Pfizer 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

103

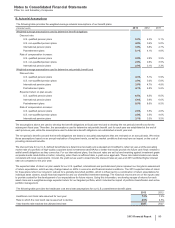

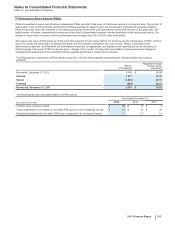

F. Performance Share Awards (PSAs)

PSAs are awarded to senior and other key management. PSAs vest after three years of continuous service from the grant date. The number of

shares paid, if any, including shares resulting from dividend equivalents, depends upon the achievement of predetermined goals related to

Pfizer's total share return as compared to an industry peer group, for the three-year performance period from the year of the grant date. The

target number of shares is determined by reference to the value of share-based awards to similar employees in the industry peer group. The

number of shares that are earned over the performance period ranges from 0% to 200% of the initial award.

We measure the value of PSA grants as of the grant date using the intrinsic value method, for which we use the closing price of Pfizer common

stock. The values are amortized on a straight-line basis over the probable vesting term into Cost of sales, Selling, informational and

administrative expenses, and Research and development expenses, as appropriate, and adjusted each reporting period, as necessary, to

reflect changes in the price of Pfizer's common stock, changes in the number of shares that are probable of being earned and changes in

management's assessment of the probability that the specified performance criteria will be achieved.

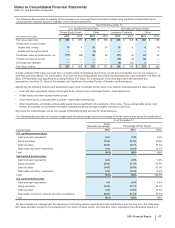

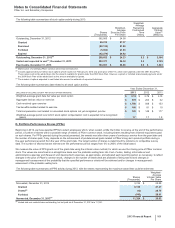

The following table summarizes all PSA activity during 2013, with the shares granted representing the maximum award that could be

achieved:

Shares

(Thousands)

Weighted-Average

Intrinsic Value

Per Share

Nonvested, December 31, 2012 5,749 $25.08

Granted 1,377 27.37

Vested (1,463)27.37

Forfeited (624)28.21

Nonvested, December 31, 2013 5,039 $30.63

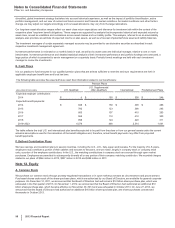

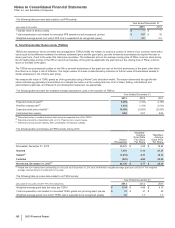

The following table provides data related to all PSA activity:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2013 2012 2011

Total fair value of shares vested $ 40 $ 13 $ 4

Total compensation cost related to nonvested PSA grants not yet recognized, pre-tax $ 25 $ 27 $ 25

Weighted-average period over which PSA cost is expected to be recognized (years) 1.7 1.7 1.9