Pfizer 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

32

2013 Financial Report

significant portion of our spending quickly, as conditions change, we believe that any prior-period information about R&D expense by

development phase or by therapeutic area would not necessarily be representative of future spending.

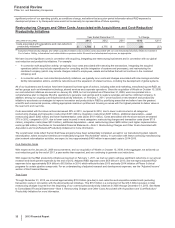

Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/

Productivity Initiatives

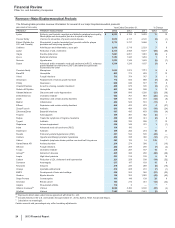

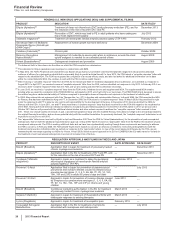

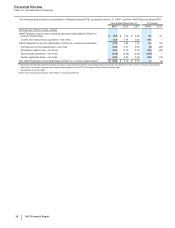

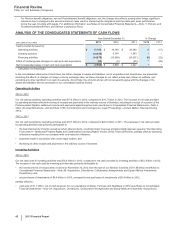

Year Ended December 31, % Change

(MILLIONS OF DOLLARS) 2013 2012 2011 13/12 12/11

Costs associated with acquisitions and cost-reduction/

productivity initiatives(a) $1,704 $2,775 $4,415 (39)(37)

(a) Comprises Restructuring charges and certain acquisition-related costs as well as costs associated with our cost-reduction/productivity initiatives included in

Cost of sales, Selling, informational and administrative expenses and/or Research and development expenses, as appropriate.

We have incurred significant costs in connection with acquiring, integrating and restructuring businesses and in connection with our global

cost-reduction and productivity initiatives. For example:

• In connection with acquisition activity, we typically incur costs associated with executing the transactions, integrating the acquired

operations (which may include expenditures for consulting and the integration of systems and processes), and restructuring the

combined company (which may include charges related to employees, assets and activities that will not continue in the combined

company); and

• In connection with our cost-reduction/productivity initiatives, we typically incur costs and charges associated with site closings and other

facility rationalization actions, workforce reductions and the expansion of shared services, including the development of global systems.

All of our businesses and functions have been impacted by these types of actions, including sales and marketing, manufacturing and R&D, as

well as groups such as information technology, shared services and corporate operations. Since the acquisition of Wyeth on October 15, 2009,

our cost-reduction initiatives announced on January 26, 2009, but not completed as of December 31, 2009, were incorporated into a

comprehensive plan to integrate Wyeth’s operations to generate cost savings and to capture synergies across the combined company. In

addition, among our ongoing cost reduction/productivity initiatives, on February 1, 2011, we announced a new research and productivity

initiative to accelerate our strategies to improve innovation and productivity in R&D by prioritizing areas that we believe have the greatest

scientific and commercial promise, utilizing appropriate risk/return profiles and focusing on areas with the highest potential to deliver value in

the near term and over time.

Costs associated with the above actions decreased 39% in 2013, compared to 2012, due to lower costs incurred in all categories:

restructuring charges and transaction costs (down $391 million), integration costs (down $237 million), additional depreciation––asset

restructuring (down $282 million) and lower implementation costs (down $161 million). Costs associated with the above actions decreased

37% in 2012, compared to 2011, due to lower costs incurred in most categories: restructuring charges and transaction costs (down $719

million), integration costs (down $312 million), additional depreciation––asset restructuring (down $655 million) and higher implementation

costs (up $46 million). See Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with

Acquisitions and Cost-Reduction/Productivity Initiatives for more information.

The overall lower costs reflect the fact that these programs have been substantially completed, except for our manufacturing plant network

rationalization, where execution timelines are necessarily long (see "Key Activities" below). In connection with these continuing manufacturing

plant network rationalization activities, we expect to incur approximately $450 million in associated costs in 2014-2016.

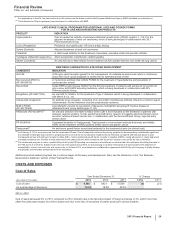

Cost-Reduction Goals

With respect to the January 26, 2009 announcements, and our acquisition of Wyeth on October 15, 2009, in the aggregate, we achieved our

cost-reduction goal by the end of 2011, a year earlier than expected, and are continuing to generate cost reductions.

With respect to the R&D productivity initiative announced on February 1, 2011, we met our goal to achieve significant reductions in our annual

research and development expenses by the end of 2012. Adjusted R&D expenses were $6.6 billion in 2013, and we expect adjusted R&D

expenses to be approximately $6.4 billion to $6.9 billion in 2014, which reflects the late-2013 and early-2014 initiation of Phase 3 clinical

programs for certain pipeline compounds. For an understanding of adjusted research and development expenses, see the “Adjusted Income”

section of this Financial Review.

Total Costs

Through December 31, 2013, we incurred approximately $15.5 billion (pre-tax) in cost-reduction and acquisition-related costs (excluding

transaction costs) in connection with the aforementioned initiatives. This $15.5 billion is a component of the $16.3 billion (pre-tax) in total

restructuring charges incurred from the beginning of our cost-reduction/productivity initiatives in 2005 through December 31, 2013. See Notes

to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/

Productivity Initiatives for more information.