Pfizer 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

27

the loss of exclusivity for Aricept 5mg and 10mg tablets in the U.S. in November 2010 and the entry of multi-source generic

competition in the U.S. in May 2011, as well as the loss of exclusivity in many major European markets in February 2012 and the

termination of the co-promotion agreement for Aricept in Japan in December 2012, which resulted in a decrease in Pfizer's share of

Aricept revenues of $309 million in 2013, compared to 2012; and

the expiration of the co-promotion agreement for Enbrel in the U.S. and Canada in October 2013,

partially offset by:

the strong performance of Enbrel in the U.S. prior to the expiration of the co-promotion agreement.

See the “Intellectual Property Rights and Collaboration/Licensing Rights” section of this Financial Review for a discussion regarding the

expiration of various contract rights relating to Aricept, Spiriva, Enbrel and Rebif.

Eliquis (apixaban) is being jointly developed and commercialized by Pfizer and Bristol-Myers Squibb (BMS). In 2012, Eliquis (apixaban)

was approved to reduce the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation in the 27 countries of the

EU, plus Iceland and Norway, Canada, Japan and the U.S. To date, we have launched that indication for Eliquis in the U.S., U.K.,

Germany, Denmark, Japan, Netherlands and Sweden. The two companies share commercialization expenses and profit/losses equally on

a global basis. While we are the third entrant in this market, we believe we have a differentiated product profile and continue to invest in

medical education and peer-to-peer programs to assist physicians in understanding the data, and we have begun direct-to consumer

advertising in the U.S.

• Embeda—In November 2013, we announced that the FDA had approved a prior approval supplement for an update to the Embeda

manufacturing process. This update addressed the pre-specified stability requirement that led to the voluntary recall of Embeda from the

market in March 2011. We anticipate returning Embeda to the market in the second quarter of 2014.

See Notes to Consolidated Financial Statements—Note 17. Commitments and Contingencies for a discussion of recent developments

concerning patent and product litigation relating to certain of the products discussed above.

Product Developments—Biopharmaceutical

We continue to invest in R&D to provide potential future sources of revenues through the development of new products, as well as through

additional uses for in-line and alliance products. Notwithstanding our efforts, there are no assurances as to when, or if, we will receive

regulatory approval for additional indications for existing products or any of our other products in development.

We continue to transform our global research and development organization and pursue strategies intended to improve innovation and overall

productivity in R&D to achieve a sustainable pipeline that will deliver value in the near term and over time. Our R&D priorities include:

delivering a pipeline of differentiated therapies with the greatest scientific and commercial promise, innovating new capabilities that can

position Pfizer for long-term leadership and creating new models for biomedical collaboration that will expedite the pace of innovation and

productivity. To that end, our research primarily focuses on five high-priority areas that have a mix of small molecules and large molecules—

immunology and inflammation; oncology; cardiovascular and metabolic diseases; neuroscience and pain; and vaccines. Other areas of focus

include rare diseases and biosimilars.

Our development pipeline, which is updated quarterly, can be found at www.pfizer.com/pipeline. It includes an overview of our research and a

list of compounds in development with targeted indication, phase of development and, for late-stage programs, mechanism of action. The

information currently in our development pipeline is as of February 28, 2014.

Among our new drug candidates in late-stage development is palbociclib (PD-0332991), an oral and selective reversible inhibitor of the CDK 4

and 6 kinases for the treatment of patients with estrogen receptor-positive, human epidermal growth factor receptor 2- negative advanced

breast cancer, recurrent advanced breast cancer and high-risk early breast cancer. On February 3, 2014, we announced that the randomized

Phase 2 trial of palbociclib achieved its primary endpoint by demonstrating a statistically significant and clinically meaningful improvement in

progression-free survival for the combination of palbociclib and letrozole compared with letrozole alone in post-menopausal women with

estrogen receptor positive (ER+), human epidermal growth factor receptor 2 negative (HER2-) locally advanced or newly diagnosed metastatic

breast cancer. Adverse events observed for the palbociclib arm were consistent with the known adverse event profile for this combination.

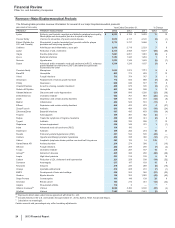

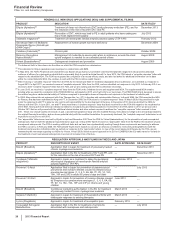

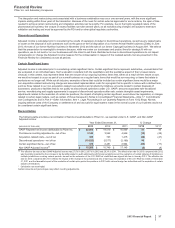

The following series of tables provides information about significant regulatory actions by, and filings pending with, the FDA and regulatory

authorities in the EU and Japan, as well as additional indications and new drug candidates in late-stage development.

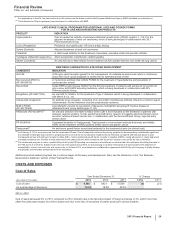

RECENT FDA APPROVALS

PRODUCT INDICATION DATE APPROVED

Duavee (Conjugated Estrogens/

Bazedoxifene)(a) Treatment of moderate-to-severe vasomotor symptoms associated with

menopause and prevention of postmenopausal osteoporosis in women with a

uterus

October 2013

(a) The FDA approved the 0.45mg/20mg dose of Duavee for these indications. We received a "complete response" letter from the FDA with regard to the

0.625mg/20mg dose for these indications, and for an indication for the treatment of vulvar and vaginal atrophy.