Pfizer 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

75

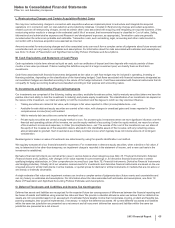

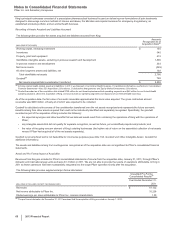

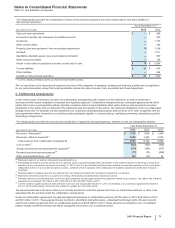

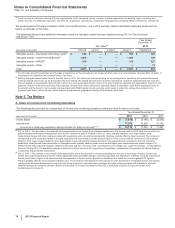

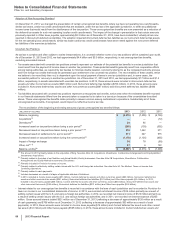

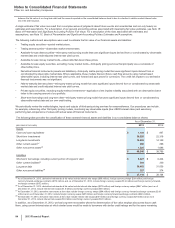

Note 4. Other (Income)/Deductions—Net

The following table provides components of Other (income)/deductions––net:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2013 2012 2011

Interest income(a) $(403)$(382)$ (456)

Interest expense(a) 1,414 1,522 1,681

Net interest expense 1,011 1,140 1,225

Royalty-related income(b) (523)(451)(543)

Patent litigation settlement income(c) (1,342) ——

Other legal matters, net(d) 35 2,220 784

Gain associated with the transfer of certain product rights to an equity-method investment(e) (459)——

Net gains on asset disposals(f) (320)(52)(40)

Certain asset impairments and related charges(g) 1,101 890 885

Costs associated with the Zoetis IPO(h) 18 125 33

Other, net (53)150 142

Other (income)/deductions––net $(532)$4,022 $2,486

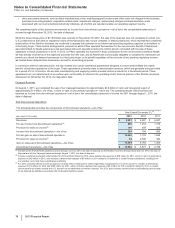

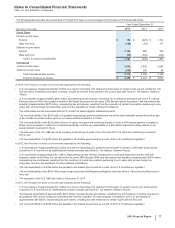

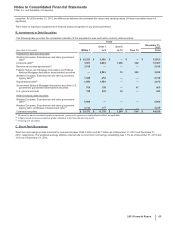

(a) 2013 v. 2012––Interest income increased due to higher investment balances. Interest expense decreased due to lower outstanding debt, refinancings at lower

rates, and the benefit of the effective conversion of some fixed-rate liabilities to floating-rate liabilities. 2012 v. 2011––Interest income decreased due to lower

average cash balances and lower interest rates earned on investments. Interest expense decreased due to lower debt balances and the effective conversion of

some fixed-rate liabilities to floating-rate liabilities. Capitalized interest expense totaled $32 million in 2013, $41 million in 2012 and $50 million in 2011.

(b) Royalty-related income increased in 2013 due to royalties earned on sales of Enbrel in the U.S. and Canada after October 31, 2013. On that date, our co-

promotion agreement for Enbrel in the U.S. and Canada expired, and we became entitled to royalties for a 36-month period. In 2012, the decrease primarily

reflects the expiration of certain royalty agreements.

(c) In 2013, reflects income from a litigation settlement with Teva Pharmaceutical Industries Ltd. (Teva) and Sun Pharmaceutical Industries Ltd. (Sun) for patent-

infringement damages resulting from their "at-risk" launches of generic Protonix in the U.S. As of December 31, 2013, the remaining receivables from Teva are

included in Other current assets ($512 million). For additional information, see Note 17A5. Commitments and Contingencies: Legal Proceedings––Certain

Matters Resolved During 2013.

(d) In 2012, primarily includes a $491 million charge relating to the resolution of an investigation by the U.S. Department of Justice into Wyeth's historical

promotional practices in connection with Rapamune, a $450 million settlement of a lawsuit by Brigham Young University related to Celebrex, and charges

related to hormone-replacement therapy litigation and Chantix litigation. In 2011, primarily includes charges related to hormone-replacement therapy litigation.

For additional information, see Note 17. Commitments and Contingencies.

(e) In 2013, represents the gain associated with the transfer of certain product rights to Hisun Pfizer, our equity-method investment in China. For additional

information, see Note 2D. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Equity-Method Investments.

(f) Net gains include realized gains and losses on sales of available-for-sale securities. Gross realized gains were $529 million in 2013, $214 million in 2012 and

$907 million in 2011. Gross realized losses were $310 million in 2013, $535 million in 2012 and $603 million in 2011. Proceeds, primarily from the sale of

available-for-sale securities, were $15.2 billion in 2013, $19.0 billion in 2012 and $10.2 billion in 2011. Also included are the net gains and losses from derivative

financial instruments used to hedge the foreign exchange component of the divested available-for-sale securities in the amounts of $137 million loss in 2013,

$351 million gain in 2012 and $264 million loss in 2011. In 2013, also includes a gain of $125 million on the sale of a portion of our in-licensed generic sterile

injectibles portfolio.

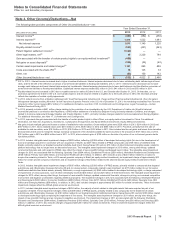

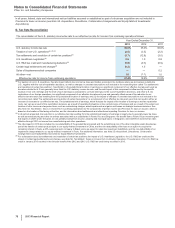

(g) In 2013, includes intangible asset impairment charges of $803 million, reflecting (i) $394 million of developed technology rights (for use in the development of

bone and cartilage) acquired in connection with our acquisition of Wyeth, (ii) $227 million related to IPR&D compounds; (iii) $109 million of indefinite-lived

brands, primarily related to our biopharmaceutical indefinite-lived brand; Xanax/Xanax XR; and (iv) $73 million of other finite-lived intangible assets, related to

platform technology, that no longer have an alternative future use. The intangible asset impairment charges for 2013 reflect, among other things, updated

commercial forecasts and, with regard to IPR&D, also reflect the impact of new scientific findings and delayed launch dates. The intangible asset impairment

charges for 2013 are associated with the following: Specialty Care ($394 million); Established Products ($201 million); Worldwide Research and Development

($140 million); Primary Care ($54 million); and Consumer Healthcare ($14 million). In addition, 2013 includes a loss of $223 million related to an option to

acquire the remaining interest in Teuto, a 40%-owned generics company in Brazil (an equity-method investment), an impairment charge of approximately $43

million for certain private company investments and an impairment charge of $32 million related to the aforementioned equity-method investment in Brazil,

Teuto.

In 2012, includes intangible asset impairment charges of $835 million, reflecting (i) $393 million of IPR&D assets, primarily related to compounds that targeted

autoimmune and inflammatory diseases (full write-off) and, to a lesser extent, compounds related to pain treatment; (ii) $175 million related to our Consumer

Healthcare indefinite-lived brand assets, primarily Robitussin, a cough suppressant; (iii) $242 million related to developed technology rights, a charge composed

of impairments of various products, none of which individually exceeded $45 million; and (iv) $25 million of finite-lived brands. The intangible asset impairment

charges for 2012 reflect, among other things, the impact of new scientific findings, updated commercial forecasts, changes in pricing, an increased competitive

environment and litigation uncertainties regarding intellectual property. The impairment charges in 2012 are associated with the following: Worldwide Research

and Development ($303 million); Consumer Healthcare ($200 million); Primary Care ($137 million); Established Products ($83 million); Specialty Care ($56

million) and Emerging Markets ($56 million). In addition, in 2012, also includes charges of approximately $55 million for certain investments. These investment

impairment charges reflect the difficult global economic environment.

In 2011, includes intangible asset impairment charges of $834 million, the majority of which relates to intangible assets that were acquired as part of our

acquisition of Wyeth. These impairment charges reflect (i) $458 million of IPR&D assets, primarily related to two compounds for the treatment of certain

autoimmune and inflammatory diseases; (ii) $193 million related to our biopharmaceutical indefinite-lived brand, Xanax/Xanax XR; and (iii) $183 million related

to developed technology rights comprising the impairment of five assets. The intangible asset impairment charges for 2011 reflect, among other things, the

impact of new scientific findings and an increased competitive environment. The impairment charges in 2011 are associated with the following: Worldwide

Research and Development ($394 million); Established Products ($193 million); Specialty Care ($135 million); Primary Care ($56 million) and Oncology ($56

million). In addition, in 2011, also includes charges of approximately $51 million for certain investments. These investment impairment charges reflect the

difficult global economic environment.