Sharp 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

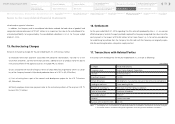

(7) Others

The dividend rate (annual) of Class B Shares is set at 7.0% if the record date for a dividend from

surplus belongs to a business year ending before the end of March 2018 and at 8.0% if the re-

cord date for dividends from surplus belongs to a business year starting after April 1, 2018. Class

B Shares are cumulative and non-participating. In addition, Class B shareholders are entitled to

receive dividends in preference to Class A shareholders and common shareholders. Class B Shares

have no voting rights and assignments are restricted.

Put options the consideration for which is common shares and call options the consideration

for which is cash are attached to Class B Shares.

Put options the consideration for which is cash are not attached to Class B Shares.

The maximum dilution rate will be approximately 20.8% if all the put options attached to Class

B Shares the consideration for which is common shares are exercised, assuming no amount equal

to accumulated unpaid dividends and no daily prorated unpaid preferred dividend amount for

the Class B Shares exist.

The Company and JIS agreed to the exercise conditions for the put options attached to Class B

Shares the consideration for which is common shares in the subscription agreement, and conse-

quently the Company’s common shares will be issued through the exercise of the put options the

consideration for which is common shares basically on or after July 1, 2018.

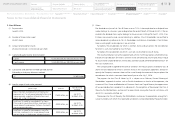

The payment for the Class B Shares by JIS is subject to an Ordinary General Meeting of

Shareholders’ approval of matters such as Partial Amendment to Articles of Incorporation, the

issuance of Class Shares and Reduction of Common Stock and Capital Reserve, the appointment

of two outside directors named by JIS in advance etc., the completion of the payment for Class A

Shares by the Allotted Banks and consent to reconciliation among the financial institutions with

which JIS is reasonably satisfied, etc.

The payment for Class A Shares by the Allotted Banks and consent to reconciliation among the fi-

nancial institutions with which JIS is reasonably satisfied, etc. will be completed by the payment date.

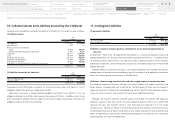

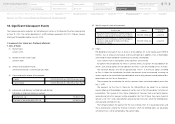

2. Class B Shares

(1) Payment date

June 30, 2015

(2) Number of shares to be issued

25,000 shares

(3) Amount of procurement funds

25,000,000,000 yen (1,000,000 yen per share)

(4) Capital and capital reserve to be increased

Capital 12,500,000,000 yen (500,000 yen per share)

Capital reserve 12,500,000,000 yen (500,000 yen per share)

(5) Subscription and allotment method (planned allottee)

Allotted by a third party allotment method.

JIS 25,000 shares

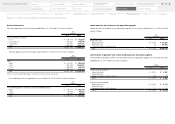

(6) Specific usage of funds to be procured

Specific usage Amounts Planned time of

spending

New installation and replacement of mechanical

equipment, etc. for achieving higher definitions and

improving yields, and other rationalization invest-

ments, etc. in the LCD business

17,600 million yen July 2015

to March 2018

Investment in molds for new products for Japan,

China and Asia and rationalization investments, etc.

in each domestic and overseas factory in the health

and environment business

4,000 million yen July 2015

to March 2018

Investment in molds for new products and ratio-

nalization investments, etc. in each domestic and

overseas factory in the business solutions business

3,000 million yen July 2015

to March 2018

Notes to the Consolidated Financial Statements

53

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

Consolidated Statements of

Cash Flows

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

Comprehensive Income

Consolidated Statements of

Operations

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary