Redbox 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 12: DISCONTINUED OPERATIONS AND SALE OF BUSINESS

Money Transfer Business (the “Money Transfer Business”)

On June 9, 2011, we completed the sale transaction of the Money Transfer Business to Sigue Corporation

(“Sigue”). We received $19.5 million in cash and a note receivable of $29.5 million (the “Sigue Note”). In

December 2011, as part of the sale transaction, we were required to provide Sigue with an additional loan of

$4.0 million under terms consistent with the Sigue Note. See Note 18: Fair Value for additional details about the

Sigue Note.

We estimated the fair value of the Sigue Note at approximately $26.7 million, which was based on the discounted

cash flows of the future note payments and was not an exit price based measure of fair value or the stated value

on the face of the Sigue Note. The discount rate used in our fair value estimate was the market rate for similar

risk profile companies and represented our best estimate of default risk. During 2012, we recognized $4.4 million

of interest income base on the imputed interest rate of the Sigue Note and received $2.0 million in interest

payments from Sigue based on the nominal interest rate of the Sigue note.

On June 9, 2011, the sold assets and liabilities of the Money Transfer Business primarily consisted of the

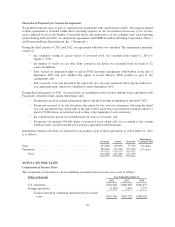

following (in thousands):

Dollars in thousands

June 9,

2011

Cash and cash equivalents ........................................... $ 57,893

Accounts receivable, net ............................................ 33,185

Other current assets ................................................ 13,560

Property, plant and equipment, net .................................... 4,066

Goodwill, intangible, and other assets .................................. 8,162

Total assets ................................................... 116,866

Accounts payable and payable to agents ................................ 65,464

Accrued liabilities ................................................. 13,062

Total liabilities ................................................ 78,526

Net assets sold .................................................... $ 38,340

The net assets disposed represent the fair value less cost to sell the Money Transfer Business. The loss on

disposal activities recognized in 2011 and 2010 was allocated to the asset disposal group including property,

plant and equipment, net, intangible and other assets.

Electronic Payment Business (the “E-Pay Business”)

On May 25, 2010, we sold our subsidiaries comprising the E-Pay Business to InComm Holdings, Inc. and

InComm Europe Limited (collectively “InComm”) for an aggregate purchase price of $40.0 million. In addition,

the purchase price was subject to a post-closing net working capital adjustment in the amount of $0.5 million,

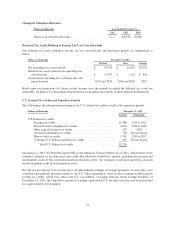

which was finalized in October 2010. The disposed assets and liabilities consisted of the following:

Dollars in thousands

May 25,

2010

Current Assets ............................................................. $24,862

Property, plant and equipment, net ............................................. 2,574

Goodwill, intangible, and other assets ........................................... 11,638

Total assets ............................................................ 39,074

Current Liabilities .......................................................... 27,717

Net assets Sold ............................................................. $11,357

74