Redbox 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

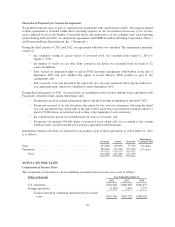

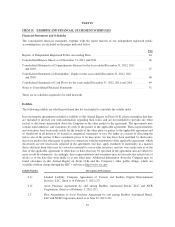

directors and employees (“segment operating income”). Segment operating income contains internally allocated

costs of our shared service support functions, including corporate executive management, business development,

sales, finance, legal, human resources, information technology, and risk management. We also review

depreciation and amortization allocated to each segment. Shared-based payments expense related to share-based

compensation granted to executives, non-employee directors and employees is not allocated to our segments and

is included in the corporate unallocated column in the analysis and reconciliation below; however, share-based

payments expense related to our content arrangements with certain movie studios has been allocated to our

Redbox segment and is included within direct operating expenses. Our performance evaluation does not include

segment assets.

During the second quarter of 2012, we completed the NCR Asset Acquisition. The assets acquired and liabilities

assumed, as well as the results of operations, are included in our Redbox segment. See Note 3: Business

Combination for additional information about the acquisition.

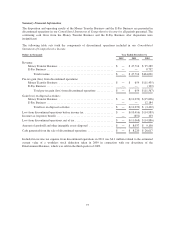

Our analysis and reconciliation of our segment information to the consolidated financial statements that follows

covers our results from continuing operations, which consists of our Redbox, Coin and New Ventures segments.

Unallocated general and administrative expenses relate to share-based compensation.

In thousands

Year Ended December 31, 2012 Redbox Coin

New

Ventures

Corporate

Unallocated Total

Revenue ................................. $1,908,773 $290,761 $ 2,509 $ — $2,202,043

Expenses:

Direct operating ....................... 1,340,899 155,740 5,475 863 1,502,977

Marketing ............................ 20,497 4,938 2,134 66 27,635

Research and development .............. 739 4,455 8,385 334 13,913

General and administrative .............. 159,885 26,367 11,999 11,984 210,235

Segment operating income (loss) ............. 386,753 99,261 (25,484) (13,247) 447,283

Less: depreciation and amortization ....... (148,068) (36,108) (349) — (184,525)

Operating income (loss) .................... 238,685 63,153 (25,833) (13,247) 262,758

Loss from equity method investments, net . . — — — (5,184) (5,184)

Interest expense, net ................... — — — (15,648) (15,648)

Other, net ............................ — — — (180) (180)

Income (loss) from continuing operations before

income taxes ........................... $ 238,685 $ 63,153 $(25,833) $(34,259) $ 241,746

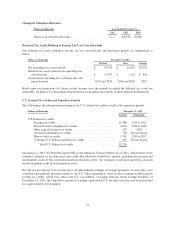

In thousands

Year Ended December 31, 2011 Redbox Coin

New

Ventures

Corporate

Unallocated Total

Revenue ................................. $1,561,598 $282,382 $ 1,392 $ — $1,845,372

Expenses:

Direct operating ....................... 1,134,167 145,362 3,349 473 1,283,351

Marketing ............................ 22,041 6,142 771 50 29,004

Research and development .............. 74 6,542 4,623 318 11,557

General and administrative .............. 120,384 23,370 10,464 9,139 163,357

Segment operating income (loss) ............. 284,932 100,966 (17,815) (9,980) 358,103

Less: depreciation and amortization ....... (115,430) (31,922) (866) — (148,218)

Operating income (loss) .................... 169,502 69,044 (18,681) (9,980) 209,885

Loss from equity method investments, net . . — — — (1,591) (1,591)

Interest expense, net ................... — — — (23,822) (23,822)

Other, net ............................ — — — 256 256

Income (loss) from continuing operations before

income taxes ........................... $ 169,502 $ 69,044 $(18,681) $(35,137) $ 184,728

77