Redbox 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

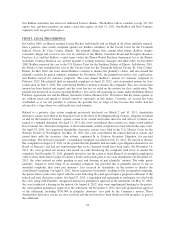

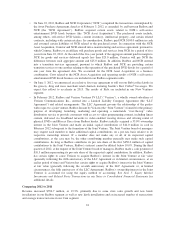

The following table summarizes information regarding shares repurchased during the quarter ended

December 31, 2012:

Total Number of

Shares

Repurchased(1)

Average Price

Paid per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Repurchase Plans or

Programs(2)

Maximum Approximate

Dollar Value of Shares

that May Yet be Purchased

Under the Plans or

Programs(4)

10/1/12 - 10/31/12 ........... 1,664 $44.36 — $209,668

11/1/12 - 11/30/12 ........... 635,358 48.66 635,000 133,451

12/1/12 - 12/31/12 ........... 938,682 48.74 938,682 133,640

1,575,704 $48.71 1,573,682 $133,640(3)

(1) Includes 2,022 shares tendered for tax withholding on vesting of restricted stock awards. None of these

transactions are included against the dollar value of shares that may be purchased under programs approved

by our Board of Directors.

(2) Includes shares from our Accelerated Share Repurchase program as well as open market repurchases as

described in Note 9: Repurchases of Common Stock in our Notes to Consolidated Financial Statements.

(3) Excludes the additional repurchase program of up to $250.0 million of our common stock authorized by our

Board of Directors on January 31, 2013.

(4) Dollars in thousands

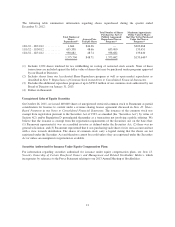

Unregistered Sales of Equity Securities

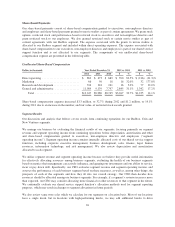

On October 26, 2011, we issued 100,000 shares of unregistered restricted common stock to Paramount as partial

consideration for licenses to content under a revenue sharing license agreement discussed in Note 10: Share-

Based Payments in our Notes to Consolidated Financial Statements. The issuance of the common stock was

exempt from registration pursuant to the Securities Act of 1933, as amended (the “Securities Act”) by virtue of

Section 4(2) and/or Regulation D promulgated thereunder as a transaction not involving a public offering. We

believe that the issuance is exempt from the registration requirements of the Securities Act on the basis that:

(1) Paramount represented it was an accredited investor as defined under the Securities Act; (2) there was no

general solicitation; and (3) Paramount represented that it was purchasing such shares for its own account and not

with a view towards distribution. The shares of common stock carry a legend stating that the shares are not

registered under the Securities Act and therefore cannot be resold unless they are registered under the Securities

Act or unless an exemption to registration is available.

Securities Authorized for Issuance Under Equity Compensation Plans

For information regarding securities authorized for issuance under equity compensation plans, see Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, which

incorporates by reference to the Proxy Statement relating to our 2013 Annual Meeting of Stockholders.

21