Pfizer 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

95

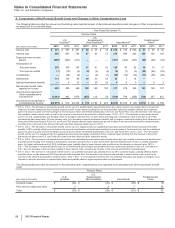

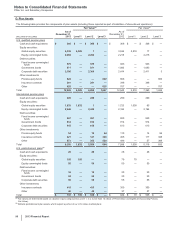

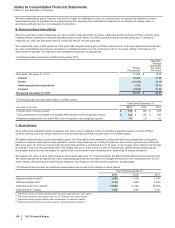

ABO for our U.S. supplemental (non-qualified) pension plans was $1.3 billion in 2013 and $1.5 billion 2012. The ABO for our international pension plans was

$9.7 billion in 2013 and $9.4 billion in 2012.

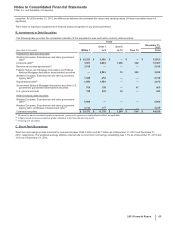

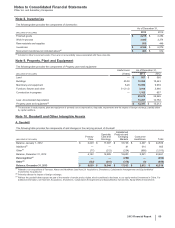

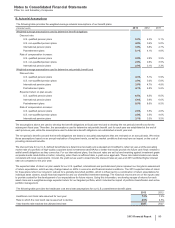

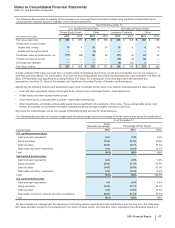

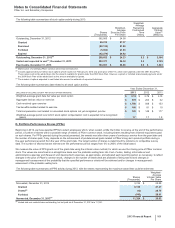

The following table provides information as to how the funded status is recognized in our consolidated balance sheets:

As of December 31,

Pension Plans

U.S. Qualified U.S. Supplemental

(Non-Qualified) International Postretirement

Plans

(MILLIONS OF DOLLARS) 2013 2012 2013 2012 2013 2012 2013 2012

Noncurrent assets(a) $—$—$—$—$318 $124 $—$—

Current liabilities(b) ——(151)(162)(46)(95)(29)(30)

Noncurrent liabilities(c) (1,107) (3,728) (1,190)(1,387) (2,338) (2,667) (2,668)(3,491)

Funded status $ (1,107) $ (3,728) $(1,341)$ (1,549) $ (2,066) $ (2,638) $(2,697)$(3,521)

(a) Included primarily in Other noncurrent assets.

(b) Included in Accrued compensation and related items and Liabilities of discontinued operations, as appropriate.

(c) Included in Pension benefit obligations, net and Postretirement benefit obligations, net, as appropriate.

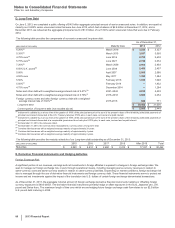

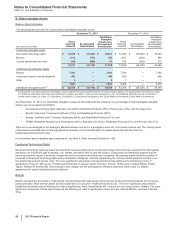

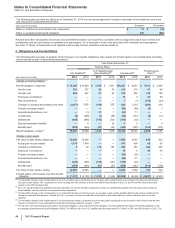

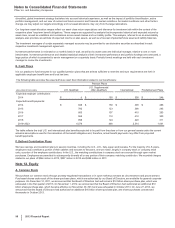

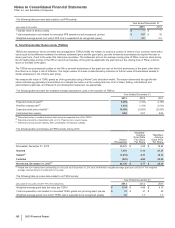

The following table provides the pre-tax components of cumulative amounts recognized in Accumulated other comprehensive loss:

As of December 31,

Pension Plans

U.S. Qualified U.S. Supplemental

(Non-Qualified) International Postretirement

Plans

(MILLIONS OF DOLLARS) 2013 2012 2013 2012 2013 2012 2013 2012

Actuarial losses(a) $ (1,974) $ (5,027) $(406)$(664)$ (2,213) $ (2,780) $ (292) $(932)

Prior service (costs)/credits and other 42 51 11 14 (18)(20)470 374

Total $ (1,932) $ (4,976) $(395)$(650)$ (2,231) $ (2,800) $ 178 $(558)

(a) The accumulated actuarial losses primarily represent the impact of changes in discount rates and other assumptions that result in cumulative changes in our

projected benefit obligations as well as the cumulative difference between the expected return and actual return on plan assets. These accumulated actuarial

losses are recognized in Accumulated other comprehensive loss and are amortized into net periodic benefit costs primarily over the average remaining service

period for active participants, using the corridor approach. The average amortization periods utilized are 9.6 years for our U.S. qualified plans, 9.5 years for our

U.S. supplemental (non-qualified) plans, 18.2 years for our international plans and 10.8 years for our postretirement plans.

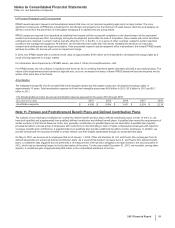

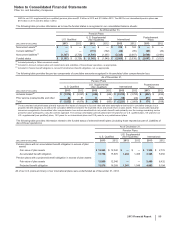

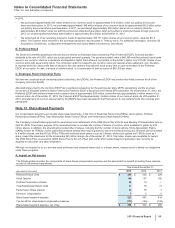

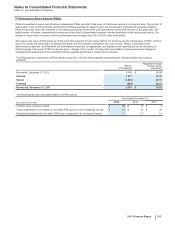

The following table provides information related to the funded status of selected benefit plans (including those reported as part of Liabilities of

discontinued operations):

As of December 31,

Pension Plans

U.S. Qualified

U.S. Supplemental

(Non-Qualified) International

(MILLIONS OF DOLLARS) 2013 2012 2013 2012 2013 2012

Pension plans with an accumulated benefit obligation in excess of plan

assets:

Fair value of plan assets $ 12,869 $ 12,540 $—$—$ 1,309 $ 2,776

Accumulated benefit obligation 13,704 15,870 1,294 1,465 3,348 5,056

Pension plans with a projected benefit obligation in excess of plan assets:

Fair value of plan assets 12,869 12,540 ——2,499 6,432

Projected benefit obligation 13,976 16,268 1,341 1,549 4,883 9,194

All of our U.S. plans and many of our international plans were underfunded as of December 31, 2013.