

down ¥75,049 million. This was due mainly to

a ¥118,423 million decrease in cash and cash

equivalents. By contrast, there was a ¥36,819

million increase in notes and accounts receiv-

able. Inventories increased by ¥43,174 million

to ¥338,300 million. Included in inventories,

finished products increased ¥52,664 million

to ¥213,124 million; work in process declined

¥8,291 million to ¥67,845 million; and raw ma-

terials and supplies were down ¥1,199 million to

¥57,331 million.

Property, plant and equipment, at cost, de-

clined by ¥119,109 million to ¥400,592 million.

Investments and other assets amounted to

¥262,122 million, down ¥25,613 million. This

was due mainly to a decrease in long-term pre-

paid expenses.

Liabilities

Current liabilities increased by ¥135,329 million

to ¥1,686,954 million. Short-term borrowings in-

creased by ¥55,749 million to ¥848,947 million.

This stemmed from a ¥44,362 million increase

in current portion of long-term debt. Notes and

accounts payable increased by ¥58,106 million

to ¥468,019 million.

Long-term liabilities decreased by ¥192,442

million to ¥230,440 million. This was due mainly

to a ¥174,992 million decrease in long-term

debt.

Interest-bearing debt at year-end stood at

¥974,276 million, down ¥119,243 million from

a year earlier.

Inventories

(billions of yen)

500

400

300

100

200

0

600

151411 12 13

Capital Investment/

Depreciation and Amortization

(billions of yen)

200

100

0

300

151411 12 13

Capital investment

Depreciation and amortization

Financial Review

27

Financial Review

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

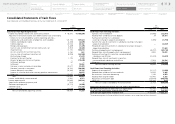

Consolidated

Subsidiaries

Independent Auditor’s

Report

Notes to the Consolidated

Financial Statements

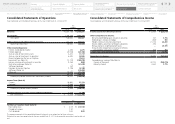

Consolidated Statements of

Cash Flows

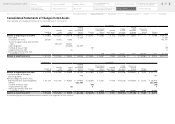

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Five-Year Financial Summary