Redbox 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

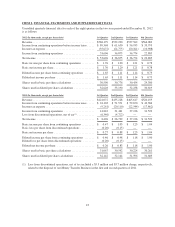

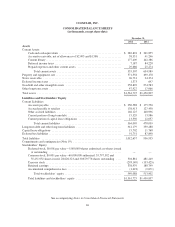

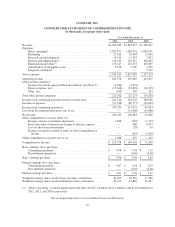

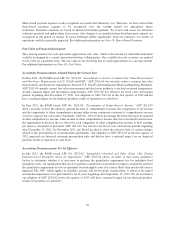

COINSTAR, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

December 31,

2012 2011

Assets

Current Assets:

Cash and cash equivalents ............................................ $ 282,894 $ 341,855

Accounts receivable, net of allowances of $2,003 and $1,586 ................ 58,331 41,246

Content library ..................................................... 177,409 142,386

Deferred income taxes ............................................... 7,187 84,228

Prepaid expenses and other current assets ............................... 29,686 25,274

Total current assets ............................................. 555,507 634,989

Property and equipment, net .............................................. 571,358 499,178

Notes receivable ....................................................... 26,731 24,374

Deferred income taxes ................................................... 1,373 647

Goodwill and other intangible assets ....................................... 358,829 274,583

Other long-term assets ................................................... 47,927 17,066

Total assets ........................................................... $1,561,725 $1,450,837

Liabilities and Stockholders’ Equity

Current Liabilities:

Accounts payable .................................................. $ 250,588 $ 175,550

Accrued payable to retailers .......................................... 138,413 127,450

Other accrued liabilities ............................................. 146,125 148,996

Current portion of long-term debt ...................................... 15,529 13,986

Current portion of capital lease obligations .............................. 13,350 12,057

Total current liabilities .......................................... 564,005 478,039

Long-term debt and other long-term liabilities ................................ 341,179 359,288

Capital lease obligations ................................................. 15,702 11,768

Deferred tax liabilities ................................................... 91,751 87,840

Total liabilities ........................................................ 1,012,637 936,935

Commitments and contingencies (Note 19) ..................................

Stockholders’ Equity:

Preferred stock, $0.001 par value—5,000,000 shares authorized; no shares issued

or outstanding ................................................... — —

Common stock, $0.001 par value—60,000,000 authorized; 35,797,592 and

35,251,932 shares issued; 28,626,323 and 30,879,778 shares outstanding .... 504,881 481,249

Treasury stock ..................................................... (293,149) (153,425)

Retained earnings .................................................. 338,979 188,749

Accumulated comprehensive loss ...................................... (1,623) (2,671)

Total stockholders’ equity ........................................ 549,088 513,902

Total liabilities and stockholders’ equity ................................ $1,561,725 $1,450,837

See accompanying Notes to Consolidated Financial Statements

46