Sharp 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

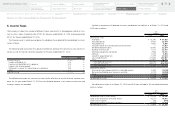

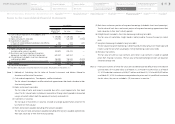

Remeasurement of deferred tax assets and liabilities due to a change in income tax rate

Pursuant to the promulgation on March 31, 2015, of “Partial Amendment of the Income Tax Act, etc.”

(Act No. 9 of 2015) and “Partial Amendment of the Local Tax Act, etc.” (Act No. 2 of 2015), the corpo-

rate tax rate will be reduced for fiscal years beginning on or after April 1, 2015.

As a result, the effective statutory tax rates, which are used to measure deferred tax assets and de-

ferred tax liabilities will be reduced to 32.8% from 35.5% for temporary differences that are expected to

be reversed in the fiscal year which starts on or after April 1, 2015 and to 32.0% from 35.5% for tempo-

rary differences that are expected to be reversed in the fiscal year which starts on or after April 1, 2016.

This change had an immaterial impact on financial statements for the year ended March 31, 2015.

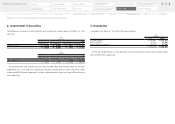

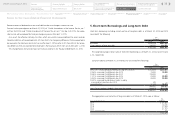

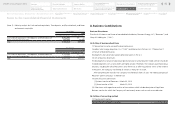

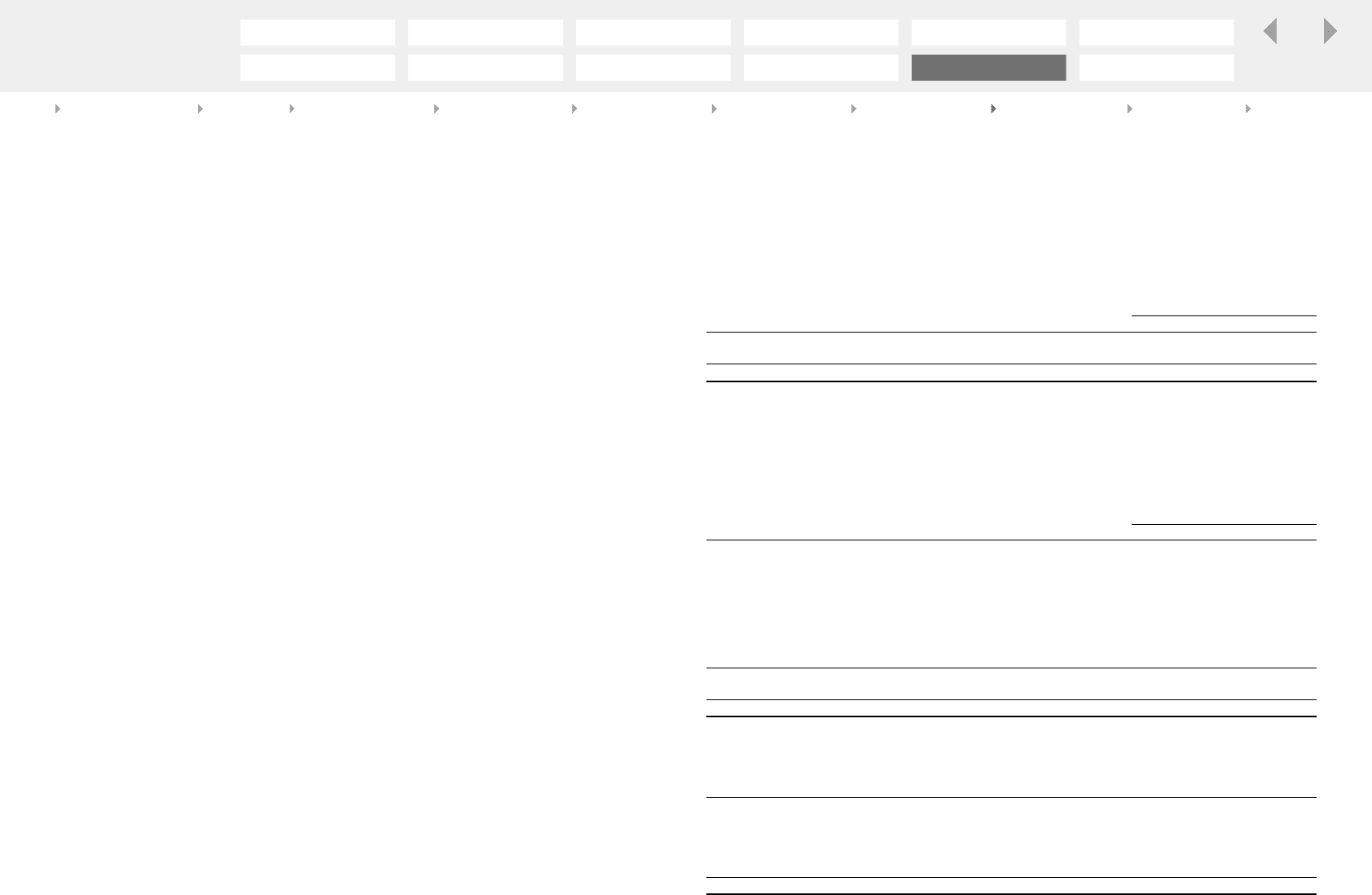

5. Short-term Borrowings and Long-term Debt

Short-term borrowings including current portion of long-term debt as of March 31, 2014 and 2015

consisted of the following:

The weighted average interest rates of short-term borrowings as of March 31, 2014 and 2015 were

2.2%, respectively.

Long-term debt as of March 31, 2014 and 2015 consisted of the following:

Yen

(millions)

2014 2015

Bank loans ¥ 626,528 ¥ 637,915

Current portion of long-term debt 166,670 211,032

¥ 793,198 ¥ 848,947

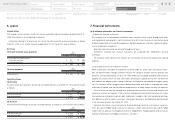

Yen

(millions)

2014 2015

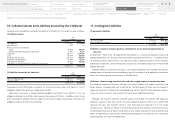

0.0%—9.1% loans principally from banks, due 2014 to 2031 ¥ 284,508 ¥ 255,581

2.068% unsecured straight bonds, due 2019 10,000 10,000

0.846% unsecured straight bonds, due 2014 100,000 —

1.141% unsecured straight bonds, due 2016 20,000 20,000

1.604% unsecured straight bonds, due 2019 30,000 30,000

0.500% unsecured Pound discount notes issued by

a consolidated subsidiary, due 2014 340 —

Lease obligations 22,143 20,780

466,991 336,361

Less—Current portion included in short-term borrowings (166,670) (211,032)

¥ 300,321 ¥ 125,329

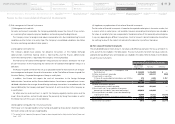

The aggregate annual maturities of long-term debt as of March 31, 2015 were as follows:

Yen

(millions)

Years ending March 31

2017 ¥ 37,861

2018 24,048

2019 31,969

2020 31,187

2021 and thereafter 264

¥ 125,329

Notes to the Consolidated Financial Statements

38

Notes to the Consolidated

Financial Statements

Financial Section

Segment Outline

Medium-Term Management Plan

for Fiscal 2015 through 2017

Investor Information

Directors, Audit & Supervisory Board

Members and Executive Officers

Risk Factors

Corporate Governance

Contents

Corporate Social

Responsibility (CSR)

Message to our Shareholders

Fiscal 2014 Review by

Product Group

Financial Highlights

SHARP Annual Report 2015

Consolidated

Subsidiaries

Independent Auditor’s

Report

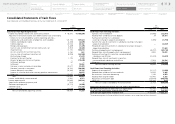

Consolidated Statements of

Cash Flows

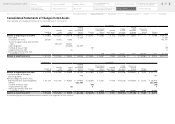

Consolidated Statements of

Changes in Net Assets

Consolidated Statements of

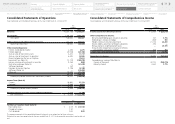

Comprehensive Income

Consolidated Statements of

Operations

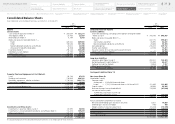

Consolidated Balance Sheets

Financial Review

Five-Year Financial Summary