Redbox 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

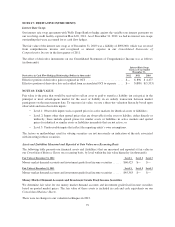

NOTE 17: DERIVATIVE INSTRUMENTS

Interest Rate Swaps

Our interest rate swap agreement with Wells Fargo Bank to hedge against the variable-rate interest payments on

our revolving credit facility expired on March 20, 2011. As of December 31, 2012, we had no interest rate swaps

outstanding that were accounted for as cash flow hedges.

The fair value of the interest rate swap as of December 31, 2010 was a liability of $896,000, which was reversed

from comprehensive income and recognized as interest expense in our Consolidated Statements of

Comprehensive Income in the first quarter of 2011.

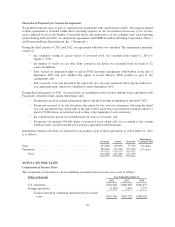

The effect of derivative instruments on our Consolidated Statements of Comprehensive Income was as follows

(in thousands):

Interest Rate Swap

Contract Year Ended

December 31,

Derivatives in Cash Flow Hedging Relationship (Dollars in thousands) 2012 2011 2010

Effective portion of derivative gain recognized in OCI .......................... $— $896 $4,477

Effective portion of derivative loss reclassified from accumulated OCI to expense .... $— $(889) $(5,553)

NOTE 18: FAIR VALUE

Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the

principal or most advantageous market for the asset or liability in an orderly transaction between market

participants on the measurement date. To measure fair value, we use a three-tier valuation hierarchy based upon

observable and non-observable inputs:

• Level 1: Observable inputs such as quoted prices in active markets for identical assets or liabilities;

• Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or

indirectly; these include quoted prices for similar assets or liabilities in active markets and quoted

prices for identical or similar assets or liabilities in markets that are not active; or

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions.

The factors or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

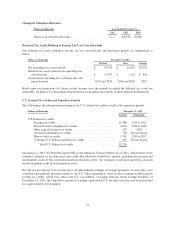

Assets and Liabilities Measured and Reported at Fair Value on a Recurring Basis

The following table presents our financial assets and (liabilities) that are measured and reported at fair value in

our Consolidated Balance Sheets on a recurring basis, by level within the fair value hierarchy (in thousands):

Fair Value at December 31, 2012 Level 1 Level 2 Level 3

Money market demand accounts and investment grade fixed income securities ...... $60,425 $— $—

Fair Value at December 31, 2011 Level 1 Level 2 Level 3

Money market demand accounts and investment grade fixed income securities ...... $45,363 $— $—

Money Market Demand Accounts and Investment Grade Fixed Income Securities

We determine fair value for our money market demand accounts and investment grade fixed income securities

based on quoted market prices. The fair value of these assets is included in cash and cash equivalents on our

Consolidated Balance Sheets.

There were no changes to our valuation techniques in 2012.

79