Redbox 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

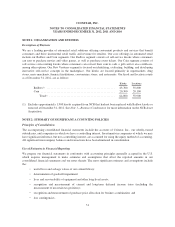

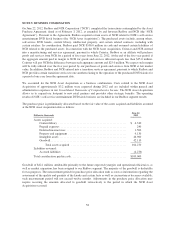

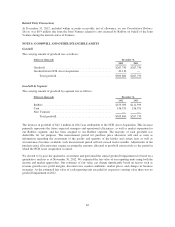

Pro forma information

The following unaudited pro forma information represents the results of operations for Coinstar, Inc. and

includes the self-service entertainment DVD kiosk business acquired from NCR as if the NCR Asset Acquisition

was consummated as of January 1, 2011. There are no material non-recurring pro forma adjustments and the pro

forma information may differ from actual results.

Dollars in thousands Year Ended December 31,

2012 2011

Revenue ............................................ $2,248,148 $1,959,686

Net income from continuing operations ................... $ 138,790 $ 93,651

Earnings per share from continuing operations:

Basic .......................................... $ 4.58 $ 3.07

Diluted ......................................... $ 4.31 $ 2.94

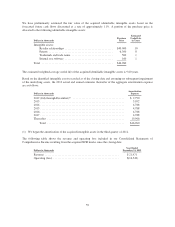

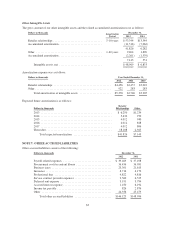

NOTE 4: PROPERTY AND EQUIPMENT

Dollars in thousands December 31,

2012 2011

Kiosks and components ................................ $1,026,989 $ 887,237

Computers, servers, and software ........................ 195,756 123,766

Office furniture and equipment .......................... 6,538 4,791

Vehicles ............................................ 7,278 9,077

Leasehold improvements ............................... 19,743 14,673

Property and equipment, at cost ......................... 1,256,304 1,039,544

Accumulated depreciation and amortization ................ (684,946) (540,366)

Property and equipment, net ........................ $ 571,358 $ 499,178

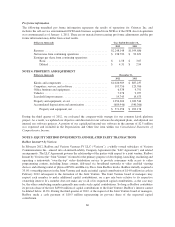

During the third quarter of 2012, we evaluated the company-wide strategy for our common kiosk platform

project. As a result, we updated our objective and direction for our software development plans, and adjusted our

internal use software projects. A portion of our capitalized internal-use software in the amount of $2.5 million

was expensed and included in the Depreciation and Other line item within our Consolidated Statements of

Comprehensive Income.

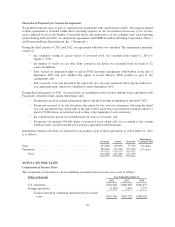

NOTE 5: EQUITY METHOD INVESTMENTS AND RELATED PARTY TRANSACTIONS

Redbox InstantTM by Verizon

In February 2012, Redbox and Verizon Ventures IV LLC (“Verizon”), a wholly owned subsidiary of Verizon

Communications Inc., entered into a Limited Liability Company Agreement (the “LLC Agreement”) and related

arrangements. The LLC Agreement governs the relationship of the parties with respect to a joint venture, Redbox

Instant by Verizon (the “Joint Venture”) formed for the primary purpose of developing, launching, marketing and

operating a nationwide “over-the-top” video distribution service to provide consumers with access to video

programming content, including linear content, delivered via broadband networks to video enabled viewing

devices and offering rental of physical DVDs and Blu-ray Discs from Redbox kiosks. Redbox initially acquired a

35.0% ownership interest in the Joint Venture and made an initial capital contribution of $14.0 million in cash in

February 2012 subsequent to the formation of the Joint Venture. The Joint Venture board of managers may

request each member to make additional capital contributions, on a pro rata basis relative to its respective

ownership interest. If a member does not make any or all of its requested capital contributions, as the case may

be, the other contributing member generally may make such capital contributions. So long as Redbox contributes

its pro rata share of the first $450.0 million of capital contributions to the Joint Venture, Redbox’s interest cannot

be diluted below 10.0%. During the third quarter of 2012, at the request of the Joint Venture board of managers,

Redbox made a cash payment of $10.5 million representing its pro-rata share of the requested capital

contribution.

60