Redbox 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

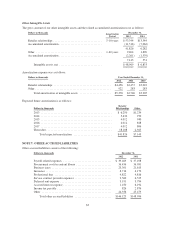

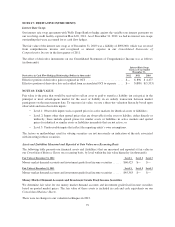

Change in Valuation Allowance

Dollars in thousands Year Ended December 31,

2012 2011 2010

Decrease in valuation allowance ...................... $— $(8,947) $(982)

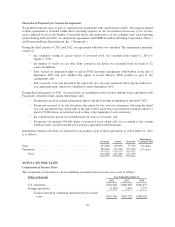

Deferred Tax Assets Relating to Income Tax Loss Carryforwards

Our deferred tax assets relating to income tax loss carryforwards and expiration periods are summarized as

below:

Dollars in thousands December 31, 2012

Federal State Foreign

Net operating loss carryforwards ................ $ 49,705 $ 62,839 $3,135

Deferred tax assets related to net operating loss

carryforwards ............................. $ 17,397 $ 2,133 $ 826

Years that net operating loss carryforwards will

expire between ............................ 2024 and 2030 2016 and 2030 2033

Based upon our projections for future taxable income over the periods in which the deferred tax assets are

deductible, we believe it is more likely than not that we will realize the benefits of these deductible differences.

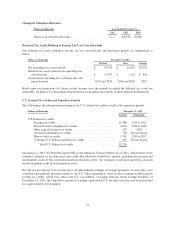

U.S. Federal Tax Credits and Expiration Periods

The following is the information pertaining to our U.S. federal tax credits as well as the expiration periods:

Dollars in thousands December 31, 2012

Amount Expiration

U.S Federal tax credits:

Foreign tax credits ......................................... $2,380 2015 to 2023

Research and development tax credits .......................... 4,024 2013 to 2032

Other general business tax credits ............................. 197 2032

Alternative minimum tax credits .............................. 728 Donotexpire

Illinois state tax credits ..................................... 1,562 2015 to 2017

California U.S. Federal and State tax credits ..................... 335 Donotexpire

Total U.S. Federal tax credits ............................ $9,226

On January 2, 2013, the President signed H.R. 8, the American Taxpayer Relief Act of 2012, which retroactively

extended a number of tax deductions and credits that otherwise would have expired, including the research and

development credit. If this legislation had been enacted in 2012, the Company would have reported a research

and development credit in its deferred tax assets.

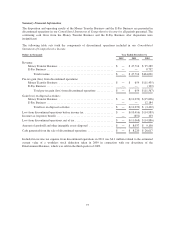

We did not provide for U.S. income taxes on undistributed earnings of foreign operations because they were

considered permanently invested outside of the U.S. Upon repatriation, some of these earnings would generate

foreign tax credits, which may reduce the U.S. tax liability associated with any future foreign dividend. At

December 31, 2012, the cumulative amount of earnings upon which U.S. income taxes have not been provided

was approximately $14.4 million.

73