Pfizer 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

70

2013 Financial Report

• other associated amounts, such as direct manufacturing costs, enabling support functions and other costs not charged to the business,

purchase-accounting impacts, acquisition-related costs, impairment charges, restructuring charges and implementation costs

associated with our cost reduction/productivity initiatives, all of which are reported outside our operating segment results.

The operating results of this business are reported as Income from discontinued operations––net of tax in the consolidated statements of

income through November 30, 2012, the date of disposal.

While the full purchase price of $11.85 billion was received on November 30, 2012, the sale of the business was not completed in certain non-

U.S. jurisdictions at that date as regulatory review of the transaction was not yet complete. In these jurisdictions, which represented a relatively

small portion of the Nutrition business, we continued to operate the business on an interim basis pending regulatory approval or divestiture to

a third party buyer. These interim arrangements, pursuant to which Pfizer operated the business for the net economic benefit of Nestlé and

was indemnified by Nestlé against any risk associated with such operations during the interim period, concluded with the sale of these

operations in those jurisdictions in 2013. In 2012, as Pfizer operated the business in those jurisdictions for the net economic benefit of Nestlé,

we had already received all of the expected proceeds from the sale, and as Nestlé was contractually obligated to complete the transaction (or

permit us to divest the delayed businesses to a third party buyer on its behalf) regardless of the outcome of any pending regulatory reviews,

we treated these delayed-close businesses as sold for accounting purposes.

In connection with the sale transaction, we also entered into certain transitional agreements designed to ensure and facilitate the orderly

transfer of business operations to the buyer. These agreements primarily relate to administrative services, which are generally being provided

for a period of 2 to 18 months. We are also manufacturing and supplying certain prenatal vitamin products for a transitional period. These

agreements are not material and none confers upon us the ability to influence the operating and/or financial policies of the Nutrition business

subsequent to November 30, 2012, the disposition date.

Capsugel Business

On August 1, 2011, we completed the sale of our Capsugel business for approximately $2.4 billion in cash and recognized a gain of

approximately $1.3 billion, net of tax, in Gain on sale of discontinued operations––net of tax. The operating results of this business are

reported as Income from discontinued operations––net of tax in the consolidated statement of income for 2011 through August 1, 2011, the

date of disposal.

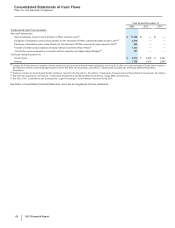

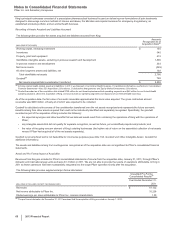

Total Discontinued Operations

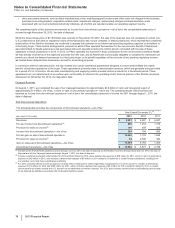

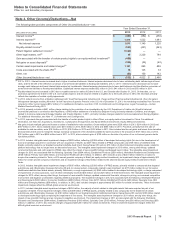

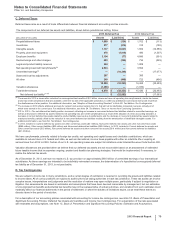

The following table provides the components of Discontinued operations—net of tax:

Year Ended December 31,(a)

(MILLIONS OF DOLLARS) 2013 2012 2011

Revenues $2,201 $6,587 $6,897

Pre-tax income from discontinued operations(a) 408 1,253 1,310

Provision for taxes on income(b) 100 459 425

Income from discontinued operations––net of tax 308 794 885

Pre-tax gain on sale of discontinued operations 10,446 7,123 1,688

Provision for taxes on income(c) 92 2,340 384

Gain on disposal of discontinued operations––net of tax 10,354 4,783 1,304

Discontinued operations––net of tax $10,662 $5,577 $2,189

(a) Includes (i) the Animal Health (Zoetis) business through June 24, 2013, the date of disposal, (ii) the Nutrition business through November 30, 2012, the date of

disposal and (iii) the Capsugel business through August 1, 2011, the date of disposal.

(b) Includes a deferred tax benefit of $23 million for 2013 and $23 million for 2012, and a deferred tax expense of $28 million for 2011, which is net of a deferred tax

expense of $42 million in 2012, and includes a deferred tax expense of $6 million in 2011 related to investments in certain foreign subsidiaries, resulting from

our intention not to hold these subsidiaries indefinitely.

(c) For 2013, primarily reflects income tax expense of $122 million resulting from certain legal entity reorganizations. For 2012 and 2011, includes a deferred tax

expense of $1.4 billion for 2012 and $190 million for 2011, which includes a deferred tax expense of $2.2 billion for 2012 and $190 million for 2011 on certain

current-year funds earned outside the U.S. that will not be indefinitely reinvested overseas. For 2012, also includes a deferred tax benefit reflecting the reversal

of net deferred tax liabilities associated with the divested Nutrition assets.