Pfizer 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

45

Domestic and International Short-Term Funds

Many of our operations are conducted outside the U.S., and significant portions of our cash, cash equivalents and short-term investments are

held internationally. We generally hold approximately 10%-30% of these short-term funds in U.S. tax jurisdictions. The amount of funds held in

U.S. tax jurisdictions can fluctuate due to the timing of receipts and payments in the ordinary course of business and due to other reasons,

such as business-development activities. As part of our ongoing liquidity assessments, we regularly monitor the mix of domestic and

international cash flows (both inflows and outflows). Repatriation of overseas funds can result in additional U.S. federal, state and local income

tax payments. We record U.S. deferred tax liabilities for certain unremitted earnings, but when amounts earned overseas are expected to be

indefinitely reinvested outside the U.S., no accrual for U.S. taxes is provided.

Accounts Receivable

We continue to monitor developments regarding government and government agency receivables in several European markets where

economic conditions remain challenging and uncertain. Historically, payments from a number of these European governments and

government agencies extend beyond the contractual terms of sale, and there have been no significant changes in the year-over-year trend.

We believe that our allowance for doubtful accounts is appropriate. Our assessment is based on an analysis of the following: (i) payments

received to date; (ii) the consistency of payments from customers; (iii) direct and observed interactions with the governments (including court

petitions) and with market participants (for example, the factoring industry); and (iv) various third-party assessments of repayment risk (for

example, rating agency publications and the movement of rates for credit default swap instruments).

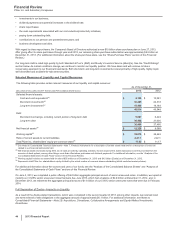

As of December 31, 2013, we had about $1.1 billion in aggregate gross accounts receivable from governments and/or government agencies in

Spain, Italy, Greece, Portugal and Ireland where economic conditions remain challenging and uncertain. Such receivables in excess of one

year from the invoice date, totaling $245 million, were as follows: $149 million in Spain; $51 million in Italy; $34 million in Greece; $10 million in

Portugal; and $1 million in Ireland.

Although certain European governments and government agencies sometimes delay payments beyond the contractual terms of sale, we seek

to appropriately balance repayment risk with the desire to maintain good relationships with our customers and to ensure a humanitarian

approach to local patient needs.

We will continue to closely monitor repayment risk and, when necessary, we will continue to adjust our allowance for doubtful accounts.

Our assessments about the recoverability of accounts receivables can result from a complex series of judgments about future events and

uncertainties and can rely heavily on estimates and assumptions. For information about the risks associated with estimates and assumptions,

see Notes to Consolidated Financial Statements––Note 1C. Basis of Presentation and Significant Accounting Policies: Estimates and

Assumptions.

Credit Ratings

Two major corporate debt-rating organizations, Moody’s and S&P, assign ratings to our short-term and long-term debt. A security rating is not a

recommendation to buy, sell or hold securities and the rating is subject to revision or withdrawal at any time by the rating organization. Each

rating should be evaluated independently of any other rating.

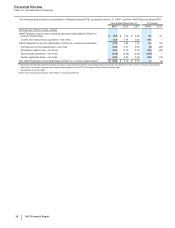

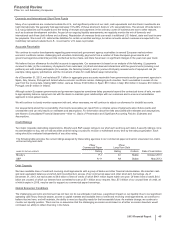

The following table provides the current ratings assigned by these rating agencies to our commercial paper and senior unsecured non-credit-

enhanced long-term debt:

NAME OF RATING AGENCY

Pfizer

Commercial Paper

Pfizer

Long-Term Debt

Date of Last ActionRating Rating Outlook

Moody’s P-1 A1 Stable October 2013

S&P A-1+ AA Stable May 2013

Debt Capacity

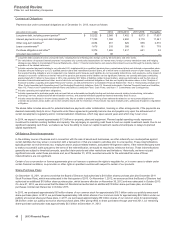

We have available lines of credit and revolving credit agreements with a group of banks and other financial intermediaries. We maintain cash

and cash equivalent balances and short-term investments in excess of our commercial paper and other short-term borrowings. As of

December 31, 2013, we had access to $8.6 billion of lines of credit, of which $961 million expire within one year. Of these lines of credit, $8.4

billion are unused, of which our lenders have committed to loan us $7.1 billion at our request. Also, $7.0 billion of our unused lines of credit, all

of which expire in 2018, may be used to support our commercial paper borrowings.

Global Economic Conditions

The challenging economic environment has not had, nor do we anticipate it will have, a significant impact on our liquidity. Due to our significant

operating cash flows, financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to

believe that we have, and will maintain, the ability to meet our liquidity needs for the foreseeable future. As markets change, we continue to

monitor our liquidity position. There can be no assurance that the challenging economic environment or a further economic downturn would

not impact our ability to obtain financing in the future.