Redbox 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information and Stock Prices

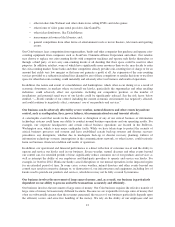

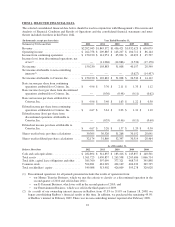

Our common stock is traded on the NASDAQ Global Select Market under the symbol “CSTR.” The following

table sets forth the high and low bid prices per share as reported by the NASDAQ Global Select Market for our

common stock for each quarter during the last two fiscal years. The quotations represent inter-dealer prices

without retail markup, markdown or commission and may not necessarily represent actual transactions.

2012 High Low

Quarter 1 .................................................. $64.85 $40.68

Quarter 2 .................................................. 69.74 56.27

Quarter 3 .................................................. 71.82 43.73

Quarter 4 .................................................. 54.16 40.50

2011 High Low

Quarter 1 .................................................. $59.29 $37.80

Quarter 2 .................................................. 57.35 44.85

Quarter 3 .................................................. 60.71 37.43

Quarter 4 .................................................. 57.07 38.76

The approximate number of holders of record of our common stock at February 1, 2013 was 94.

Dividends

We have never declared or paid any cash dividends on our common stock. In addition, we have restrictions

relating to the payment of dividends under our current credit facility. Currently we intend to retain all future

earnings for the foreseeable future to fund development and growth of our business, retire debt obligations or

repurchase our common stock.

Repurchases of Common Stock

The Board of Directors approved in July 2011 a repurchase program of up to (i) $250 million of our common

stock plus (ii) the amount of cash proceeds received after July 15, 2011 from the exercise of stock options by our

officers, directors, and employees. Repurchases may be made through open market purchases, negotiated

transactions or other means, including accelerated share repurchases and 10b5-1 trading plans in accordance with

applicable securities laws and other restrictions. The share repurchase program will continue until the amount of

Coinstar common stock authorized is repurchased, the Board of Directors determines to discontinue or otherwise

modify the share repurchase program. The repurchase program is in addition to our other Board authorized

repurchase program for up to $12.5 million of our common stock.

The authorizations allowed us to repurchase up to $133.6 million of our common stock as of December 31, 2012.

Repurchased shares become a part of treasury stock. On January 31, 2013, our Board of Directors approved an

additional repurchase program of up to $250.0 million of our common stock plus the cash proceeds received

from the exercise of stock options by our officers, directors, and employees.

20