Saab 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAAB ANNUAL REPORT 2013

ANNUAL REPORT 2013

ADVANTAGE SAAB:

INNOVATIVE AND

EFFICIENT SOLUTIONS

Table of contents

-

Page 1

ANNUAL REPORT 2013 ADVANTAGE SAAB: INNOVATIVE AND EFFICIENT SOLUTIONS -

Page 2

... solutions needed to be intelligent and cost-efï¬cient from the start - beginning on the drawing board. In short: Saab was born smart. Since then we have been a key development partner to the Swedish Defence Materiel Administration (FMV) and the Swedish Armed Forces and customers in other countries... -

Page 3

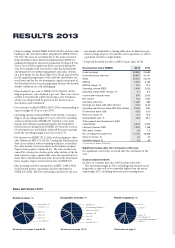

.... Sales distribution 2013 Business areas, % Aeronautics, 27 Dynamics, 14 EDS, 16 SDS, 23 S&S, 13 Combitech, 6 Geographic markets, % Sweden, 41 EU excluding Sweden, 17 Rest of Europe, 3 Americas, 13 Asia, 18 Africa, 4 Australia, etc., 5 Market segments, % Air, 45 Land, 27 Naval, 10 Civil Security... -

Page 4

...Investments are made in product innovation, development of prioritised products and system integration expertise. Acquisition of businesses shall strengthen key areas and add to our local presence. pERfORMAncE pROfitABLE GROwth pORtfOLiO proï¬table growth A local presence on prioritised markets... -

Page 5

... 2013 Saab received numerous recognitions in 2013 for its engineering expertise and multifunctional products, including an agreement with fMV for development of the next generation Gripen - the Gripen E - and a co-operation agreement with Boeing to develop new training aircraft for the US Air force... -

Page 6

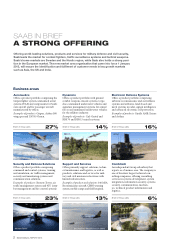

... Arthur. Share of Group sales 27% 14% Share of Group sales 16% Gripen rbs 70 arthur Security and Defence Solutions Offers a product portfolio comprising command and control systems, training and simulation, air traffic management, security and monitoring systems and communication solutions... -

Page 7

...1,598 23,750 Saab's business areas have systems, products and services that meet the various defence and security needs of the market. The units interact within the group, both in research and development and in marketing. The aim is both to have a specialised offering in each market segment and to... -

Page 8

... in Saab. Allow me to share some reflections having taken an active role in Saab's development for a long time, as a director and as chairman. Saab operates in an industry where a long-term approach and financial stability form part of the business itself. Customers are often defence authorities... -

Page 9

...is well matched to its customers, with cost-effective and multi-functional defence and security solutions for both military and civilian use. We also know that in order to remain at the cutting edge we must constantly develop our offering. We have therefore identified key technologies at the core of... -

Page 10

...in key markets. This means that the investments made in research and development are better able to match future customer needs for defence and security solutions. In turn, this leads to lower costs today and more secure revenues in the future. Saab is one of the most research-intensive companies in... -

Page 11

... look forward to another exciting year in which I believe we will see new international breakthroughs for Saab's fantastic product portfolio. Stockholm, February 2014 An important business in the community Today we are present locally in 32 countries. In Sweden we have operations in 50 different... -

Page 12

... with the Brazilian Air Force for the purchase of 36 Gripen NGs. Saab's offer to the Brazilian government covers technology transfer and industrial partnership, which may mean that some parts may be manufactured in Brazil. development". This methodology was secured through the development of the... -

Page 13

.... An increasing number of the world's air forces have realised that having an information advantage is actually more important than having maximum speed and manoeuvrability. Sweden has a 40-year tradition of developing inter-aircraft information sharing - experience that is gathered in the Gripen... -

Page 14

... interlinked business segments and make use of their high-tech skills in fields like ISR, cyber security, technical consulting, system integration, training, simulation and traffic management to support both security, resilience and efficiency. But at the same time the development has brought new... -

Page 15

..., the two main dimensions of security policy is critical to also understanding the opportunities, breadth and potential in Saab's market. Threats to the climate and environment Threats and risks to society International responses Defend borders and territories Time 1937 2013 Training Command... -

Page 16

... means an increased need for cost-effective products, services and solutions without compromising on capability and interoperability. The market for civil security is growing in the region. In December 2013, European Union heads of state and government discussed for the first time in several years... -

Page 17

... Africa. In order to become a long-term supplier to the UN, Saab will focus on a number of selected niches such as solutions for maintenance, systems of unmanned craft and a number of pure product offerings. source: IHs Jane's aerospace, Defence & security, Defence budgets annual report 2013 saab... -

Page 18

... and work on developing high-tech products and solutions. Saab Academy offers numerous training programmes to Saab employees, including leadership training. number of employees in Sweden vs. Rest of the world number of university-trained 57% RoW 20% Sweden 80% 14 saab annual report 2013 -

Page 19

.... Saab's ambition is to describe its business in a clear way that makes it easy for current and potential investors to understand the business model and evaluate the risks and opportunities the company is facing. Yield 3.2 2.8 2.6 3.3 1.9 2009 2010 2011 2012 2013 saab annual report 2013 15 -

Page 20

... driving forces Saab's offering and strengths Business flow Market area organisation SAAB'S BUSINESS MODEL TECHNOLOGIES THAT MEET THE NEEDS OF THE MARKET Market driving forces The driving forces in Saab's markets are linked to altered threat scenarios and new societal security needs. Defence... -

Page 21

Market driving forces Saab's offering and strengths Business flow Market area organisation Saab's offering and strengths Saab is world leading within system integration and continues to invest heavily in research and development to meet customer needs. Saab offers products within the air, land,... -

Page 22

Market driving forces Saab's offering and strengths Business flow Market area organisation Business flow Saab's earnings are primarily generated by long-term customer contracts, service assignments and sale of goods. Margins vary depending on the nature of the project. The main focus of Saab's ... -

Page 23

... business opportunities by having employees in local markets. Through its local offices, Saab is closer to its customers and has a better understanding of their needs. Saab's local managers throughout the world now have greater responsibility for running operations. In the long term, the market area... -

Page 24

..., Swedish-developed product for remote air trafï¬c management, ready for launch in the ï¬rst quarter of 2014. saab often meets its customers at trade shows worldwide. In 2013 saab attended, among others, the Defence security equipment International (DseI) show in london. AMERicAS Saab's position... -

Page 25

... the lead on new business opportunities in selected countries in Asia. The creation of the Market Area Asia Pacific has further strengthened this strategy and provided further opportunities for Saab Business Areas to base services supporting the region out of Australia. saab annual report 2013 21 -

Page 26

...expansion on emerging markets and of innovative solutions like Saab's Remote Tower system, developed together with the Swedish Air Navigation Service Provider (ANSP) LFV. Saab's Remote Tower system offers a possibility to combine a dynamic use of resources, information sharing and safety enhancement... -

Page 27

...60 customers in 40 countries • Guides 2 million aircraft movements each month (24 per cent of world air travel) • Saab Maritime trafï¬c Management • More than 60 systems deployed • Four of the 10 largest container ports, equivalent to 86 million TEUs (Twentyfoot Equivalent Unit ) per year... -

Page 28

... in areas that complement our product portfolio and support business in prioritised geographic markets. EBit, % 12.5 23 24 24 8.5 For long-term financial goals and outlook for 2014, see page 44. 5.7 5.6 4.0 2009 2010 2011 2012 2013 2. PERFORMANCE Activities during the year Market conditions... -

Page 29

... goals best fulfil the company's long-term business strategies. Alongside our comprehensive management development programme, we are working to further strengthen leadership. Part of this effort is our internal initiative to formulate expectations placed on management in a more performance driven... -

Page 30

...as the Americas and Asia. Sales of smaller projects and products have been stable for many years. In order to remain successful and achieve our long-term goal of annual organic growth of 5 per cent over a business cycle, Saab must continue developing new high-tech, cost-efficient solutions. Close co... -

Page 31

...to gain market share in selected markets. The new market area organisation will support large orders (e.g., for the new Gripen) but our main focus is to increase the number of small- and medium-sized orders. To create profitable growth, Saab will focus its research and development investments on the... -

Page 32

... of uniform global purchase, sales, product and quality processes. Saab will further develop the new structure for financial governance in 2014. In practice, this entails shifting profit responsibility from the businesses areas down to the business units and improving internal transparency. More... -

Page 33

...-year increase in capitalised expenditures is primarily attributable to the development of Gripen E. Amortisation of capitalised development costs totalled MSEK 454 (590). 1.4 1.2 1.2 1.3 67 47 15 2009 2010 2011 2012 2013 24 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 saab annual report... -

Page 34

... perform internships in Sweden. The first group of grant holders is scheduled to arrive in Sweden in August 2014. 10 23 new generation of Saab's cutting-edge radar technology Saab is further developing its radar system, including with AESA technology, to strengthen its market position and product... -

Page 35

... and electronic systems, making them ready to be mounted in the fuselage and operated immediately - plug & play. In addition, the doors are made of composites rather than sheet metal, which both improves performance and reduces weight. Boeing 787 Dreamliner Production Line saab annual report 2013... -

Page 36

... help create a "paradigm shift", supported by state-of-the-art and innovative technology. The total estimated cost of the development phase of SESAR is EUR 2.1 billion. Within SESAR Saab AB participates in the areas of Remotely Operated Towers, Trafï¬c Flow Management, Integrated Tower solutions... -

Page 37

... of 2014. TECHNICAL SOLUTIONS FOR ATTRACTIVE CITIES saab is running a project for attractive cities in collaboration with the Inter-american Development bank and the swedish energy agency. this is a long-term initiative aimed at using existing skills and technical products to develop a product... -

Page 38

... equality plays a significant role), we will continue to work to achieve our ambitious goals. These focus areas have been integrated as an essential part of Saab's business strategy. Saab's key stakeholders owners Customers society suppliers and partners employees 34 saab annual report 2013 -

Page 39

...individual Corporate responsibility is a strategic long-term commitment and deals and markets. We also participated in the UN's work to part of Saab's business strategy. Our ambition is to set an example develop the international Arms Trade Treaty (ATT), which conwithin business ethics, based on our... -

Page 40

... important to develop clear, global regulations for trade with defence materiel aimed at safeguarding human rights and international humanitarian law. saab worked actively on the un's International arms trade treaty, which entered into force in april 2013. Principle 2 LABOUR Principle 3 businesses... -

Page 41

...is headed by the company's General Counsel, who reports to the board's Audit Committee. Saab has an Ethics and Compliance unit responsible for overseeing, co-ordinating and developing corruption prevention efforts and providing expertise in the area. The Group function Market Network Management (MNM... -

Page 42

... Based on Sweden's highly ranked development and innovation capacity, Saab took the initiative to use bilateral innovation alliances to share information on the Swedish innovation system. One example is the Swedish-Brazilian research and innovation centre CISB, where industry works with universities... -

Page 43

...). In 2011-2013, Saab acquired and tested an IS/IT tool to manage information on the chemicals contained in its products. Implementation will begin in 2014. The tool will also be used to verify that the products meet current chemical requirements imposed by law and by customers. Environmental issues... -

Page 44

... 2013 2009 2010 2011 2012 2013 2009 2010 2011 The decrease in VOC emissions in 2013 is due to decreased production in Saab Barracuda. Aeronautics and Support & Services produce the most emissions. Trichloroethylene is used within Aeronautics and Electronic Defence Systems. In recent years... -

Page 45

... market is fierce, and at Saab we have a shared responsibility to improve efficiency and sharpen our skills in developing our business and customer relationships. It is essential that we create a more performance driven culture, one which clari- TECHNOLOGY WOMEN OF THE YEAR saab's 2013 technology... -

Page 46

... in the spring of 2014; recruitments were made during the autumn of 2013. 1) TraineeGuiden trend in percentage of female managers Target 30% 30 25% 25 20 15 10 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Trend female managers, % Trend female employees, % 42 saab annual report 2013 -

Page 47

....1 2012 25th 75 22.1 1) Based on a global employee survey conducted in January 2014 Educational background, % Natural sciences, 3 Social sciences, 2 Other, 12 Economy, 7 Technology, 76 number of employees in Sweden vs. Rest of the world % Sweden, 80 Other countries, 20 saab annual report 2013... -

Page 48

... world's leading high technology companies, Saab offers products, solutions and services for military defence and civil security. In 2013 the Group had customers in over 100 countries, with research and development conducted mainly in Sweden. Most of our employees work in Europe, South Africa, the... -

Page 49

... 2012 2013 2009 2010 2011 2012 2013 No. of employees Services and solutions • Aeronautics offer the Gripen fighter - extremely cost-efficient, offering continuous upgrades and a level of performance that meets the stringent requirement of armed forces. • The Skeldar unmanned helicopter system... -

Page 50

... cash flow No. of employees 5.9 6.8 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 Services and solutions Products and services have been sold to more than 60 countries around the world and includes ground combat weapons, missile systems, camouflage, torpedoes and... -

Page 51

... the decrease in sales in 2013 compared to 2012 was a low level of order bookings in 2011 and 2012. Markets outside Sweden accounted for 69 per cent (76) of sales. The operating loss in 2013 was mainly attributable to increased investments in product development projects, costs for rationalisation... -

Page 52

... location. Security and Defence Solutions includes the following business units: Command and Control Systems, Critical System and Communication Solutions, Airborne Surveillance Solutions, Traffic Management and Training & Simulation. Driving forces Multinational missions and new technology drive the... -

Page 53

... projects. Employees Order bookings Order bookings in 2013 decreased compared to 2012 due to tougher market conditions. During 2013 orders were received from FMV for the development of Gripen E and serial production of 60 Gripen E for Sweden. The total order value for Support and Services related... -

Page 54

... 2012 2013 2009 2010 2011 2012 2013 Services and solutions • Combitech is active in the aviation, defence, telecom and other industries as well as the public sector. • Combitech offers services in systems development, systems integration, information security, systems security, communications... -

Page 55

ADMINISTRATION REPORT > RISKS AND RISK MANAGEMENT RISKS AND RISK MANAGEMENT Saab's business generally entails significant investments, projects delivered over long periods of time, and hightech product development or refinement. Operations involve customer and supplier relationships, joint ventures... -

Page 56

...new systems and products Management of long-term customer projects involves risks. Saab's operations entail complex development projects on the leading edge of technology where the competitive situation is complex. Our success depends on the ability to offer cost-effective high technology solutions... -

Page 57

...work was performed. In addition an internal policy for the work with security issues for the Group was introduced. In 2014 Saab is aiming at preparing a long-term strategy and action plan aiming at reaching our target to become recognised as world leading within business security and risk management... -

Page 58

... REPORT > RISKS AND RISK MANAGEMENT OPERATING RISKS RISK Develop and introduce new systems and products The risk is a failure by Saab to achieve the levels of business required for its products to be profitable. Management of longterm customer projects The risk is a failure by Saab to meet customer... -

Page 59

... for developing and reviewing remuneration and other employment terms for the Group Management. The Board is entitled to divert from the guidelines in the event there are reasonable grounds to do so in any specific case. These guidelines apply as from the 2013 Annual General Meeting. Fixed... -

Page 60

...monthly salary. If the employee retains the purchased shares for three years after the investment date and is still employed by the Saab Group, the employee will be allotted a corresponding number of Series B shares free of charge. The plan was introduced in autumn 2007 in Sweden and Norway. In 2008... -

Page 61

... and Australia. South Africa was included in 2009, Finland in 2010, the Czech Republic in 2011, India in 2012 and Thailand, Holland and Canada in 2013. In April 2008, Saab's Annual General Meeting resolved to introduce a performance-based plan for senior executives and key employees entitling... -

Page 62

... Group companies Untaxed reserves Statement of cash flows, supplemental information Information on Parent Company Environmental report Exchange rates used in ï¬nancial statements Deï¬nitions of key ratios 98 98 98 105 105 106 106 114 114 114 115 116 117 118 118 118 58 saab annual report 2013 -

Page 63

... (15,245), or 59 per cent (64) of total sales. 81 per cent (82) of sales were related to the defence market. MSEK Sweden EU excluding Sweden Rest of Europe Americas Asia Africa Australia, etc. total MSEK Air Land Naval Civil Security Commercial Aeronautics Other total saab annual report 2013 59 -

Page 64

... a write-down of the value of shareholding in the Indian company Pipavav. During the second quarter, Saab invested MSEK 247 in Pipavav through a, to Saab, directed new share issue. A combination of negative currency effects and share price development resulted in a value decline totalling MSEK 133... -

Page 65

... to year-end 2012 as a result of the increase of accrued revenue from customers due to higher activity level in some large projects, mainly related to the development of Gripen E. 2012 is restated according to the changed accounting principles for pensions (IAS19) saab annual report 2013 61 -

Page 66

...- total liabilities 15,678 17,658 20,243 tOtAL EQUitY AnD LiABiLitiES 27,905 28,938 30,878 For information on the Group's assets pledged and contingent liabilities, see Note 42. 2012 is restated according to the changed accounting principles for pensions (IAS19) 62 saab annual report 2013 -

Page 67

... reserve Adjustment due to change of accounting principles for pensions attributable to change in tax rate in Sweden transactions with shareholders: Share matching plan Dividend Acquisition and sale of non-controlling interest closing balance, 31 December 2012 1,746 - 543 - 457 74 - -51 -175... -

Page 68

... of MSEK 555 were sold, compared to MSEK 852 at 31 December 2012. Hence, it had a negative impact on operating cash flow of MSEK 297 in 2013. During the year, an investment was made in the publicly traded Indian company Pipavav, amounting to MSEK 247. The investment was reported as acquisition of... -

Page 69

...549 77 -11 1,031 SALES AnD incOME The Parent Company includes units within the business areas Aeronautics, Electronic Defence Systems, Security and Defence Solutions and Support and Services. Group staff and Group support are included as well. The Parent Company's sales in 2013 amounted to MSEK 16... -

Page 70

... 2012. Gross capital expenditures in property, plant and equipment amounted to MSEK 387 (185). Investments in intangible assets amounted to MSEK 63 (48). At the end of the period, the Parent Company had 8,781 employees, compared to 8,737 at the beginning of the year. 66 saab annual report 2013 -

Page 71

...2013 2012 Untaxed reserves Provisions Provisions for pensions and similar commitments Other provisions total provisions Liabilities Liabilities to credit institutions Liabilities to Group companies Advance payments from customers Accounts... 42 42 10 3,992 10 4,244 saab annual report 2013 67 -

Page 72

...in equity: Change in revaluation reserve -7 7 - net comprehensive income for the year transactions with shareholders: Dividend to shareholders Share matching plan closing balance, 31 December 2013 - - - - 885 885 1,746 700 543 -477 46 4,107 885 -477 46 7,981 68 saab annual report 2013 -

Page 73

...xed assets Sale of and investments in short-term investments Sale of and investments in ï¬nancial assets Investments in subsidiaries Sale of subsidiaries cash flow from investing activities Financing activities Change in receivables from Group companies Change in labilities to Group companies and... -

Page 74

... the Group) are divided into six business areas: Aeronautics, Dynamics, Electronic Defence Systems, Security and Defence Solutions, Support and Services, and Combitech. The operations in each business area are described in Note 4. Saab has a strong position in Sweden and the large part of its sales... -

Page 75

... the year: • Aeronautics • Dynamics • Electronic Defence Systems • Security and Defence Solutions • Support and Services • Combitech Complementing the six segments is Corporate, which comprises Group staffs and departments as well as other non-core operations. Sales of goods and services... -

Page 76

... in equity. Revenue gible and tangible fixed assets. Customer-financed research and development is recognised in cost of goods sold. Administrative expenses relate to expenses for the Board of Directors, Group Management and staff functions. Marketing expenses comprise expenses for the in-house... -

Page 77

... Production volume is set using future sales projections according to a business plan based on identified business opportunities. Acquired development costs are amortised on a straight line basis over a maximum of 10 years. • Goodwill: In the Parent Company, goodwill is amortised over a maximum 20... -

Page 78

... and cash equivalents, immediately accessible balances with banks and similar institutions, and short-term liquid investments with a maturity from acquisition date of less than three months, which are exposed to no more than an insignificant risk of fluctuation in value. 74 saab annual report 2013 -

Page 79

... goods, cost consists of direct manufacturing expenses and a reasonable share of indirect manufacturing expenses as well as expenses to customise products for individual customers. Calculations take into account normal capacity utilisation. Dividends The dividend proposed by the Board of Directors... -

Page 80

... after the investment date, employees are allotted as many shares as they purchased three years earlier provided that they are still employees of the Saab Group and that the shares have not been sold. In certain countries, social security expenses are paid on the value of the employee's benefit when... -

Page 81

... ventures Shares in associated companies and joint ventures are recognised by the Parent Company according to the acquisition value method. Revenue includes dividends received. Intangible fixed assets All development costs are recognised in profit or loss. Tangible fixed assets Tangible fixed assets... -

Page 82

... by Group Management and the Board of Directors' audit committee. UncERtAintiES in EStiMAtES AnD ASSUMptiOnS Long-term customer contracts nOtE 3 Revenue Distribution Revenue by signiï¬cant source Group MSEK 2013 2012 Parent Company 2013 2012 Sale of goods Long-term customer contracts Service... -

Page 83

...in South Africa, Australia, the uf and other selected countries globally. Saab's operating and management structure is divided into six business areas which also represent operating segments; Aeronautics, Dynamics, Electronic Defence Systems, Security and Defence Solutions, Support and Services, and... -

Page 84

.... Electronic Defence Security and Defence Solutions Support and Services combitech corporate Eliminations Group Group MSEK Aeronautics Dynamics Systems 2013 2012 2013 2012 2013 2012 2013 2012 2013 2012 2013 2012 2013 2012 2013 2012 2013 2012 External revenue Internal revenue... -

Page 85

...Group MSEK 2013 2012 Parent Company 2013 2012 aeronautics electronic Defense Systems Security and Defence Solutions Support and Services Total 6,708 3,013 3,752 3,048 16,521 5,896 3,361 3,045 3,036 15,338 Cost related to lost legal dispute Change in fair value of biological assets exchange rate... -

Page 86

... full-time equivalents. The term full-time equivalents excludes long-term absentees and consultants. Fixed term employees and probationers are however included in the calculation. Gender distribution of corporate management Share of women, per cent 2013 2012 parent company Board of Directors other... -

Page 87

...Electronic Defence Systems. parent company MSEK 2013 2012 Depreciation/amortisation Capitalised development costs Goodwill other intangible fixed assets Buildings Plant and machinery equipment, tools and installations Total -200 -39 -100 -64 -103 -66 -572 -200 -39 -86 -65 -105 -53 -548 saab annual... -

Page 88

... MSEK 2013 2012 parent company MSEK Result from shares in associated companies/joint ventures 2013 2012 Dividends Group contributions received Capital gain on sale of shares impairments other Total 654 310 -69 -20 875 55 847 38 -47 -58 835 430 -430 8 8 -3 15 12 current tax expense (-)/tax... -

Page 89

... tax rate in Sweden Reported effective tax -22.0 -0.1 0.2 -20.2 23.7 -18.4 1,085 -239 -1 2 -219 257 -200 -26.3 -0.2 -7.3 2.0 -2.3 -34.1 1,464 -385 -3 -107 29 -33 -499 2012 has been restated in accordance with the changed accounting principles for pensions (fuaf 19). saab annual report 2013 85 -

Page 90

... in the Parent Company, Saab ab, has been recognised in profit or loss. parent company MSEK Deferred tax liabilities 31-12-2013 Estimated utilisation dates of recognised deferred tax assets net MSEK Group parent company Tangible fixed assets inventories accounts receivable Prepaid expenses... -

Page 91

...in the comprehensive income translation difference closing balance 31 Dec 2012 intangible fixed assets Tangible fixed assets Lease assets Biological assets Long-term receivables inventories accounts receivable Prepaid expenses and accrued income Long-term liabilities Provisions for pensions other... -

Page 92

... and customer relations. Amortisation is included in the following lines in the income statement Group MSEK 2013 2012 Parent Company 2013 2012 Cost of goods sold Parent Company 2013 2012 168 2 454 141 2 590 139 200 125 200 marketing expenses Research and development costs Acquisition value... -

Page 93

... development of markets where the units are active. The business areas Dynamics, Electronic Defence Systems and Security and Defence Solutions have a substantial order backlog of projects that stretches over a number of years. The risks and opportunities affecting the operating margin are managed... -

Page 94

... installations Parent Company 2013 2012 MSEK 2013 Group 2012 Parent Company 2013 2012 Acquisition value opening balance, 1 January acquired through business acquisitions acquisitions from companies within the Group investments Reclassifications Divestments Translation differences Closing balance... -

Page 95

...and cars. Group MSEK premises and buildings Machinery and equipment Outcome 2012 232 240 146 155 total 197 302 2013 Other lease assets opening balance, 1 January acquisitions Depreciation for the year Translation differences Closing balance, 31 December 2 -2 3 1 -2 2 contracted 2014 2015 2016... -

Page 96

... information on fair value of investment properties in the parent company nOtE 19 Biological Assets Group MSEK 2013 2012 In the Parent Company, investment properties are recognised as buildings according to the acquisition cost method. Investment properties in the Parent Company are mainly leased... -

Page 97

...INFORMATION > NOTES NOTE 21 Group MSEK Shares in Associated Companies Consolidated According to the Equity Method Share in associated companies' income 2013 2012 Carrying amount, 1 January acquisition of associated companies Sale of associated companies Share in associated companies' income new... -

Page 98

.... The Group's financial reports include the following items that constitute the Group's ownership interest in the joint venture's sales, income, assets and liabilities. Gripen International KB MSEK 2013 2012 fixed assets Shares in joint ventures Current assets Total assets Total equity Long-term... -

Page 99

... INFORMATION > NOTES NOTE 23 Parent Company's Shares in Associated Companies and Joint Ventures NOTE 25 Financial Investments Group Parent Company MSEK 2013 2012 MSEK 31-12-2013 31-12-2012 Financial investments held as fixed assets Financial assets available-for-sale measured at fair value... -

Page 100

... Costs attributable to assignment revenue amounted to msek 3,506 (1,873). Reported gross income amounted to msek 751 (382). Parent Company MSEK 31-12-2013 31-12-2012 Other long-term receivables interest-bearing receivables non interest-bearing receivables Total 16 6 22 42 7 49 Saab and the Swedish... -

Page 101

FINANCIAL INFORMATION > NOTES NOTE 30 Prepaid Expenses and Accrued Income Group Parent Company 31-12-2013 31-12-2012 Change in number of outstanding shares 2013 Number of outstanding shares at 1 January Early share matching Share matching plan Number of outstanding shares at 31 December Series A... -

Page 102

... msek 59 (81) later than five years of the closing day. Liabilities to credit institutions mainly consist of Medium Term Notes (mtn). For more information on financial risk management, see Note 41. The fair value of mtns exceeds book value by msek 5 (16). Saab otherwise does not consider there to be... -

Page 103

... INFORMATION > NOTES noTe 37, ConT. USA cost reported in the income statement Group 2013 MSEK Sweden USA Switzerland total The us has a defined-benefit plan which includes some employees and moreover there is a supplementary plan for certain senior Executives. The plans are company-specific... -

Page 104

... the terms of the saa and taa mandate • Annually approve the benchmark indices for follow up of the pension fund assets • Annually approve the stop loss limit investment strategy and risk management the cost is reported on the following lines in the income statement: Group MSEK 2013 2012 The... -

Page 105

... during a twelve-month period. If the employee retains the purchased shares for three years after the investment date and is still employed by the Saab Group, the employee will be allotted a corresponding number of Series b shares gratuitously. In April 2008 Saab's Annual General Meeting resolved to... -

Page 106

...73 13 20 15 8 5 5 3 69 2009 2010 2011 2012 62,633 46,972 82,007 53,109 138 115 176 177 2013 Share Matching Plan and Performance Share Plan Performance Share Plan 2011 Performance Share Plan 2012 Total In April 2013 Saab's Annual General Meeting resolved to offer employees a new Share Matching... -

Page 107

... at year-end 2012/2013; specifically, Executive Vice Presidents, Heads of the Business Areas and Heads of Group staffs. During 2013 the following senior executives have left Group Management or the company: Marketing Director Jonas Hjelm (1 January), Head of Group Communications Carina Brorman... -

Page 108

... who left Group Management in 2013. 6) Left the Board of Directors in April 2013, after informing that he had declined re-election, and has received remuneration for the period January-March. 7) Share related plans relate to both Share Matching Plans and Performance Share Plans. Guidelines... -

Page 109

... to adapt resources and changeover costs. The expenditure is expected to fall in 2014-2015. Project losses Obligations related to regional aircraft MSEK Group Parent Company opening balance, 1 January 2013 amount utilised during the year Closing balance, 31 December 2013 694 -79 615 278 -8 270... -

Page 110

.... Saab uses three days and a 99-per cent probability. The Treasury Risk Analysis unit reports each portfolio's risk defined according to established risk measures to Group Management on a daily basis. Financial instruments Parent Company 31-12-2013 31-12-2012 Accrued expenses Accrued project costs... -

Page 111

...Measured at fair value 31-12-2013 financial assets financial investments Long-term receivables Derivatives1 forward exchange contracts Currency options interest rate swaps electricity derivatives Total derivatives accounts receivable and other receivables Short-term investments Liquid assets total... -

Page 112

FINANCIAL INFORMATION > NOTES NOTE 41, CONT. The Group's outstanding derivatives Currency derivatives Million Currency Nominal currency Asset SEK Fair value 2013 Liability SEK Net Nominal currency Asset SEK Fair value 2012 Liability SEK Net maturity up to one year eUR USD other -287 -531 - 57 ... -

Page 113

... in fixed price tenders. Definitions Foreign currency risk refers to the risk that fluctuations in exchange rates will negatively affect income. Exchange rate fluctuations affect Saab's income and equity in various ways: • Income is affected when sales and the cost of goods and services sold are... -

Page 114

...+/- 12 months. As of year-end, the duration for investments was 7 months (17). Interest rate risks in the Group's funding must not exceed 60 months duration. As of year-end, the duration for financing was 55 months (8). Interest rate futures and swaps are used for interest risk management to achieve... -

Page 115

...12-2013 31-12-2012 3 years 4 years 5 years and forward Total Adjustment 2) total 1) Effects of derivative agreements entered are included in the ï¬xed interest. 2) Adjustment of nominal value compared to book value due to market valuation at a premium or discount. Assets Liquid assets Short-term... -

Page 116

... to accept risks in relation to benchmarks (hedging strategy) at the equivalent of msek 1 (1) expressed in VaR. The market value of electricity derivatives as of year-end was msek -12 (-13). Since 1 January 2010, electricity derivatives are used as cash flow hedges for the Stockholm price area (se3... -

Page 117

... 2013, counterparty risks amounted to msek 3,617 (5,356), of which deposits with banks, mortgage institutions, companies and the Swedish state totalled msek 3,118 (4,916). Trading The Board has given Saab Treasury a risk mandate for trading in currency and money market instruments. During the year... -

Page 118

..., Sweden Denmark South Africa UK USA Finland Ownership share, per cent 2013 2012 Group company Combitech AB HITT N.V. MEDAV GmbH Saab Australia Pty Ltd Saab Barracuda AB Saab Barracuda LLC Saab Czech s.r.o. Saab Defense and Security USA LLC Saab Dynamics AB Saab Danmark A/S Saab Grintek Defence... -

Page 119

... Systems AB, 556028-1627, Mölndal, Sweden Saab North America, Inc., USA Saab Precision Components AB, 556627-5003, Jönköping, Sweden Saab Seaeye Holdings Ltd, UK Saab South Africa (Pty) Ltd, South Africa Saab Surveillance Solutions AB, 556627-1929, Linköping, Sweden Saab Surveillance Systems AB... -

Page 120

...to the changed accounting principles for pensions (ias 19). interest paid and dividends received Group MSEK 2013 2012 Parent Company 2013 2012 Dividends received Interest received Interest paid Total 10 98 -183 -75 2 218 -101 119 652 181 -200 633 291 342 -169 464 116 saab annual report 2013 -

Page 121

...Acquisitions in 2012 mainly relate to the Dutch company hitt n.v., the German company medav gmbh, Sörman Intressenter ab (parent company of Sörman Information ab), Täby Displayteknik ab, and 70 per cent of the shares in the Norwegian company Bayes Risk Management as. saab annual report 2013 117 -

Page 122

...Parent Company nOtE 49 Exchange Rates used in financial Statements Year-end rate Average rate 2013 2012 Production of aircraft and aircraft components by the Parent Company, Saab ab, in the Tannefors industrial zone in the municipality of Linköping is subject to licensing pursuant to the Swedish... -

Page 123

...on the cutting edge of technology. Over the years, Saab has conducted significant development projects and managed the associated risks with great success. See also risks and uncertainties in the annual report. The Board of Directors' proposed dividend amounts to SEK 4.50 per share, corresponding to... -

Page 124

... international Financial Reporting Standards (iFRS), as adopted for use in the European Union, and generally accepted accounting principles, and give a true and fair view of the financial positions and results of the Group and the Parent Company, and that the management report gives a fair review... -

Page 125

... other parts of the annual accounts and consolidated accounts. We therefore recommend that the annual meeting of shareholders adopt the income statement and balance sheet for the parent company and the group. Report on other legal and regulatory requirements The Board of Directors and the Managing... -

Page 126

... a number of areas for how the employees are expected to act in contacts with customers, business partners and in the society and with each other as colleagues. Saab's Code of Conduct is a part of the governance of Saab. For further information, please refer to page 37 of the Annual Report. Swedish... -

Page 127

...management. Internal Audit 8 Business Areas aeronautics Dynamics electronic Defence Systems Security and Defence Solutions Support and Services Combitech Group Functions finance HR Communications iCT Quality and environment Legal affairs Procurement Strategy Reports appoints all operating units... -

Page 128

... reports are also put together in between the Board meetings and sent to the Board. The Board regularly reviews and considers investments, matters on research and development, organisational issues as well as mergers and acquisitions, and divestments of companies. included in the Board's annual work... -

Page 129

...the US Air Force. During the year, the Board has also worked with essential export and marketing strategies, the company's business ethical standards as well as efficiency measures within the Group. The Board of Directors and Group Management also received anti-corruption training in 2013, under the... -

Page 130

... company for the financial year 2013. The Board of Directors has also met on one occasion with the auditor without the presence of the CEO or any other members of the Group Management. Internal control over financial reporting • Elected in 2011 for the term until the Annual General Meeting 2015... -

Page 131

... around the world. The major parts of sales are generated from countries outside of Sweden. As a rule, projects entail considerable sums of money, stretch over long periods of time and involve technological development or refinement of products. Based on Saab's operations, the material risk areas in... -

Page 132

...aB, Sweden, Business area manager, Business area Cables, President, aBB Cables aB, President, asea Cylinda Production, manager, asea Low Voltage Division asea central staff - Production, asea trainee SARA MAZUR member of the Board since 2013 Vice President and Head of ericsson Research, ericsson aB... -

Page 133

... of the Local Deputy Board member 1995-2008 m.S.e.e. from Chalmers University Swedish association of Graduate en- President of the Local Trade Union if of Technology gineers, Saab Dynamics aB, Karlskoga metall at electronic Defence Systems, Shares in Saab: 613 Born 1964 Saab aB, Jönköping Lule... -

Page 134

... Area Security and Defence Solutions Born 1960, M.Sc. and Ph.D. (Tec. Lic.) Employed 2008 Shares in Saab: 4,412 LARS-ERIK WIGE Senior Vice President and Head of Business Area Support and Services Born 1954 Employed 2001 Shares in Saab: 3,194 ANNIKA BÄREMO Senior Vice President and Head of Group... -

Page 135

... REPORT To the annual General meeting of the shareholders of Saab aB Corporate identity number 556036-0793 it is the Board of Directors who is responsible for the Corporate Governance Report for 2013 on pages 122-130 and for ensuring that it has been prepared in accordance with the Annual Accounts... -

Page 136

... and Australia. South Africa was included in 2009, Finland in 2010, the Czech Republic in 2011, india in 2012 and Thailand, Holland and Canada in 2013. in April 2008 Saab's Annual General Meeting resolved to introduce a performance-based plan for senior executives and key employees entitling... -

Page 137

...,000 100 5,000 0 2009 2010 2011 2012 2013 0 Dfa funds, US Lazard frères Gestion funds, france fidelity funds, US other foreign owners B share, SeK omX Stockholm_Pi, SeK Thousands of shares traded (incl. off-floor trading) Data per Share 2008-2013 2013 Closing prices 1) at year-end, SEK high... -

Page 138

... maRKeTS eQUiTieS, SToCKHoLm STEFAN CEDERBERG, [email protected] enSKiLDa SeCURiTieS, SToCKHoLm CHRIS HALLAM, [email protected] GoLDman SaCHS, UK SANDY MORRIS, [email protected] JeffeRieS, UK MATS LISS, [email protected] SWeDBanK, SToCKHoLm 134 SAAB ANNUAL REPORT 2013 -

Page 139

... Corporate Internal sales Total Operating income Aeronautics Dynamics Electronic Defence Systems Security and Defence Solutions Support and Services Combitech Corporate Total Net ï¬nancial items Income before taxes Net income for the period Attributable to Parent Company's shareholders 2013... -

Page 140

... Average number of shares 2013/2012/2011/2010/2009: 109,150,344, 2008: 107,515,049 and 2007/2006/2005: 109,150,344. Conversion of debenture loan concluded 15 July 2004. 4) 2013 Board of Directors' proposal. 5) Figures presented for 2012 are restated according to the changed accounting principles for... -

Page 141

...ï¬c Management Information System VSHORAD Very Short Range Air Defence Financial Information 2014 Annual General Meeting 2014 Interim Report January-March 2014 Interim Report January-June 2014 Interim Report January-September 2014 8 April 25 April 18 July 23 October Headquarters Saab AB P.O. Box... -

Page 142

ADVANTAGE SAAB: INNOVATIVE AND EFFICIENT SOLUTIONS