Saab 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6 SAAB ANNUAL REPORT 2013

CEO COMMENT

UNIQUE EFFICIENCY OFFERS

GROWTH OPPORTUNITIES

Saab is in many respects a unique company. Our ori-

gins and our DNA have resulted in us doing things both

smart and cost-effectively. The ability to anticipate

requirements for defence and security solutions means

that Saab is at the absolute forefront of developing and

customising its product portfolio.

Saab has a clear focus. We supply high-tech products, integrated

solutions and services in a cost-eective manner to our cus-

tomers. In this way we assure returns for our shareholders and

achieve our growth targets. Guiding Saab in the right direction

in a challenging market requires that we have very good under-

standing of both global and local markets and of our customers.

We need to have dedicated employees and the right cost structure.

Saab’s strategy is based on four cornerstones: creating long-

term protable growth; constantly reviewing and adapting our

portfolio; creating more ecient operations; and continuously de-

veloping our employees. e past year has been marked by both

challenges and very positive breakthroughs. Clear examples of the

latter are Brazil’s choice of Gripen and the decisions of the Swiss

parliament to proceed with its procurement of Gripen.

Changing market

When I summed up 2012 at the annual general meeting in April,

one subject I spoke about was the way eciency, active portfo-

lio management, and research and development contribute to

growth, competitiveness and good protability. I also brought up

the challenging market situation that requires us to constantly

develop our ability to deliver according to our customers’ needs.

I can now say that the tough market situation is a continuing

reality. Competition is erce and customer needs are changing

faster than ever before. is requires us to always be prepared for

change and to develop together with our customers.

A more customised and focused portfolio

e new market area organisation will ensure a continuous dialogue

with customers in key markets. is means that the investments

made in research and development are better able to match future

customer needs for defence and security solutions. In turn, this

leads to lower costs today and more secure revenues in the future.

Saab is one of the most research-intensive companies in Sweden

and in the global defence market. In the past year we invested 28

per cent of sales in research and development. e technologies

we are investing in will complement existing product areas and

enhance Saab’s competitiveness. In order to shorten lead times

from identied need to delivery and revenue, we have strength-

ened the portfolio management system used by both the develop-

ment and the sales organisations. Identied customer needs are

now better matched with decisions on development eorts.

Focus on efficiency

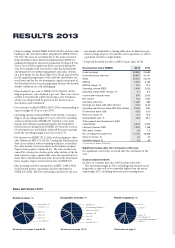

Sales amounted to MSEK 23,750, an organic decline of 2 per

cent. Budget constraints in the US had a negative impact on our

training and trac management operations in the US. Business

area Dynamics was also aected by budget constraints and delays

in customers’ investment processes. is was compensated by

growth in the business areas Aeronautics and Combitech.

e order backlog has been lled with strategically important

orders and was at a historically record high of MSEK 59,870

(34,151). During the year we received orders worth SEK 29.8bil-

lion from Sweden’s FMV, related to the development and produc-

tion of the Gripen E. Apart from these orders, we are seeing a

clear shi in the defence market. Saab’s business has previously

experienced its main growth in the traditional markets of the

West, but business is now being won and is growing in emerging

markets, such as those in Asia.

e continued challenging market conditions have prompted

us to announce eciency measures in 2013 that are expected

to generate MSEK 500 in cost reductions at the close of 2014.

Another example of action is the establishment of the new market

area organisation at the beginning of 2013. Our nancial position

is strong, which ensures that we can work with a long-term stance.

is is essential in our business, where we oen have commit-

ments with our customers for many years.

Focus on governance and cash flow

Achieving sucient protability is about being in control of the

margins on execution and deliveries. Our portfolio includes

everything from long-term contracts with complex systems

to products and services delivered to customers on short lead

times. e reported margin varies according to the particular

project mix. During the year a more transparent and more clearly

broken down governance model was introduced in order to

obtain greater internal transparency. e gross margin for 2013

amounted to 26.6 per cent (30.0). Operating income for 2013

totalled MSEK1,345 (2,050) and the operating margin was 5.7

per cent (8.5). e result includes a material non-recurring item

of MSEK231 related to a lost legal dispute in Denmark. Adjusted

for material non-recurring items the operating income amounted

to MSEK 1,576 (1,843) and the operating margin was 6.6 per cent

(7.7), which is in line with the revised guidance provided in the

half-year report.

A key priority is to secure a positive cash ow. As part of the

eorts to work actively on cash ow during the year, inventory

and outstanding accounts receivable have been analysed. It is not

uncommon for working capital to vary over time in the defence

industry. is depends largely on when milestone payments are

made and on the current project mix. 2013 operating cash ow

totalled MSEK -1,480 (-396). e lower operating cash ow in

2013 is mainly attributable to timing dierences in milestone pay-

ments in large projects, investments and acquisitions, as well as a

payment related to the Danish legal dispute.

International breakthrough proves Saab’s capability

e Gripen system’s cost-ecient multifunctionality is a success

on the international export market. e Gripen C/D is today

in use with ve air forces and with the British Empire Test Pilot

School. During the year, FMV ordered development, modica-

tion and production of 60 Gripen Es for the period 2013–2026.