Redbox 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Subject to applicable conditions, we may elect interest rates on our revolving borrowings calculated by reference

to (i) the British Bankers Association LIBOR rate (“LIBOR Rate”) fixed for given interest periods or (ii) Bank of

America’s prime rate (or, if greater, the average rate on overnight federal funds plus one half of one percent or

the LIBOR Rate plus one percent) (the “Base Rate”), plus the margin determined by our consolidated net

leverage ratio. For borrowings made under the LIBOR Rate, the margin ranges from 125 to 200 basis points,

while for borrowing made under the Base Rate, the margin ranges from 25 to 100 basis points. In 2012, the

applicable LIBOR Rate margin was fixed at 125 basis points and the applicable Base Rate margin was fixed at 25

basis points. The interest rate on amounts outstanding under the term loan at December 31, 2012 was 1.46%.

The Credit Facility contains standard negative covenants and restrictions on actions including, without limitation,

restrictions on indebtedness, liens, fundamental changes or dispositions of our assets, payments of dividends,

capital expenditures, investments, and mergers, dispositions and acquisitions, among other restrictions. In

addition, the Credit Facility requires that we meet certain financial covenants, ratios and tests, including

maintaining a maximum consolidated net leverage ratio and a minimum interest coverage ratio, as defined in the

Credit Facility. As of December 31, 2012, we were in compliance with the covenants of the Credit Facility.

Convertible Debt

The aggregate outstanding principal of our 4.0% Convertible Senior Notes (the “Notes”) was $185.0 million on

December 31, 2012. The Notes bear interest at a fixed rate of 4% per annum, payable semi-annually in arrears on

each March 1 and September 1, and mature on September 1, 2014. The effective interest rate at issuance was

8.5%. As of December 31, 2012, we were in compliance with all covenants.

The Notes become convertible (the “Conversion Event”) when the closing price of our common stock exceeds

$52.38, 130% of the Notes’ conversion price, for at least 20 trading days during the 30 consecutive trading days

prior to each quarter-end date. If the Notes become convertible and should the Note holders elect to convert, we

will be required to pay them up to the full face value of the Notes in cash as well as deliver shares of our

common stock for any excess conversion value. The number of potentially issued shares increases as the market

price of our common stock increases. As of March 31, 2012 and June 30, 2012, such early conversion event was

met. Certain Notes were submitted for conversion in the second and the third quarter of 2012 and settled in

accordance with the terms of the indenture governing the Notes. The loss from such early conversion event was

inconsequential. In the fourth quarter of 2012, we repurchased 15,000 Notes or $15 million in face value of Notes

for $20.7 million, including the accrued interest of $0.2 million, in cash. The loss from early extinguishment of

these Notes was approximately $1.0 million. As of December 31, 2012, the Conversion Event was not met and

the Notes remained classified as a long-term liability on our Consolidated Balance Sheets.

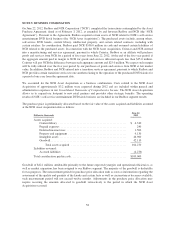

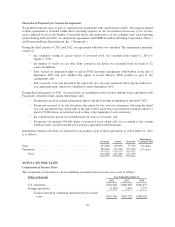

The following interest expense was recorded related to the Notes:

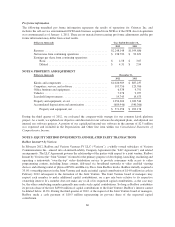

Dollars in thousands Year Ended December 31,

2012 2011 2010

Contractual interest expense ....................... $ 8,000 $ 8,000 $ 8,000

Amortization of debt discount ...................... 7,109 6,551 6,037

Total interest expense related to the Notes ........ $15,109 $14,551 $14,037

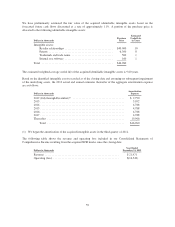

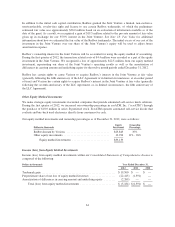

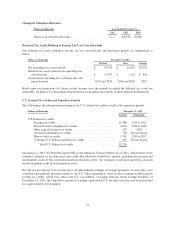

The remaining unamortized debt discount is expected to be recognized as non-cash interest expense as follows

(in thousands):

Year

Non-cash

Interest

Expense

2013 ............................................................. $ 7,134

2014 ............................................................. 5,039

Total unamortized discount ....................................... $12,173

65