Saab 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

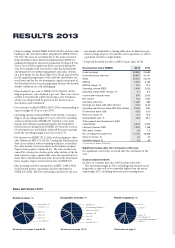

Long-term financial goals and results

Sales, SEK billion

Organic sales growth averaging

5per cent annually over a busi-

ness cycle.

In 2013 organic growth was

-2 per cent (-2).

Operating margin, %

Operating margin after deprecia-

tion and amortisation (EBIT) of at

least 10 per cent – is formulated

as an average over a business

cycle.

In 2013 the operating margin

after depreciation/amortisation

(EBIT) was 5.7 per cent (8.5).

Equity/Assets ratio, %

Equity/assets ratio of over

30 per cent.

At year-end 2013 the equity/

assets ratio was 43.8 per cent

(39.0).

Dividend, SEK

The long-term dividend objective

is to distribute 20–40 per cent of

net income to shareholders over

a business cycle.

For 2013 the Board proposes

a dividend of SEK 4.50 (4.50),

representing 65 per cent (30)

of net income.

20132012201120102009

24.6 24.4 23.5 24.0 23.8

20132012201120102009

5.6

4.0

12.5

8.5

5.7

20132012201120102009

35

39 41 39

44

20131

2012201120102009

2.25

3.50

4.50 4.50 4.50

1) Proposed by Board of Directors

PROFITABLE

GROWTH

PORTFOLIO

PERFORMANCE

PEOPLE

Since 2010, Saab’s strategy has focused

on four priority areas. Our aim is to create

long-term value by accomplishing these

strategic priorities. Saab shall also

maintain a solid balance sheet, focus on

capital efficiency and generate strong

cash flow.

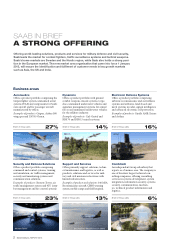

Profitable growth

A local presence on prioritised markets enables

us to strengthen the relationship with our

customers. We focus on markets where we have

a strong market position and on product areas

with good growth opportunities.

Performance

We have a long tradition of integrating high-

tech systems and we reconsider and develop

our tools, methods, and work procedures

continuously. is enables us to offer high

performance and cost ecient solutions.

Portfolio

e portfolio is focused on areas with significant

competitive advantages and growth potential.

Investments are made in product innovation,

development of prioritised products and system

integration expertise. Acquisition of businesses

shall strengthen key areas and add to our local

presence.

People

Saab shall be an employer of choice in the

global market. We are focusing on securing and

developing the right skills for current and future

needs. Motivated, driven and high performing

employees are the backbone of our offering, ef-

ficiency and growth.

SAAB HAS A CLEAR FOCUS

Vision

It is a human right to

feel safe.

Mission

To make people safe by

pushing intellectual and

technological boundaries.

Values

Expertise: We combine a strong history of knowledge

with constant learning.

Trust: We are honest and reliable global citizens, and

we keep our promises.

Drive: We have a passion for innovation, are open to

change and committed to being fast and exible.