Pfizer 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

100

2013 Financial Report

Amounts capitalized as part of inventory cost and the impact of modifications under our cost-reduction and productivity initiatives to share-

based awards were not significant for any period presented. Generally, the modifications resulted in an acceleration of vesting, either in

accordance with plan terms or at management’s discretion.

B. Restricted Stock Units (RSUs)

RSUs are awarded to select employees and, when vested, entitle the holder to receive a specified number of shares of Pfizer common stock,

including shares resulting from dividend equivalents paid on such RSUs. For RSUs granted during the periods presented, in virtually all

instances, the units vest after three years of continuous service from the grant date.

We measure the value of RSU grants as of the grant date using the closing price of Pfizer common stock. The values determined through this

fair value methodology generally are amortized on a straight-line basis over the vesting term into Cost of sales, Selling, informational and

administrative expenses, and Research and development expenses, as appropriate.

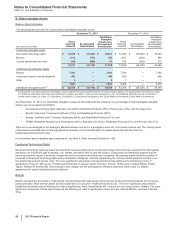

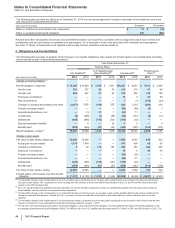

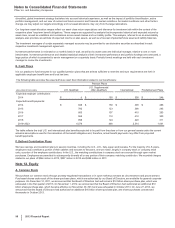

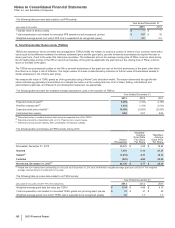

The following table summarizes all RSU activity during 2013:

Shares

(Thousands)

Weighted-

Average

Grant Date

Fair Value

Per Share

Nonvested, December 31, 2012 37,860 $19.34

Granted 10,253 27.39

Vested (13,943) 18.16

Reinvested dividend equivalents 1,139 29.14

Forfeited (2,558) 21.98

Nonvested, December 31, 2013 32,751 $22.50

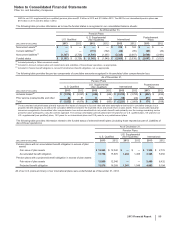

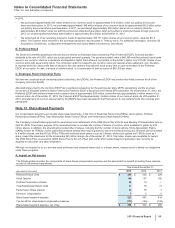

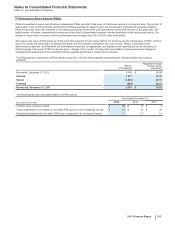

The following table provides data related to all RSU activity:

(MILLIONS OF DOLLARS)

Year Ended December 31,

2013 2012 2011

Total fair value of shares vested $379 $348 $256

Total compensation cost related to nonvested RSU awards not yet recognized, pre-tax $239 $258 $264

Weighted-average period over which RSU cost is expected to be recognized (years) 1.8 1.8 1.8

C. Stock Options

Stock options are awarded to select employees and, when vested, entitle the holder to purchase a specified number of shares of Pfizer

common stock at a price per share equal to the closing market price of Pfizer common stock on the date of grant.

All eligible employees may receive stock option grants. No stock options were awarded to senior and other key management in any period

presented; however, stock options were awarded to certain other employees. In virtually all instances, stock options granted since 2005 vest

after three years of continuous service from the grant date and have a contractual term of 10 years. In most cases, stock options must be held

for at least 1 year from the grant date before any vesting may occur. In the event of a sale or restructuring, options held by employees are

immediately vested and are exercisable for a period from three months to their remaining term, depending on various conditions.

We measure the value of stock option grants as of the grant date using, for virtually all grants, the Black-Scholes-Merton option-pricing model.

The values determined through this fair value methodology generally are amortized on a straight-line basis over the vesting term into Cost of

sales, Selling, informational and administrative expenses, and Research and development expenses, as appropriate.

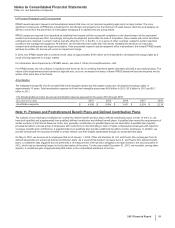

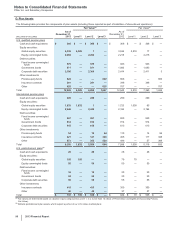

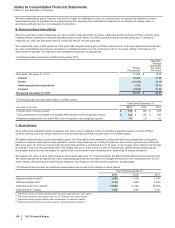

The following table provides the weighted-average assumptions used in the valuation of stock options:

Year Ended December 31,

2013 2012 2011

Expected dividend yield(a) 3.45%4.10%4.14%

Risk-free interest rate(b) 1.16%1.28%2.59%

Expected stock price volatility(c) 19.68%23.78%25.55%

Expected term(d) (years) 6.50 6.50 6.25

(a) Determined using a constant dividend yield during the expected term of the option.

(b) Determined using the interpolated yield on U.S. Treasury zero-coupon issues.

(c) Determined using implied volatility, after consideration of historical volatility.

(d) Determined using historical exercise and post-vesting termination patterns.