Redbox 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Notes become convertible (the “Conversion Event”) when the closing price of our common stock exceeds

$52.38, 130% of the Notes’ conversion price, for at least 20 trading days during the 30 consecutive trading days

prior to each quarter-end date. If the Notes become convertible and should the Note holders elect to convert, we

will be required to pay them up to the full face value of the Notes in cash as well as deliver shares of our

common stock for any excess conversion value. The number of potentially issued shares increases as the market

price of our common stock increases. As of March 31, 2012 and June 30, 2012, such early conversion event was

met. Certain Notes were submitted for conversion in the second and the third quarter of 2012 and settled in

accordance with the terms of the indenture governing the Notes. The loss from such early conversion event was

inconsequential. In the fourth quarter of 2012, we repurchased 15,000 Notes or $15 million in face value of Notes

for $20.7 million, including accrued interest of $0.2 million, in cash. The loss from early extinguishment of these

Notes was approximately $1.0 million. As of December 31, 2012, the Conversion Event was not met and the

Notes are classified as a long-term liability on our Consolidated Balance Sheets.

Letters of Credit

As of December 31, 2012, we had five irrevocable standby letters of credit that totaled $6.8 million. These

standby letters of credit, which expire at various times through 2013, are used to collateralize certain obligations

to third parties. As of December 31, 2012, no amounts were outstanding under these standby letter of credit

agreements.

Other Contingencies

During the first quarter of 2012, we recorded a loss contingency in the amount of $8.4 million in our

Consolidated Statements of Comprehensive Income related to a supply agreement. Based on subsequent periods’

activity, we recorded an additional $3.0 million. As of December 31, 2012, the amount accrued within other

accrued liabilities in our Consolidated Balance Sheets was $11.4 million, representing our best estimate of loss.

We believe the likelihood of additional losses material to our accrual as of December 31, 2012 is remote.

Contractual Payment Obligations

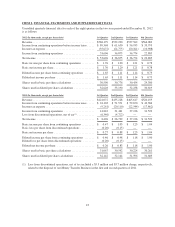

A summary of our contractual commitments and obligations as of December 31, 2012 was as follows:

Dollars in thousands Total 2013

2014 &

2015

2016 &

2017

2018 &

Beyond

Long-term debt and other ...................... $ 344,890 $ 15,529 $226,548 $102,813 $ —

Contractual interest on long-term debt ............ 12,333 7,400 4,933 — —

Capital lease obligations(1) ..................... 30,556 14,235 15,643 601 77

Operating lease obligations(1) ................... 52,417 10,166 16,924 15,146 10,181

Purchase obligations(1)(2) ....................... 7,492 6,154 1,338 — —

Asset retirement obligations .................... 14,020 — — — 14,020

Liability for uncertain tax positions .............. 2,383 276 1,002 1,105 —

Content agreement obligations(1) ................. 1,354,748 690,337 664,411 — —

Retailer revenue share obligations(1) .............. 70,578 45,162 23,788 1,628 —

Total .................................. $1,889,417 $789,259 $954,587 $121,293 $24,278

(1) See Note 19: Commitments and Contingencies in our Notes to Consolidated Financial Statements.

(2) Excludes any amounts associated with the manufacturing and services agreement entered into as part of the

NCR Asset Acquisition, pursuant to which Coinstar, Redbox or an affiliate will purchase goods and services

from NCR for a period of five years from June 22, 2012. At the end of the five-year period, if the aggregate

amount paid in margin to NCR for goods and services delivered equals less than $25.0 million, Coinstar will

pay NCR the difference between such aggregate amount and $25.0 million. See Note 3: Business

Combination in our Notes to Consolidated Financial Statements.

39