Saab 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Or

5per cent annually over a busi-

ness cycle.

In 2013 or

-2 per cent (-2).

Operating margin after deprecia-

tion and amortisation (EBIT) of at

least 10 per cent – is formulated

as an average over a business

cycle.

In 2013 the operating margin

after depreciation/amortisation

(EBIT) was 5.7 per cent (8.5).

Equity/assets ratio of over

30 per cent.

At year-end 2013 the equity/

assets ratio was 43.8 per cent

(39.0).

The long-term dividend objective

is to distribute 20–40 per cent of

net income to shareholders over

a business cycle.

For 2013 the Board proposes

a dividend of SEK 4.50 (4.50),

representing 65 per cent (30)

of net income.

S

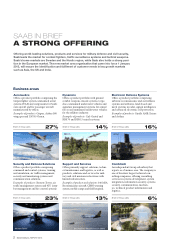

Sales distribution 2013

Business areas, %

Aeronautics, 27

Dynamics, 14

EDS, 16

SDS, 23

S&S, 13

Combitech, 6

Read more on pages 2 and 45-50

Geographic markets, %

Sweden, 41

EU excluding Sweden, 17

Rest of Europe, 3

Americas, 13

Asia, 18

Africa, 4

Australia, etc., 5

Read more on page 12–13

Market segments, %

Air, 45

Land, 27

Naval, 10

Civil Security, 8

Commercial Aeronautics, 7

Other, 3

Read more on page 3

also to several other signifi cant orders received during the

and integration of combat management and radar systems

on a new frigate for the Royal ai Navy. Brazil placed orders

for the upgrade programme of the airborne surveillance sys-

the Brazilian border security programme Sisfron. Meanwhile,

market conditions are still challenging.

activity level primarily within the business area Dynamics,

which was compensated by growth in the business areas

Aeronautics and Combitech.

of a potential earn-out liability. Adjusted for non-recurring

Saab, in accordance with accounting standards, reclassifi ed

the value decline of the investment in the Indian company

Pipavav from equity to fi nancial net. e value decline was

caused by a share price decline and a value decline of the In-

done. e reclassifi cation and write-down of the investment

RESULTS 2013

was mainly attributable to timing diff erences in milestone pay-

ments in large projects, investments and acquisitions, as well as

a payment related to a legal dispute.

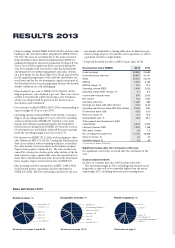

Key fi nancial ratios (MSEK) 2013 2012

Order bookings 49,809 20,683

Order backlog at year-end 59,870 34,151

Sales 23,750 24,010

EBITDA 2,367 3,186

EBITDA margin, % 10.0 13.3

Operating income (EBIT) 1,345 2,050

Operating margin (EBIT margin), % 5.7 8.5

Income after fi nancial items 979 2,003

Net income 742 1,560

Operating cash fl ow -1,480 -396

Earnings per share, SEK (after dilution) 6.79 14.52

Operating cash fl ow per share, SEK (after dilution) -13.56 -3.63

Dividend per share, SEK 4.5014.50

Return on equity, % 6.3 12.8

Equity/Assets ratio, % 43.8 39.0

Total research and development (R&D)

expenditures 6,543 5,946

Internally fi nanced R&D 1,332 1,798

R&D share of sales 5.6 7.5

No. of employees at year-end 14,140 13,968

Share of women, % 22 22

Academic degree, % 57 55

1) Proposed by Board of Directors

Signifi cant events after the conclusion of the year:

No signifi cant events have occurred a er the conclusion of the

year.

Outlook statement 2014:

ring items, is expected to be somewhat higher than the opera-